Skift Take

It's easier to understand IAG CEO Willie Walsh's sanguine tone on last week's earnings call given he clearly had this deal in the pipeline. If it goes through — and it's still a big if given the competition concerns — it will ease the pain of Delta's recent Latam deal.

IAG is making an offer to buy Air Europa for $1.1 billion (€1 billion) as it looks to take a bigger slice of the lucrative Europe-Latin America aviation market.

The deal comes just over a month after Delta agreed to buy 20 percent of Latam Group, potentially taking away IAG’s previous partner and introducing an element of uncertainty into its plans for the region.

Air Europa is part of Spanish tourism group Globalia, which also includes a tour operators, travel agencies and hotels. It operates scheduled domestic and international flights to 69 destinations, including European and long-haul routes to Latin America, the United States, Caribbean and North Africa.

IAG plans to position Air Europa within its Iberia unit while retaining the brand, at least initially. It will sit within the group’s “value” segment alongside Irish carrier Aer Lingus and Iberia Express. Air Europa will also leave SkyTeam when it joins IAG.

“Acquiring Air Europa would add a new competitive, cost effective airline to IAG, consolidating Madrid as a leading European hub and resulting in IAG achieving South Atlantic leadership, therefore generating additional financial value for our shareholders,” Willie Walsh, CEO of IAG, said.

“IAG has a strong track record of successful acquisitions, most recently with the acquisition of Aer Lingus in 2015 and we are convinced Air Europa presents a strong strategic fit for the group.”

Should the deal clear all the necessary regulatory hurdles, then IAG expects to complete the transaction in the second half of 2020.

South America Expansion

The Europe-Latin America market is an important one for airlines. It was one of the main reasons why British Airways wanted to merger with Iberia back in 2010.

“This is a strategically sensible deal that will strengthen IAG’s position in Latin America and looks to be priced competitively,” analysts at broker Bernstein said in a note to investors.

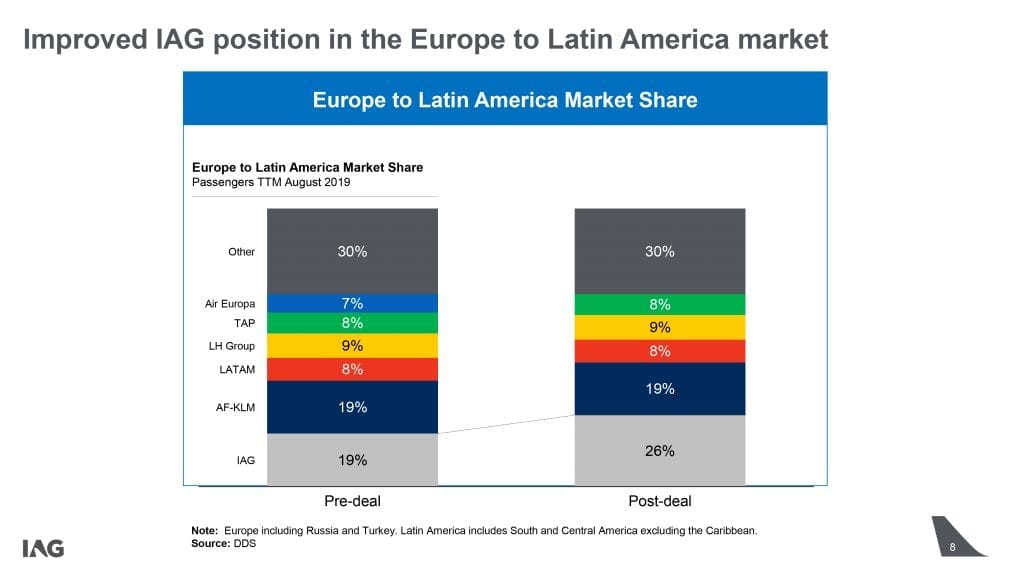

According to an analyst presentation, Air Europa currently has a 7 percent market share with IAG and Air France-KLM joint market leaders at 19 percent.

The deal would put IAG out in front on 26 percent. But given the obvious competition concerns it remains to be seen whether regulators in the European Union and elsewhere will ultimately give it the green light.

If it doesn’t go through IAG will pay Air Europa a $45 million (€40 million) break fee.

In IAG’s favor, however, is the likely loss of its joint venture opportunity with Latam as well as the potential — it says — for the expansion of Madrid as an airport hub, which will help it rival Europe’s big four: Amsterdam, Frankfurt, London Heathrow, and Paris Charles De Gaulle.

Speaking on Monday morning on an earnings call, Ryanair group CEO Michael O’Leary, said the acquisition was a “good deal for IAG” but that he would hope the competition authorities step in.

“I think we will be certainly be looking for the competition authorities to require some competition divestment, particularly the Air Europa short-haul presence of some of the Spanish domestics and the European short-haul,” he said.

The Europe to Latin America market.

What next for Globalia?

If the deal goes through it will drastically shrink the size of the Globalia group.

The air division of the business, of which Air Europa is an integral part, made up 52 percent of all revenue or $2.2 billion (€2 billion), according to its 2018 accounts.

The entire company made a pre-tax profit of $80.2 million (€71.9 million).

Globalia describes itself as an “integrated group engaged in transport, travel and tourism”, which means that “transactions between the airline, wholesale travel agencies and retail travel agencies are very significant.”

The potential loss of the airline puts into question the future of the rest of the group.

“We are convinced that the incorporation of Air Europa to a group such as IAG, who over all these years has demonstrated its support to the development of airlines within the group and the Madrid hub, will be a success”, said Javier Hidalgo, CEO of Globalia in the IAG press release.

Skift asked for a further statement from Globalia but was told by a spokesperson that the company would not be commenting on the news.

CORRECTION: An earlier version of this story incorrectly reported Javier Hidalgo’s job title as CEO and founder. This has been amended.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: air europa, delta air lines, europe, iag, latin america, m and a

Photo credit: An Air Europa Boeing 737-800. IAG is buying the airline. Olivier CABARET / Flickr