Skift Take

Now we have to wonder: What will Blackstone buy next?

After 11 years, the world’s largest private equity firm is checking out of one of the world’s largest hospitality companies in what will be known as, perhaps, the best private equity profit ever made on record.

Blackstone Group announced on Friday it would sell its remaining 5.79 percent stake in Hilton Worldwide Holdings, in a sale worth an estimated $1.45 billion based on Hilton’s closing stock price on May 17. Hilton plans to repurchase 1.3 million of the total 15.8 million shares being sold by Blackstone.

With this sale, it’s estimated that Blackstone will reap a cumulative profit of $14 billion over the course of its 11-year investment in Hilton, more than tripling its initial investment, and ending one of the longest PE plays in the travel and hospitality sector.

While it’s not uncommon for private equity firms like Blackstone to eventually sell off their stakes in companies they take public, Blackstone’s long relationship with Hilton was a particularly long and profitable one.

“From my point of view, it has been a spectacular partnership with Blackstone,” Hilton CEO Christopher Nassetta told Skift. “They bought the company in 2007, at the peak of the buyout business and going into the Great Recession. It was fair to say, if you want to go ahead and read the headlines from back then — it didn’t look pretty. Everyone thought it was a bust. It was the biggest private equity check ever written. Everyone said would be the greatest private equity loss in history. It’s now the largest private equity profit ever made.”

Nassetta also confirmed to Skift that Blackstone President and COO Jonathan Gray will remain as chairman of Hilton’s board of directors after Blackstone’s sale is completed.

“I will always share an incredible relationship with Jon and Blackstone,” Nassetta said. “They are unbelievable partners, friends, and supporters of me and the company and management. We will always shave a very special relationship. They will not own any part of the company from this point forward, but Jon is staying on as our chairman, and I couldn’t be more excited to continue the relationship there.”

Blackstone and Hilton’s Relationship

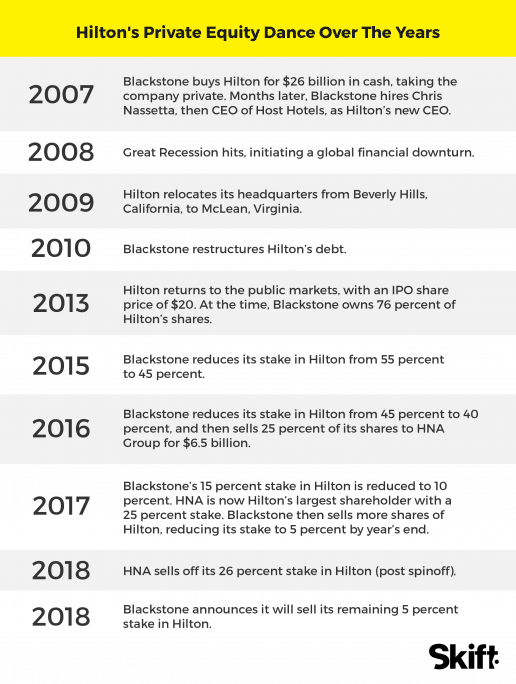

Blackstone bought Hilton for $26 billion in an all-cash deal in 2007, making it a private company.

At the time, many industry watchers thought the deal would prove to be disastrous — and it also happened to take place just before the Great Recession of 2008 decimated global markets, and badly hurt the hospitality industry, among others.

Once Blackstone assumed control of Hilton and took the company private, one of the first things Blackstone’s Gray did was to hire Nassetta as the company’s CEO. Nassetta, at the time, was the chairman and CEO of Host Hotels, the real estate investment trust spun off of Marriott back in 1993.

Back in 2007, Hilton was also a very different company, and Blackstone’s Gray sought out Nassetta to help turn the floundering company around.

“A large part of the story is we really transformed the business,” Nassetta said, noting that his own relationship with Blackstone and with Gray stretches beyond 11 years to nearly 20. “We took a business that had been a great global business and had lost its way — and we reinjected a lot of new life. We went from a mediocre performer in the industry to a leading performer in the industry, and that’s because we built an incredible culture — a team aligned around a purpose and a cause to do great things together.”

During the years when Hilton was private, Blackstone had masterfully managed the financial downturn with a restructuring in 2010, helping the hotel company pay off its debts in the process at highly discounted rates. By 2013, Blackstone had increased the value of its deal by about $10 billion.

In 2013, six years after its initial purchase, Blackstone brought Hilton back to the public markets with an initial public offering share price of $20, and the company has since grown even more. It is now valued at $24.8 billion, with a share price of around $80.

In 2017, Hilton completed a spinoff of its timeshare and real estate units to become an asset-light manager and franchisor of hospitality brands like its biggest rivals, Marriott among them.

Since taking the company public, Blackstone has been taking steps to reduce its stake in Hilton — as private equity firms are likely to do, noted Michael Bellisario, a senior equity analyst with R.W. Baird & Co.

“When private equity firms take companies public, they don’t intend to own them as companies forever,” Bellisario said. “Blackstone has been selling stocks since they took the company public. This is an ordinary course of business for a private equity firm that has taken a company public.”

In October 2016, just before Hilton completed its spinoff of its timeshare and real estate businesses, Blackstone sold 25 percent of its stake in Hilton to Chinese conglomerate HNA Group for an estimated $6.5 billion.

Since then, HNA Group — under intense pressure from the Chinese government — has sold off all its shares in Hilton, as well as its shares in its spun off timeshare and real estate units.

Bellisario, for one, sees little to no influence on HNA’s divestitures on Blackstone’s decision to sell its remaining shares in Hilton.

“The only thing I see from my seat, potentially related to HNA, is that Blackstone didn’t sell its shares earlier because it knew, at some point in the near future, that HNA would sell, and it did, therefore Blackstone held onto its 17 million shares longer than it would have otherwise liked to, but it did it for the benefit of the company and the other 95 percent of shareholders not named HNA,” he said.

However, Dan Wasiolek, a senior equity analyst at Morningstar, said some investors may question whether now is the optimal time for Blackstone to sell its remaining shares.

“Blackstone has seen its investment play out and views the valuation at a good exit point,” Wasiolek said. “The push back to this view is that Blackstone sold more substantial stakes in Hilton at much lower valuation levels in May 2015 and the first quarter of 2017.”

Taking in a longer view of Blackstone’s sales of Hilton shares, a $14 billion profit over the course of more than a decade is not an insignificant amount.

Gray told Bloomberg: “Our motto for Blackstone real estate is buy it, fix it, sell it, and Hilton really fell into that as a company we felt we could transform.” And while “it’ll be hard to top [the Hilton deal],” Gray also said, “You never know what the future will bring and we continue to identify large-scale transactions where there are opportunities to create value.”

Since Blackstone became involved with Hilton, the company has doubled the number of hotel rooms in its portfolio to 900,000, and there are currently 350,000 more rooms on the way. Hilton has also boosted its organic growth by adding new brands such as Curio Collection, Tapestry Collection, Tru by Hilton, and Home2Suites, with plans to add more.

For Nassetta, the bigger story is about what happens going forward for the hospitality company, which is turning 100 next year.

“It’s a great example of how private equity can get involved into something and add a tremendous amount of good,” Nassetta said. “The company that was floundering a little bit and was transformed to do great things again. We are just getting started in terms of what we’re going to do next.”

Have a confidential tip for Skift? Get in touch

Tags: blackstone, hilton

Photo credit: An exterior shot of the Hilton Midtown. Private equity firm Blackstone, which bought Hilton in 2007 and has remained a principal shareholder in the company since it went public again in 2013 is selling off its remaining 5 percent stake. Andrew Kelly / Reuters