Skift Take

Webjet has really transformed its business over the past few years through a couple of sizable acquisitions. The Australian consumer market is proving pretty tough, so pursuing a strategy of global expansion in the wholesale arena makes sense.

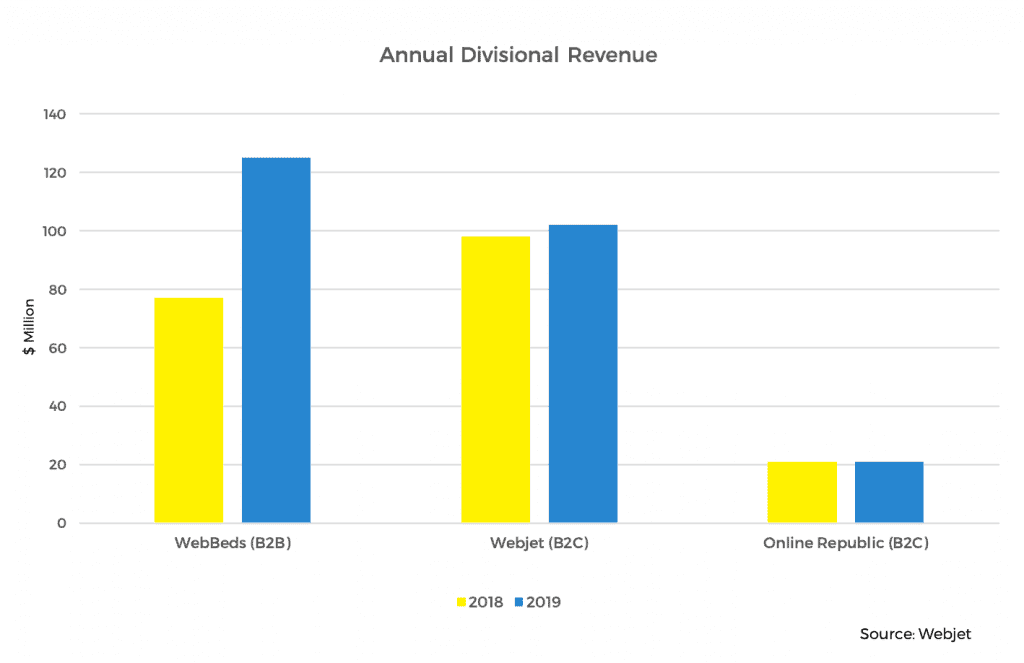

It was only a couple of years ago that Australia-based travel company Webjet made a tiny proportion of its profit from business-to-business sales, but in just a short space of time its WebBeds unit has grown to become the number two global player, contributing $46 million in profit (EBITDA).

This means that WebBeds is now more profitable than its consumer brand Webjet.com.au and generates more revenue than the entire consumer division, which includes New Zealand online travel agency Online Republic.

“Unlike the Webjet of six years ago that was highly focused on the AU [Australian] domestic market, the expansion of our business into the B2B world globally means that we’re not reliant on any customer, market or supplier segment,” said managing director John Guscic on an earnings call on Thursday.

“This has helped us successfully challenges of the year. We have built a global wholesale business. This global wholesale business is scaling beautifully and is the key contributor to our EBITDA outperformance for FY ’19.”

The acquisitions of UK-headquartered JacTravel and Dubai-based Destinations of the World have helped fuel Webjet’s wholesale boom and it sounds like the buying spree might continue.

Asked about further M&A deals, Guscic said: “The thought process is that we are still under 4 percent of the entire market. We have 30,000 directly contracted hotels today I would like to increase that number and I would like to distribute our product across every travel vertical and every geography. And we’re not massively penetrated in any market.”

He added that while the integration of JacTravel into Webjet wasn’t perfect, the process with Destinations of the World went much better, which had given the company “an increased level of confidence around making further acquisition in the B2B space.”

Thomas Cook Woes

It was mostly good news for Webjet with rising profit and revenue in 2019 but one blip is the performance of its partnership with struggling European tour operator Thomas Cook.

In 2016, Thomas Cook announced an outsourcing deal with Webjet covering around 3,000 direct hotel contracts. Webjet said the performance of the Thomas Cook partnership was below expectations and that next year it was cutting its total transaction value estimates from $203-$304 million to $101-$135 million.

Despite the significant downgrade, Guscic expects the deal with Thomas Cook to remain in place whatever happens with its potential change in ownership and that it “will deliver the same expected outcome”.

Full-Year Results

Webjet’s pre-tax profit rose 27 percent to $51 million in the year to the end of June, 2019. Revenue grew 26 percent to $248 million.

Shares in the company fell 8.3 percent following the results announcement despite the company saying it had enjoyed a “strong start” to the new financial year.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: australia, b2b, earnings, WebBeds, webjet, wholesalers

Photo credit: The WebBeds logo. Parent company Webjet is after more B2B acquisitions. Webjet