Skift Take

We're often told that travel brands will soon know what we want to buy before we do. But few airlines are anywhere near that level.

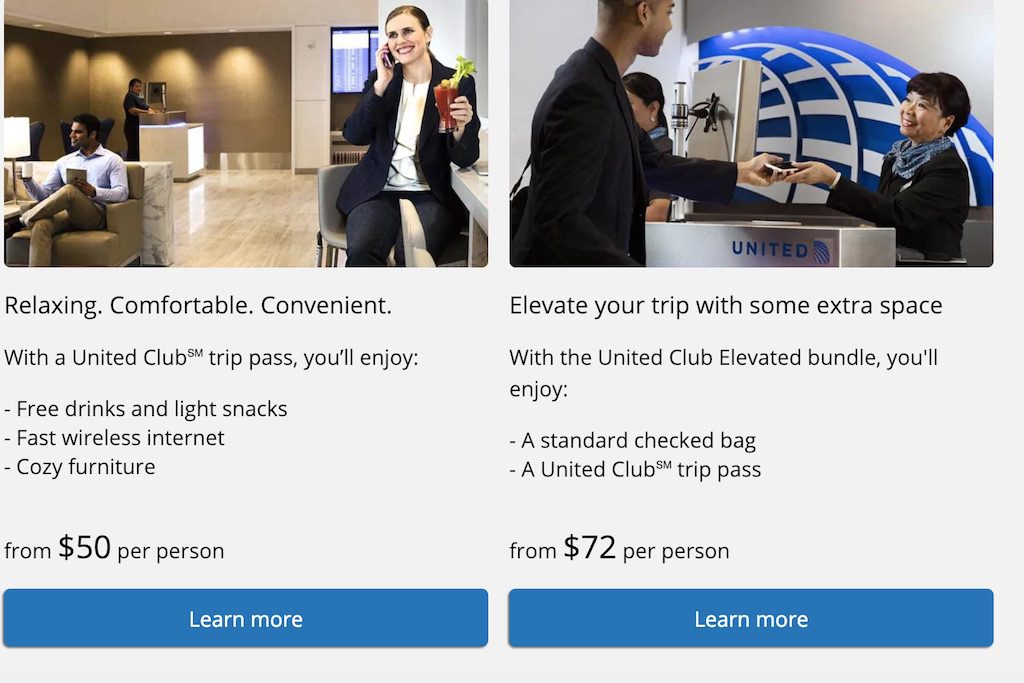

Almost every time I log into my United Airlines account to check an upcoming trip, I’m offered a special bundle with lounge access and a checked bag. It’s priced at $72 for one of my next itineraries, from Newark to Dallas/Fort Worth.

I’m always amused. I’m a member of the United Club, so I don’t need lounge access. I’m also an elite-level United frequent flyer, and receive checked bags for free, not that I have checked a bag in my decade taking business trips. Doesn’t United know this?

I bring this up because my colleague Sean O’Neill, Skift’s travel tech editor, has written a piece called Travel Upselling Gets Smarter Than Ever. It’s one of 12 Megatrends Skift’s team has identified for 2019.

He’s right. Each year, brands become more sophisticated, and many have improved at how they send offers. O’Neill writes about how Finnair’s chatbot can suggest tours and activities, and how more airlines are displaying visual representations of their ancillary products, which could make them attractive to customers. From experience, I know United has impressive functionality for upgrade upsells, often making a compelling offer just when I want to buy, such as when I’m on my way to the airport.

But for all the talk about how brands are leveraging data to personalize experiences for customers, I’m often surprised at how rarely I receive relevant offers from big travel companies. What about you? Do you find brands know what you want?

— Brian Sumers, Senior Aviation Business Editor [[email protected], @briansumers]

Best of SKift

Travel Megatrends 2019: Travel Upselling Gets Smarter Than Ever: There’s no doubt travel brands improve at upselling each year. But some have just started the process. And even those that are good at it have much work ahead. Read this story by Sean O’Neill to learn what’s new for 2019.

Ryanair Reorganizes Exec Team as It Falls to Loss: Did Michael O’Leary, Ryanair’s CEO since 1994, receive a big promotion? Or was he kicked upstairs for a soft landing? The airline reported its first quarterly loss since 2014, Skift’s Patrick Whyte writes, and announced O’Leary will no longer lead the carrier’s day-to-day operations. Instead, he’ll be CEO of the Ryanair Group, which will include four subsidiaries: Ryanair DAC (the main airline), Laudamotion, Ryanair Sun, and Ryanair UK.

