Skift Take

Do or die? Test and learn? Now or never? As Airbnb marches toward going public in 2020, a key question in many minds will be how Airbnb deals with Google — and at what price. There are no slam-dunk answers.

Expedia does it. So does Booking Holdings, TripAdvisor, Vacasa, Red Awning, and several of the online travel agencies’ sub-brands such as Agoda, Vrbo, Hotels.com, and Holiday Lettings.

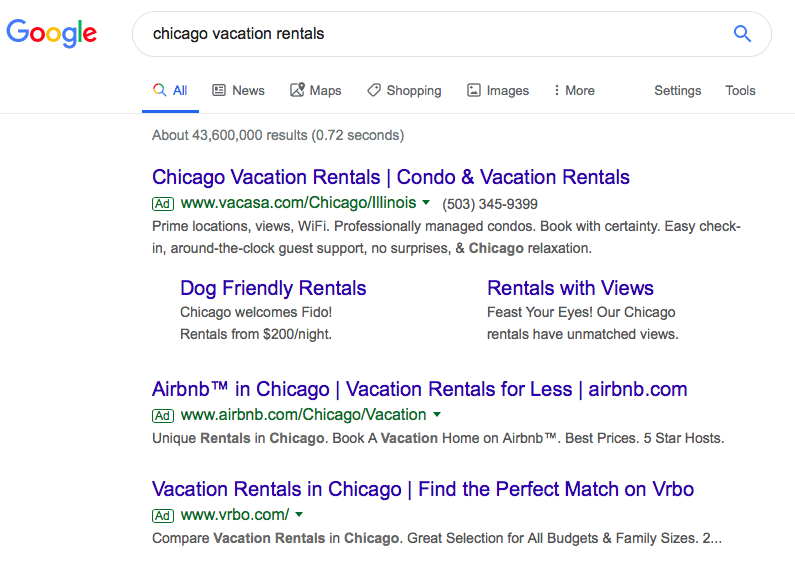

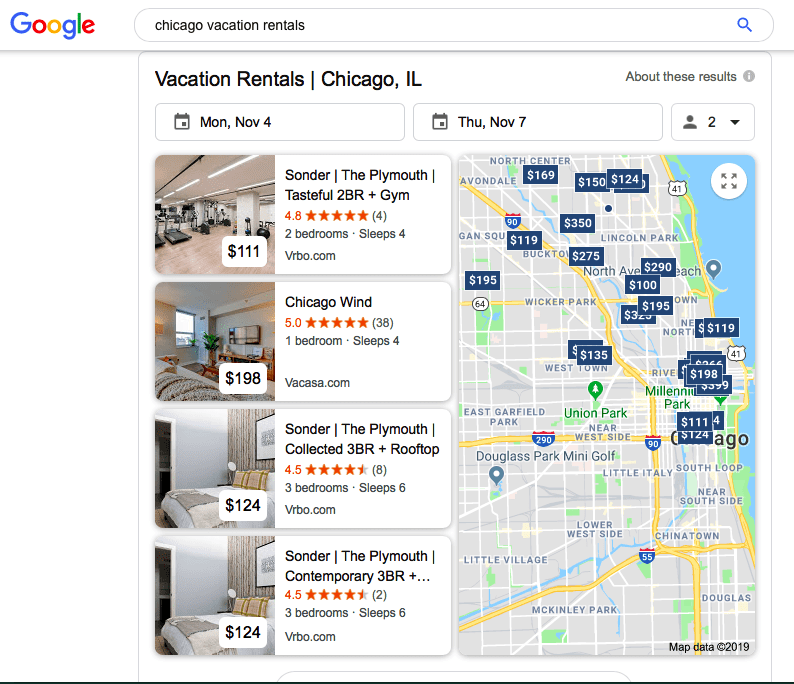

But over the weekend, when Google debuted its new four-pack stack of vacation rentals in Google Search, a feature that’s a gateway to Google’s travel page, including vacation rentals and other travel businesses, notably absent from the mix of usual participants was Airbnb.

With short-term rental giant Airbnb intending to go public in 2020, and considering one of its selling points is its brand awareness and all of the direct traffic that it attracts without having to pay billions of dollars annually to Google, a critical decision will be whether Airbnb should participate in Google vacation rentals.

Over the last six months, according to SimilarWeb, Airbnb got about 60 percent of its desktop and mobile traffic direct without having to pay Google or other search engines. In contrast, Booking.com had much higher traffic numbers, but only about 45 percent of it came direct, according to SimilarWeb, although Booking.com claims that figure should be higher than 50 percent.

While many investors and people inside and outside the travel industry debate which company, Airbnb or Booking.com, will eventually ascend to the top of the heap in short-term rentals, a credible argument can be made that in the long run, barring regulatory interference, Google may be Airbnb’s biggest threat.

After all, Expedia CEO Mark Okerstrom, for example, has been open about the fact that Google is its strongest competitor.

Register Now for Skift Short-Term Rental Summit on December 5

Asked whether Airbnb would be smart to participate in Google’s burgeoning vacation rental business, Kayak co-founder and CEO Steve Hafner said, “It would be rational move for Airbnb.”

“Google brings additional distribution to them and likely for free,” Hafner said. “But Airbnb must prevent Google from commoditizing their properties into a meta experience. After all, most high volume non-hotel accommodations are already available on sites like Booking.com and Vrbo.”

