Skift Take

Google now prods its users to try to cut their travel costs by considering alternative airports and other tricks. Yet the incremental moves may not appease a European watchdog that may question its broader business practices in travel.

Is Google naughty or nice? In the past week, this perennially smoldering debate on the travel industry’s conference circuit got fresh fuel.

On the “naughty” side, a Times of London article claimed that the European Commission had told one of its reporters that it is investigating Google’s flights and hotel services business.

But the commission has not made an official announcement about investigating Google’s travel practice. And Politico’s Brussels site reported Tuesday that its sources say the commission has not yet decided whether to pursue a complaint against Google Flights.

An investigation would pose a threat to Google given that Europe’s watchdog and regulatory body fined the U.S.-based search giant $2.7 billion, or 2.42 billion euro, in June for alleged “abuse of market dominance” for its not-dissimilar shopping ads for retail goods.

Google will appeal the case. In response to that shopping ruling, Google issued a statement: “When you use Google to search for products, we try to give you what you’re looking for. Our ability to do that well isn’t favoring ourselves, or any particular site or seller – it’s the result of hard work and constant innovation, based on user feedback.”

Based on Google executives’ past comments, it would seem likely that they would make similar arguments about their travel comparison services.

Some travel industry lobbyists disagree. Christoph Klenner, secretary-general of the European Technology and Travel Services Association — whose members include Amadeus, Booking.com, Expedia, and Sabre — has asked the commission to investigate.

Klenner also issued a statement: “Google leaves competitors with no choice but to buy visibility. Because there is no alternative to Google, online travel companies are prepared to, and do in reality, bid up to their entire margin to be placed near the top of Google’s search results. All this money cannot be spent to innovate or to offer consumers better deals.”

The commission noted that Google’s market share in most European countries exceeds 90 percent, a sign of monopoly power that could be misused to push consumers to its preferred products. Google’s advocates counter that that statistic doesn’t count other sites that aren’t strictly speaking search businesses, such as Amazon and eBay, as alternatives for consumers.

Google draws the ire of many travel executives for its size as an advertising platform. Skift estimated that Google generated at least about $12.2 billion in revenue from travel advertisers in 2016. To get an idea of the scope, Expedia generated $8.7 billion in revenue in 2016, for example.

New Tools for Consumers

On the “nice” — or pro-consumer — side of the ledger this week, Google added functionality to its flight and hotel search products that will make it easier for flexible consumers to find bargains.

The tools mainly added more contextual information about the ticket and hotel prices they display. The tools make it easier for a consumer to find cheaper alternatives that they might otherwise miss, given that only so many search options can be crammed into a small mobile screen.

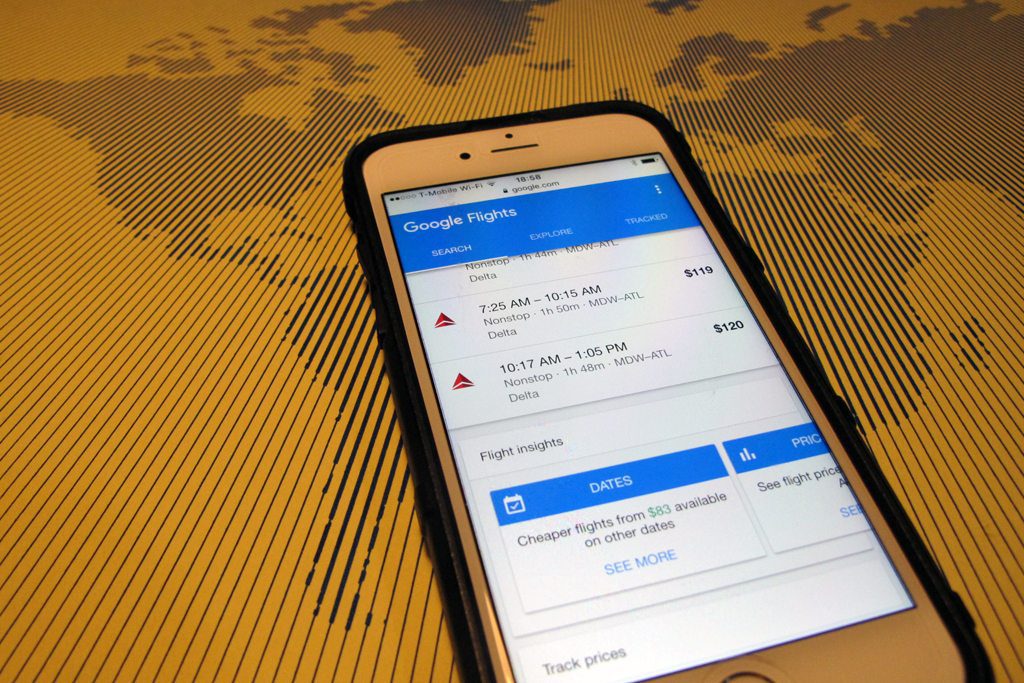

U.S.-based Google users, and soon consumers worldwide, have begun to see a new section in the Google Flights search display called Flight Insights. The section provides a visual, mobile-optimized way of discovering whether it would be cheaper to travel on a different day or if it would be cheaper to fly in or out of an alternate airport.

