Skift Take

Carlson Rezidor hasn't taken advantage of its vast potential. This new name and strategy may help.

Carlson Rezidor Hotel Group has changed its name to Radisson Hotel Group, and that’s not the only big change the company is making this year.

In addition to the name change, which is being reported here in the press for the first time, but took place in November 2017 according to a company spokesperson, the company is also embarking on a comprehensive five-year strategic plan which includes reinvestment in its five brands; a pruning of at least 10 percent of its underperforming Americas-based Radisson hotels; layoffs at Carlson; and a focus on organic growth.

The name change to Radisson Hotel Group is noted in Rezidor’s most recent investor day presentation, which was released on January 17. The primary reason for using Radisson in the new company name, the document noted, “leverages the wide awareness of the Radisson brand name globally.”

A clue to the new corporate brand name was revealed when the company announced that the Country Inn & Suites by Carlson brand was changing to Country Inn & Suites by Radisson last month.

The same presentation also outlines Radisson Hotel Group’s five-year plan for becoming “one of the top three hotel companies in the world.”

Makarand Mody, assistant professor of hospitality marketing at the Boston University School of Hospitality Administration, said this new direction, strategy, and corporate name were much needed, especially since “the company does not have an overarching customer-facing parent brand that can draw equity from the individual brands, like the Marriott or Hilton.”

He added, “Radisson is definitely the strongest brand equity component in the portfolio so it does make sense to put it front and center. I think building the brand equity inside out from the Radisson identity will serve the company well.”

The Transition From Carlson Rezidor to Radisson Hotel Group

It’s been a little more than a year since Minnetonka, Minnesota-based Carlson Hotels was purchased by Chinese conglomerate HNA Group in December 2016. And it’s been five months since HNA acquired the additional 19.1 percent of shares in Rezidor it needed to become the publicly traded Swedish company’s majority 70.4 percent stakeholder in October 2017.

During this period, it was uncertain what would happen to both entities — Carlson Hotels and Rezidor Hotel Group. There was a waiting game involving whether HNA would be able to buy those additional 19.1 percent of shares.

And there were plenty of executive leadership changes along the way.

In 2016, angry NH Hotel Group shareholders alleged that HNA Group’s purchase of Carlson Hotels, and likely Rezidor, would pose a major conflict of interest since HNA owns 29.3 percent of the company. Those shareholders ousted NH Hotel Group CEO Federico González in June 2016, and he was named CEO of Carlson Hotels in January 2017, only to be appointed president and CEO of Rezidor Hotel Group in May 2017.

Since HNA’s acquisition of Carlson Hotels, the company has seen three CEOs: David Berg served as CEO from May 2015 to February 2017, followed briefly by González, and now there’s John Kidd, a former HNA executive, who took over the CEO role in May 2017.

For a long time, there were more questions than answers. Today, however, we do have a better sense of where HNA wants to take both companies.

“This new strategic direction is timely for the Carlson Rezidor Hotel Group,” Mody said. “It is a strong hotel company with some very good brands, but I do think it hasn’t maximized the potential of these brands with its existing brand architecture strategy, which is confusing to say the least.”

Nothing is fundamentally changing in terms of how the newly named Radisson Hotel Group is structured, although the company has outlined a new, more clearly defined organizational leadership chart. Publicly owned Rezidor is still the master franchise of privately owned Carlson Hotels. The combined organization, which will be known as Radisson Hotel Group going forward, comprises more than 1,180 hotels around the world. Rezidor focuses on Europe, the Middle East, and Africa, while Carlson Hotels is focused on the Americas and Asia.

Mody also noted, “From a digital marketing standpoint, the new brand.com will present a better face to the customer, and enable more effective SEO, SEM, and other digital optimization. All the customer would need to do then is to type “Radisson” into Google, and they would see everything the company has to offer. That’s the kind of integration that has currently been missing for the company.”

For a better understanding of Radisson Hotel Group’s plans for growth, Skift recently spoke to Ken Greene, president of the Americas, and to Chema Basterrechea, the company’s executive vice president and chief operating officer, both of whom just joined the organization in 2017. Greene was the former president and CEO of Delta Hotels and Resorts, which is now owned by Marriott International. Basterrechea is the former COO of NH Hotel Group.

