What If Accor Acquires Oyo?

Skift Take

Global hotel chains are often anything but direct. Look how they coin terms such as limited service, select service, lower midscale, to describe affordable accommodations. And most have avoided going lower than those levels to hit the floor where nightly rates are at $24, to use Oyo Hotels’ average room rate globally last year.

None have scaled this segment as Oyo has. Now in its sixth year of operation, Oyo says it has around 750,000 rooms, more than Accor, which Oyo’s research shows has around 685,000 rooms. Yet, despite Oyo’s global scale and funding of more than $1.7 billion from backers such as SoftBank and most recently Airbnb, global hotel chains largely still don’t see it as a competitor, or a true hotel company.

But what if one of them buys, or buys into, Oyo or another budget hotel chain?

Last month, the Economic Times of India speculated that Accor was in advanced talks to invest up to $40 million in Oyo’s rival, Treebo, citing people who were aware of the development.

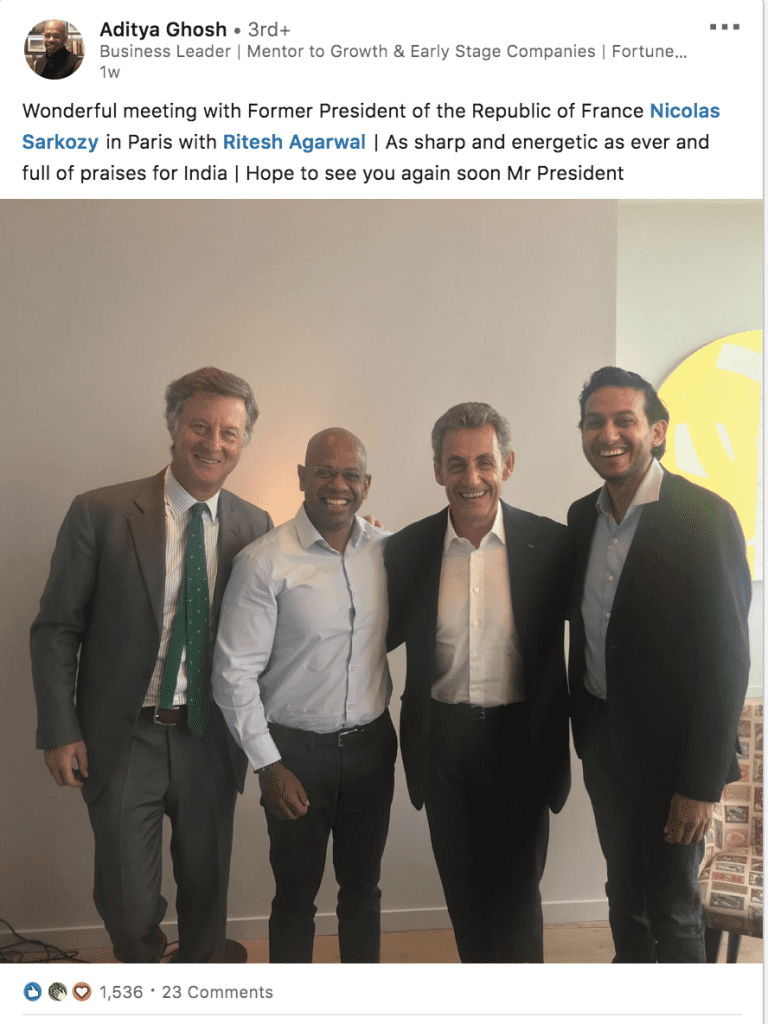

Accor’s potential interest in a budget chain heightened when Oyo’s founder, Ritesh Agarwal, flew to Paris after speaking at Skift Forum Asia on May 27. Soon after, Oyo’s CEO of South Asia, Aditya Ghosh, shared a photo on LinkedIn of him and Agarwal with Accor’s CEO Sebastien Bazin and former France president Nicolas Sarkozy in the city of love.

Accor has not responded to Skift at press time.

During his session onstage at Skift Forum Asia, Agarwal completely sidestepped the possibility of Accor taking a stake in Oyo.“The only reason I continue to be excited about what I’m doing is the potential impact it has [on people],” he said. “It’s an amazing opportunity that every street across the world can have a beautiful living space. I think that’s unique. I’m only focused on that.”

Budget Romance?

More money is being poured into budget hotels. Another Oyo competitor, Fabhotels, raised its total funding to $43.1 million following a $7.9 million infusion in early June from Goldman Sachs, Accel and Qualcomm, Crunchbase data shows.

Hotel investment gurus said they won’t be surprised if Accor romances the idea of an acquisition in the budget hotel space, for several reasons.

Firstly, it is “so Bazin” to be bold, acquisitive and experimental, they said. Accor has acquired no fewer than seven non direct hotel companies since 2016.

Secondly, Accor’s roots were in economy, so the chain isn’t a stranger to budget. It continues to operate its Formule 1 hotels, now called HotelF1 in France, and more recently spun off an Ibis Budget brand from its economy brand Ibis, which shows it wants a piece of the low-cost hotel market.

But Ibis Budget is still priced higher than other budget brands. A Google search shows that the Ibis Budget Jakarta Cikini charges $23 for a night on June 29, which is cheap, but an Oyo, Airy or RedDoorz hotel could be had for half that price.

That, is one reason why global hotel chains have ignored the standalone independent hotels ranging from 20 to 50 rooms, even though collectively they are a significant market across the globe. The earnings profile is just so different from limited or full service.

“Prominent hotel operators have turned a blind eye to this space due its unit economics,” said Nandivardhan Jain, CEO of Mumbai-based Noesis Capital Advisors. “The last four years have seen new hotel aggregators or technology-focused hotel brands converting this unorganized room inventory into an organized market. But it has its own operational and financial challenges.”