Nabil Naghdy, the Swiss-based manager of the flight search product, wrote in a blog post that U.S. consumers using mobile devices can now see a calendar view of date combinations for any given flight deal, with the least expensive fares highlighted in green and the priciest ones in red.

Ben Austin, the San Francisco-based manager of the hotel search product, said the company has also made it easier to find the cheapest dates to book a hotel with a new nightly rate calendar view, and a new chart with historical rate trends to see how competitive today’s rates actually are.

To be fair, these are functions that were pioneered by metasearch companies like Kayak and Skyscanner years ago.

In our informal tests, the search results were blazingly fast. Industry competitors like Kayak CEO Steve Hafner have conceded in the past that Google has an annoying ability to deliver the industry’s fastest response time on mobile — though its results are often not as comprehensive as what other providers offer. That speediness happens by pre-computing millions of possible prices and then using that cache of data to push answers whenever a consumer runs a search for a specific trip.

Engineers under the travel engineering director Dave Marmaros work with Richard Holden, who heads Google’s product teams in travel, to choose to solve niche user experience problems via relentless testing.

Over time, the search giant’s new travel tools may speed up the trip-planning process for millions of users. For example, at a quick glance, a consumer can now see nearby airports on an interactive map, viewing the distance between each one and a user’s final destination. Users can then shop by airports of their choosing, making a tradeoff between convenience and airfares levels.

Incremental Strategy

The incremental nature of the new functionality Google rolls out is almost comically small in proportion to the fear that the travel industry has about the tech company. However, it’s not so comical when coupled with the market share gains Google is making at the expense of competitors.

For fans of the company, Google’s approach to travel search appears to be led by engineers laser-focused on a couple of challenges that, if solved, could boost margins per transaction simply by delivering a better user experience rather than through what critics charge is an abuse of market power. As of early 2015, the company said its flights product wasn’t even profitable.

The incremental, user-focused approach dovetails with things that company executives have said about their strategy.

Rob Torres, writing earlier this year for the annual Economic Impact Research paper from World Travel & Tourism Council, said: “From initial research to on-location assistance, mobile devices have the ability to truly transform the core of travel experience… But only if companies reimagine their offering in a user and mobile-first way.”

Torres translated that goal into a few practical steps, such as delivering a mobile experience that assists the traveler, agnostic as to whether it is via a Web or app channel, and developing for fast page load times with a goal of pages loading in less than two seconds on global networks, meaning 2G or 3G.

Google’s new travel-search functionality coincidentally exemplifies a mobile-first approach. For example, users can now see more dates with desirable fares by swiping left on their mobile device screen for an efficient user experience on a tiny screen.

Google claims that its incremental changes result in bottom-line differences. A year ago, Google Flights began notifying flyers when airfares would expire. Google says today that “almost 10 percent of the time that a Google Flights user sees a tip, they choose to change their original travel dates.”

To be fair, that claim is not as solid as it looks. The company bases that claim on a July survey of 467 U.S.-based adults who planned a vacation in the last year rather than its data of how actual consumers used its tools.

But the broader point is that the company thinks the incremental approach is resonating with consumers.

Likewise, with its market power and resources, there’s little reason for Google to be in any hurry.

Speaking at the Skift Global Forum in September, Google Travel’s vice president of engineering, Oliver Heckmann, said the company wants consumers to begin their travel planning in the earliest stages through its search engine and associated products, and it does not seek to become a trip-planning site.

Speaking at the Phocuswright conference, Kayak’s Hafner said: “If we were all the CEO of Google we would be doing the … same thing. Look, they built a great service, people go use Google, if they want to provide answers to people showing travel intent on Google they are well within their space to do that.”

Clearly, the “naughty or nice” debate will last for some time — unless EU regulators, and perhaps their U.S. counterparts, actually step in.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: google, google flight search, regulations

Photo credit: Under a Flight Insights section of its metasearch product, Google has added new tools. For example, tap on Dates to see a calendar view of date combinations with the cheapest prices highlighted in green and the most expensive in red. Skift