What follows are their views about the five-year plan.

First Things First: What’s Going On with HNA?

Recent headlines about HNA have focused on the company’s need to sell off billions in assets and reports that the company was asking its own employees for loans.

In December, the company noted that it pledged approximately 8.9 percent of its shares in Rezidor as a security for a loan agreement with a lender. Most recently, the company announced it was selling $4 billion in U.S. real estate assets.

The company, which is facing massive short-term debt of approximately $29.3 billion, also owns a 25-percent stake in Hilton, in addition to a number of other businesses both inside and outside the travel industry.

Greene and Basterrechea didn’t seem too concerned about HNA’s financial woes and its potential impact on their plans for growing Radisson Hotel Group.

“Actually, it’s not the least bit of concern for me,” Greene said, saying, “The reason I came and took the job as president of Carlson was because of HNA.”

“They’ve done a tremendous amount of acquisitions in just the last two years. I mean, $50 billion plus. And they’ve approved our strategic plan, which involves a tremendous amount of investment. Since I have been here, HNA, the global steering committee, and our board have been extremely supportive of us. They have granted our requests for investment. It hasn’t been an issue one bit for us. And I’m not too concerned about the financial health of our parent company.”

Basterrechea reiterated Greene’s comments, saying both companies and the five-year plan are “independent” and “autonomous … from a financing point of view,” with regard to HNA. He added, “We don’t depend on the health of our main shareholder to go ahead.”

Basterrechea also thinks there’s room for a lot of synergy and opportunity for Radisson Hotel Group in the Chinese market, thanks to HNA’s influence.

And Greene believes that HNA’s various investments in multiple travel businesses, “actually helps them understand the industry a lot better.” He added, “We’re very pleased that they decided to acquire Carlson 100 percent. We think it’s a hidden gem. It has a great portfolio of brands that will grow.”

What’s Happening with the Radisson Brand?

Of the group’s brands, Radisson is receiving marquis treatment thanks to the company name change to Radisson Hotel Group, and partly because of that, the combined organization is devoted to “repositioning” the brand and investing a lot to do it.

In other words, Radisson is undergoing a makeover, similar to the transformation Marriott’s Sheraton is already going through, especially in the United States.

“With the core Radisson brand,” Greene said, “we have a bit of a tarnished image.”

In April 2016, Skift spoke to Colby Brock, the general manager of the Radisson Hotel New Rochelle, shortly after it was announced that HNA was buying Carlson Hotels. She told Skift, at the time, that her hotel, which her family built more than 40 years ago, was formerly a Sheraton, but had switched to the Radisson flag approximately 16 years ago because it “seemed like an up-and-coming brand” in the U.S. market.

She said that while she very much liked working with Carlson Hotels and had high hopes for what HNA could do with Carlson Hotels, she lamented the growth of the Radisson brand in the Americas.

“They couldn’t or wouldn’t keep up pace with Marriott or Hilton with how quickly they were building or adding products,” Brock said of the Radisson brand. “If you want to capture American guests, you have to have presence. You need to be in their face. Marriott and Hilton spend hundreds of million in ads. They are always promoting their brands. Radisson and Carlson didn’t take the time, or they didn’t know how, or didn’t care to do that here in the Americas. They just really focused their energy abroad.”

Greene said he hopes to do with Radisson what he did with the Delta Hotels and Resorts brand. “When I came in as CEO, Delta had a great reputation, a long history, great people, and a wonderful service culture, but not a lot of investment had been put into it over the years. It had a lot of awareness in Canada and in 18 months we turned Delta around, and ultimately, we sold it to Marriott. Radisson, I think, is a very similar exercise in terms of getting the quality.”

He also believes, for one, that Radisson’s brand awareness gives them an advantage in the repositioning process, even if it’s not the best brand image right now.

“It has great awareness — people know Radisson,” Greene said. “Their perception of Radisson is probably not what we want it to be today, but I’d rather have great awareness and have to fix the quality, than have no awareness or little awareness, and have a great brand. Because awareness takes a lot of money to create.”