For now, according to a source, all of the clicks from the Google four-pack feature in Search over to Google’s travel page, and then onward to the online travel agency site, are free. Google, which debuted vacation rentals in its one-stop shop travel pages earlier this year, isn’t monetizing any of it yet while it works on the user experience. And unlike for its treatment of hotels, in Google vacation rentals only one apartment or vacation rental company is shown per listing.

So there is no auction in vacation rental listings like there is for hotels in on Google’s travel pages, with the big online travel agencies bidding for placement. Google hasn’t shared any of its monetization plans with at least some of the partners who plan on participating in Google’s short-term rental business.

In the should it or shouldn’t it debate over whether Airbnb would be wise to puts its apartments, vacation rentals and hotels into Google’s travel pages, it’s often overlooked that Airbnb already advertises in Google Search. Airbnb’s paid advertisement is the second one shown, below Vacasa’s in this example.

The issue is whether Airbnb should hand over considerable power to Google, essentially enabling Google to eat into Airbnb’s profits and serve as a marketing channel for Airbnb when the two companies will increasingly compete for consumer eyeballs and loyalties. A related question is whether Airbnb should cede that Google turf to its competitors.

Under Google’s new vacation rental four-pack in Google Search, users click on a listing, and navigate to Google’s travel section, where they can select a vendor such as Agoda or Hotels.com, and complete the booking on the online travel agency site. The aim is that these leads would show more travel intent and would therefore be more likely to convert into a booking.

Google has on-boarded some of the bigger companies first into its vacation rental business, and smaller players are on the way, according to a source.

Tim Choate, founder and CEO of property management company Red Awning Group, thinks it would be a misstep for Airbnb to abstain from participating in Google vacation rentals.

“I completely understand why Airbnb is not participating in this effort as they are trying to maintain their exclusiveness of inventory,” Choate said. “But at the same time we believe more marketing is always better than less, and choosing not to participate in one of the largest potential channels for travelers is to me a mistake.”

Talks?

In the travel industry, as the saying goes, everyone is always talking to everyone so it would be foolhardy to think that Google’s travel executives don’t have Airbnb co-founder and CEO Brian Chesky’s phone number, and that there haven’t been discussions.

Of course a key question, if you believe that Airbnb might be open to putting its inventory into Google’s vacation rental business, would be under what terms. Airbnb does advertise in Google Search, Airbnb’s HotelTonight unit does some boutique hotel advertising in Google’s travel pages, and we found some Airbnb short-term rental advertisements in Chinese search engine Baidu, as well.

So search engine advertising is not taboo for Airbnb. In fact, here’s an Airbnb advertisement in Chinese search engine Baidu.

For his part, Hafner of Kayak, which offers short-term rental referrals, mostly from sister brands in parent company Booking Holdings, would welcome some Airbnb listings.

“Of course I’d love for Airbnb to participate in Kayak, and Brian (Chesky of Airbnb) knows that,” Hafner said.

There are many people who think that Airbnb should forego advertising in Google travel.

Andrew McConnell, the CEO of vacation rental management platform Rented, injected some caution about the question.

“On if it is smart for them to do it or not, that is insanely difficult,” McConnell said. “Google made clear (at a short-term rental conference in Italy) they are not an OTA, so the booking still happens on Airbnb. In that sense, do it.”

But what if Google decides to pivot one day into becoming an online travel agency?

“But what if they change their mind later and everyone is trained to go straight to Google?” McConnell wondered. “What if Airbnb doesn’t participate and everyone goes straight to Google anyway? It’s above my pay grade. That’s why Brian (Chesky) makes the big bucks.”

Bobby Healy, a travel industry veteran and Google critic, tweeted that Google can succeed in vacation rentals because it’s basically an extension of Google Search. “That’s why vertical search providers (including airlines) should not participate in Google. Handing over the keys to the Kingdom (funnel).”

Agree with that. Extensions of a monopoly search function is straightforward. Replacing the functionality of a vertical provider not so much. That's why vertical search providers (including airlines) should not participate in Google. Handing over the keys to the Kingdom (funnel)

— Bobby Healy 🍔 (@realBobbyHealy) October 6, 2019

Viator founder Rod Cuthbert likened travel companies throwing their lot in with Google to people suffering from Stockholm Syndrome.

I was sleeping while you all were debating. Great to see Airbnb refuse to play Google's game, while the others suffer from Stockholm Syndrome, managing to convince themselves that it'll all work out in the end. It won't; this isn't a fairy tale.

— rod cuthbert (@rodcu) October 6, 2019

“Great to see Airbnb refuse to play Google’s game, while the others suffer from Stockholm Syndrome, managing to convince themselves that it’ll all work out in the end,” Cuthbert tweeted. “It won’t; this isn’t a fairy tale.”

Either way, the final scene in this distribution fairy tale has yet to air.

Register Now for Skift Short-Term Rental Summit on Dec. 5

Corrections: We eliminated references to Google Trips as the name of Google’s travel pages. We also eliminated a statement that Google’s vacation rental business could deliver 10x as much traffic as Google search. Google said a presenter actually said the company hopes to grow its vacation rental business 10x.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, alternative accommodations, google, short-term rentals, skift short-term rental summit, str2019, vacation rentals

Photo credit: A short-term rental in Cape Town listed in Airbnb. So far, Airbnb is not participating in Google's relatively new vacation rental business. Airbnb