Guest experience is a major one. While new entrants have done decent work on booking experience, hotel visibility on online platforms and property management system and support, at ground level the majority of the inventory have yet to see any significant operations level change in guest experience, maintained Jain.

“Until guest stay experience improves, it’s difficult to build a loyal customer base, which is critical for a longterm sustainable growth. These hotel facilities require an operational bandwidth with the right manning, training, on-site technical support, for better efficiencies. Till now most of the aggregators use deep discounting as a vital tool to attract customers,” he said.

This raises the main question, given the ownership and operating model of the likes of Oyo, which effectively is franchising and distribution of a wide array of properties in both product and service quality, can the sector be successfully branded on a sustainable basis?

“I have my doubts,” said Robert Hecker, Horwath HTL’s managing director for Pacific Asia.

“OTAs have certainly provided the independent budget sector with useful distribution channels not possible prior to the rise of Internet technology. But the only way for the branding to start to mean anything from a customer stay perspective would be common ownership of the properties, or at least the majority being controlled by larger portfolio players who can install some consistency in the customer experience. If not, it's really just a sector specific distribution channel.

“Would consumers want such a specific sector distribution channel versus sorting through multi-sector options on the OTAs? May be. For the budget hotel owners, if the distribution channel costs are lower than the OTA costs, and consumers seek the budget distribution channel, then owners would be on board for sure.”

Clarence Tan, a hotel leader in Asia-Pacific with 23 years of experience, said, “For budget hotels, I believe you need to own the hotels and the systems and processes to systemize and standardize as much as possible. It’s like budget airlines. This is very costly in today’s asset light approach as it is capital intensive, as can be seen from the funds the players need to raise.

“The hotels can be potentially confusing for customers and create new complexities for the management company. Budget hotels do not operate the same as normal hotels. A lot of work and capital for very little gain. You may gain scale but at what expense?”

He added, “Budget hotels also do not work globally and work best only in strong domestic markets, for example, India, Japan, Australia and may be China from an Asia-Pacific perspective.”

Potential Benefits

So why would Accor entertain the idea of investing in a new-age budget hotel player like Oyo or Treebo?

For one, if Accor can “decode” how to work optimally with small inventory hotels, such an association will add “tremendous value” to the global hospitality ecosystem, benefiting stakeholders such as hotel owners, guests, employees, vendors, government and society, said Jain.

“In key cities, real estate is quite expensive due to limited land at locations like the central business district, railway stations, et cetera. In these markets very limited fresh room supply is coming. Whereas existing independent hotels real estate acquisition is historical. Converting this unorganized supply to organized supply is a big opportunity, which if done efficiently then collectively at macro level, will make this a great business case,” he said.

According to Oyo, there are more than six million hotel and guesthouse rooms in India subcontinent, 45 million in China and 158 million globally.

That kind of volume would be irresistible to Accor, said Michael Evanoff, chairman of Singapore-based Marlborough Hospitality Services.

“Accor is unique among the big chains, as from the beginning it’s willing to go with a wide range of brands, from budget to luxury,” he said. “Accor is quite willing to expand in the budget area because in reality it has been there for a long time. Accor’s primary focus is on volume. A senior Accor executive once told me that the company’s goal is to be like Starbucks -- there should be an Accor property on every corner.”

Bazin, during the chain’s 2018 results presentation in Paris in February, said the brand should be “as big as Danone, Total, Coca-Cola, McDonald’s.”

Evanoff and Jain also pointed out an opportunity for Accor in India, where limited supply is coming into the market because the long lead time it takes -- three to four years — to build a hotel.

“India is a very difficult place to do business in. Local knowledge and connections are essential. Investing in an existing successful chain is far and away the best way to quickly gain a strong foothold on the sub-continent. Most of the big chains have expanded gradually, relying on doing multiple deals with a handful of local partners. This is risk free, but slow going,” said Evanoff.

He reminded that countries such as India, China and Indonesia have huge populations but most of them have limited financial resources. “The demand is clearly there. Plus, 10 or more budget properties can be developed for the cost of one luxury property — and in one-third of the time.”

Oyo or Treebo?

According to Jain, Treebo’s room supply is “a little more curated” than its competitive set, but Oyo has the advantage of scale and global footprint.

“International hotel operators like Accor opt for longterm watertight contracts, which are for 15 to 20 years. While acquiring or investing in these companies they need to carefully evaluate what mode of contract these companies sign with hotels — its duration, lock-in, protection clauses, et cetera,” he said.

For the new-age budget chains, the benefits are in gaining more investment or buy-out, which means even faster global rollout. As well, potential synergies with having a hospitality partner, including access to distribution and loyalty plan of the global chain.

Hecker however believes that any budget acquisition by any global hotel company would be a pure investment play rather than about adding value to the chain’s existing brands or even creating a new product brand.

“It’s definitely about capitalizing on the aggregation of an ultimately huge sector of the hotel industry made possible by a new Internet distribution system,” said Hecker. “So, ultimately it is an investment/financial play, albeit creating involvement across the entire ladder of the hospitality sector, touching all possible customers and those that may migrate up the ladder over time.”

He said a pure investment play poses little risk as the acquisition is not treated as part of the brand portfolio.

“It would only be about the financial risks if it doesn’t work out, which is always possible if consumers don’t take the Oyo distribution channel,” adding he’d like see the kind of booking activity taking place via Oyo at this point, as the focus has only been on supply growth.

If Accor buys Oyo, Hecker said he can see how other chains might not want to leave it with Accor alone to participate in the sector and would likely get into the game.

That could be the turning point for hoteliers to view Oyo as part of the competition.