As part of this 18-month brand exercise, Greene said that 10 percent of the brand’s worst-performing properties, anywhere from 10 to 15 hotels, in the U.S. will be asked to leave the system. The company will then focus on “the next lowest 25 percent quartile by either pushing them up, or incentivizing them, or doing whatever we can to get them to renovate and provide a more consistent experience for our guests, and in a very short period of time you can effect the change,” he said.

Back in 2016, Brock told Skift that her biggest hope would be for HNA to “grow the Radisson brand and bring national attention to it, and give guests and customers that same warm fuzzy feeling that their competitors do.” She said that she wished U.S. consumers were as familiar with the Radisson brand as their European counterparts.

“We get a lot of European guests who come in from overseas and are very familiar with the brand, and they are 100-percent more likely to choose us over a Hilton or a Marriott,” Brock said. “They need to create that same kind of confidence in our product, and mimic whatever they do in Europe, but here. It’s a great brand, but buyer confidence and brand recognition is crucial.”

Greene said that the company plans to invest heavily in 21 key gateway cities throughout the Americas to develop “billboard properties,” especially under the flagship Radisson Blu brand.

“That basically gives us a beautiful umbrella for the rest of our brand,” he said. “It increases our awareness, and allows us to get global accounts.”

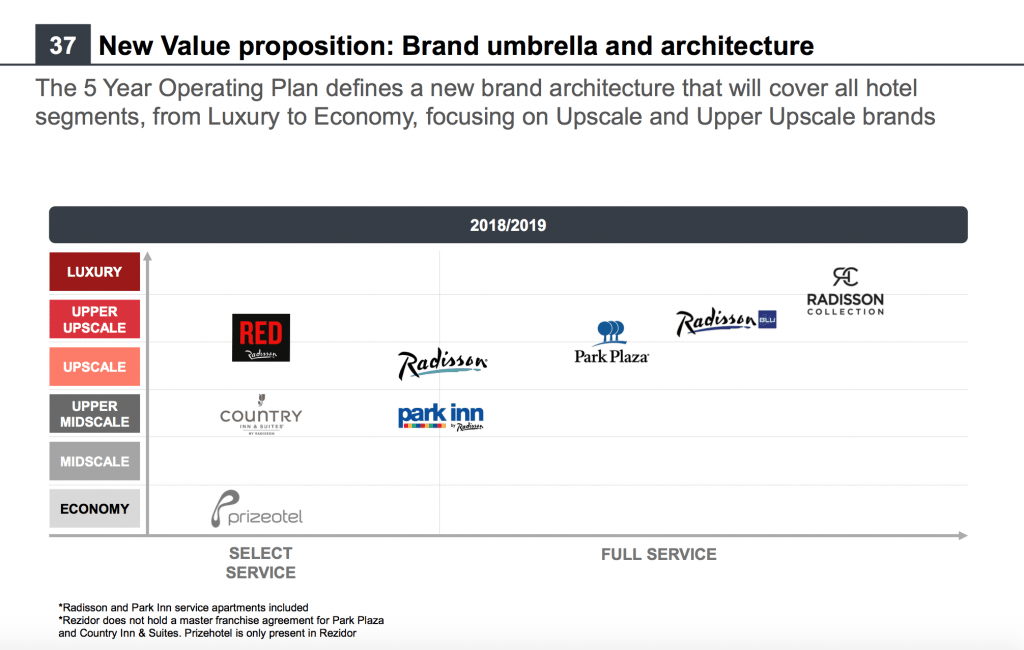

A chart from Radisson Hotel Group’s Investor Day presentation demonstrates the company’s brand portfolio. Source: The Rezidor Hotel Group

What Will Happen to the Other Brands?

Cleaning up all of Radisson Hotel Group’s brands, not just Radisson-branded hotels, is also top of mind on the Rezidor side of Radisson Hotel Group, which comprises Europe, Africa, and the Middle East regions. Basterrechea said that of Rezidor’s more than 360 hotels, about half of the 60 of that are leased “were producing negative numbers at a big level” and “there was a clear need for an ordered action regarding those leased properties.” He said, “We estimate 60 percent of our portfolio is losing revenue due to some opportunities that we have seen regarding the asset or the brand realization.”