Qatar Airways Still Considering Its Oneworld Future: Maybe Oneworld should be thanking Qatar Airways CEO Akbar Al Baker, who loves to wonder aloud whether he should take his airline out of the alliance. Without Al Baker, Oneworld might become irrelevant. His shtick keeps everything interesting.

Wizz Air Pinched by Fuel Price Rise: Quarterly profit at European low-cost carrier Wizz Air plunged over the winter as high fuel prices and increased labor costs ate into earnings, Patrick Whyte writes from London. But the discount airline should still post a big profit for the full year.

Another European Airline Bites the Dust: Nope. It’s not Norwegian. The latest European airline to go under is the German leisure airline Germania. According to the aviation research firm CAPA, Germania was the fourth biggest carrier in Germany behind Lufthansa, Condor, and TUI. Patrick Whyte has more details.

Legacy Airlines Look to Asia for Travel Technology Innovations: Lufthansa Group is a smaller player in Singapore, but it nonetheless chose the city as headquarters for the first non-German location of its innovation hub. As Skift Asia Editor Raini Hamdi writes, “It wants to be embedded in the Asian ecosystem of travel technology startups, digital enterprises, and academia, not just be an outsider looking in but an insider participating in the market.”

The Secret to 72 Years of Profit at South Africa’s Comair: The South African aviation company Comair has been profitable for more than seven decades. Skift freelancer Richard Holmes writes that its recent success comes as management has diversified beyond the airline business. In addition to operating an airline, Comair owns a pilot training center, a catering company, and an airport lounge company. A quarter of its profit last year came from non-flying sources.

Why Qantas’ Surprise Stake in Alliance Worries Virgin: The Virgin here is Virgin Australia, which is not much of a competitor to Qantas anymore, as Qantas has crushed the upstart. Last week Qantas Group took a nearly 20 percent stake in Alliance Airlines, a Brisbane-based charter operator. Virgin Australia has used Alliance for wet-lease operations, but it’s not clear that will continue long-term.

Best of the Rest

Should You Tip Your Flight Attendant? U.S. discount carrier Frontier Airlines has permitted flight attendants to solicit tips for a while, but journalists only recently figured it out. Airlines generally do not allow flight attendants to solicit (or even take) tips, which makes sense since their priority is safety. But I told CNN I don’t think gratuities on planes are so bad. “We tip everywhere else we go,” I said. “Why shouldn’t we tip on an airplane?”

Airbus A380 Superjumbo Has a Big Problem on Its Hands: It’s probably best for Airbus to let the A380 program die, right? Things do not look good for the superjumbo, as Bloomberg writes. No airline wants new jets, but I suppose there’s always a chance carriers will see the virtues of the airframe in the future. Remember, airlines only began coveting the versatility of the Boeing 757 once Boeing stopped making it. Same with the Boeing 717.

Airlines’ ‘Mr. Fix It’ Wants to Save the World’s Worst Carrier: CNBC’s Leslie Josephs interviewed Bill Franke, the 81-year-old chairman of Indigo Partners, the group that has stepped in to save Iceland’s Wow Air. Franke has an impressive record with ultra-low-cost carriers, and it sounds like he’ll use his usual playbook with Wow. “We obviously see potential here or we wouldn’t [invest],” Franke told CNBC.

United Airlines Makes Changes After Review of Plane Stranded for More Than 12 Hours: Last month, a United Boeing 777 from Newark to Hong Kong diverted to Goose Bay Airport in Newfoundland for a medical emergency. But on the ground, after the passenger got off, the crew discovered a problem with the aircraft’s door. Customers were stranded for more than 12 hours. Pilots are now being asked to avoid the remote airport except for emergency landings, The Wall Street Journal reports.

Contact Me

Skift Senior Aviation Business Editor Brian Sumers [[email protected]] curates the Skift Airline Innovation Report. Skift emails the newsletter every Wednesday. Have a story idea? Or a juicy news tip? Want to share a memo? Send him an email or tweet him.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airline innovation report, ancillary revenue, personalization, united airlines

Photo credit: United Airlines often tries to upsell its customers. But sometimes it will try to sell them extras they do not need. United Airlines