To remedy this, he said the company is planning to invest 150 million euros, or approximately $183.8 million over the next five years to upgrade, renovate, and even upgrade the brands of those particular leased hotels.

Investment in the other brands has already begun, too, and the new Radisson Hotel Group will have a total of eight brands, ranging from full-service luxury to economy select-service: Radisson Collection (formerly Quorvus Collection); Radisson Blu; Park Plaza; Radisson; Park Inn by Radisson; Radisson Red; Country Inn & Suites by Radisson; and Prizeotel.

However, it should be noted that Rezidor doesn’t have a master franchise agreement for Park Plaza and Country Inn & Suites, and Prizeotel is a brand that is only present in Rezidor.

Greene said he believes the Country Inn & Suites brand “should be four times as large as it is today.” There are approximately 480 properties globally today, and the group is working hard to make sure all existing properties have the newest fourth-generation prototype in place, while adding new owners and properties.

The upscale select-service Park Inn by Radisson is another brand Greene hopes to grow more in the Americas, especially since the majority of the brand’s more than 140 hotels reside outside of the U.S “They’ve got this great reputation, so we’re going to take the European prototype and bring it over to the U.S., Americanize it, and introduce it to the marketplace,” he said. “I don’t think anybody knows what a Park Inn really is in this part of the world, but it’s pretty well defined in Europe, the Middle East, and Asia.”

Eventually, the goal is for Radisson Hotel Group to grow its global portfolio of 188,000 rooms and increase it to 255,000 rooms by the year 2022.

When asked if the company would add more brands any time soon, Greene said that while that could “opportunistically happen,” the new five-year plan is focused on organic growth and “contemplates us having exactly the same brands we have today.”

He added that “what makes us unique right now is that we have one brand for every segment, and from an owner value proposition, we think that’s a great differentiator.”

What Will Happen to Carlson Hotels’ Headquarters and Workforce?

Carlson Hotels has been headquartered in Minnetonka, Minnesota for decades, but the company is currently hoping to relocate its offices within the Minneapolis area.

“We’re committed to staying in the Minneapolis area as a company,” Greene said.

However, as part of this new strategic plan and new leadership, Carlson Hotels reduced its workforce by 20 percent.

Greene said, “I think we were very, very inefficient and, actually kudos to the team that had to deal with that infrastructure for so long because it was really ineffective and inefficient. So, when you look at the investment in technology that we’re doing, and look at what we did from a workforce reduction, it makes a lot of sense within that concept.”

What Else Does This Five-Year Plan Entail?

In addition to changing the names of the combined corporate entity, as well as soft brand Quorvus Collection (now known as Radisson Collection), the company is also changing the name of the loyalty program, Club Carlson, although the new name of the loyalty program was not disclosed in its investor day presentation.

Mody wondered if the new loyalty program name might be Club Radisson, but noted, “The drawback, of course, is that Club Carlson is a strong loyalty program that has developed its equity over time … It may take some time for customers to adjust, but over the medium- and long-term, the benefits to the overall brand architecture strategy are clear.”

In addition to giving the loyalty program a new name and repositioning the brands, the new strategy plan also calls for major technology platform investments, a new human resources strategy, and improved optimization for revenue management.

Time will tell if the new strategy succeeds, but as far as Greene and Basterrechea are concerned, the future of the new Radisson Hotel Group looks bright.

“All in all, we have a very ambitious goal: to become one of the top three hotel companies in the world,” Basterrechea said. “It doesn’t meant that we’ll be frustrated if, by year five, we are not one of the top three, but we would like to set, as I said before, very ambitious objectives, because only by setting them and by being very positive, and being demanding with yourself and your teams, that’s when you can actually achieve the big things.”

Have a confidential tip for Skift? Get in touch

Tags: carlson hotels, carlson rezidor, hna, nh hotels, radisson, rezidor, rezidor hotel group

Photo credit: A rendering of a new guest room at the Radisson Blu Cologne. Under a new five-year strategic plan, parent company Carlson Rezidor Hotel Group is changing its name to Radisson Hotel Group and investing heavily in repositioning its brands. Radisson Hotel Group