Skift Take

While much is written about the U.S. and Shanghai parks, Disney’s partnership in Japan contributes high margin licensing fees and promotes the Disney brand.

Disney is by far the largest entertainment conglomerate in the world, with its massive parks and resorts unit representing its travel footprint. This segment generated more revenue than industry powerhouses like Priceline, Expedia, Marriott, and Hilton. Parks and resorts may represent less than a third of Disney’s sales directly, but it’s a crucial consumer touchpoint facilitating Disney’s cross-monetization of content.

In our full report, A Deep Dive Into Disney’s Competitive Position In Travel, we discussed each individual theme park, peering into the specific economic contributions and ownership structures. We analyzed attendance trends, pricing power, new expansion projects, and competition. In the excerpt below, we provide our analysis of the Tokyo Disney Resort, which operates under an asset-light royalty model, giving the resort more importance than one would expect at first glance. Additionally, it reinforces the Disney brand in Asia for the studio and consumer products businesses.

For more insights on how Disney cross-monetizes its intellectual property across the company, get the full report here.

TOKYO DISNEY RESORT

Walt Disney has no ownership of the Tokyo parks, Tokyo Disneyland and Tokyo DisneySea. Instead, Oriental Land Company (OLC) owns and operates them and pays royalty and licensing fees to Walt Disney. While Disneyland Paris has had financial issues, Tokyo Disney has been a resounding success, both in the fees it brings Disney and for the owners of the park itself. Both of the parks are in the top five in worldwide attendance.

Tokyo Disney Resort is on 494 acres with two parks, four hotels, and is just 12 kilometers east of Central Tokyo. There are 30 million people living within a 30-mile radius. The parks are only 15 minutes from Tokyo Station, 30 minutes from Haneda Airport, and 60 minutes from Narita International Airport. The hotels are a small part of the business with 80 percent of revenue coming from the two parks.

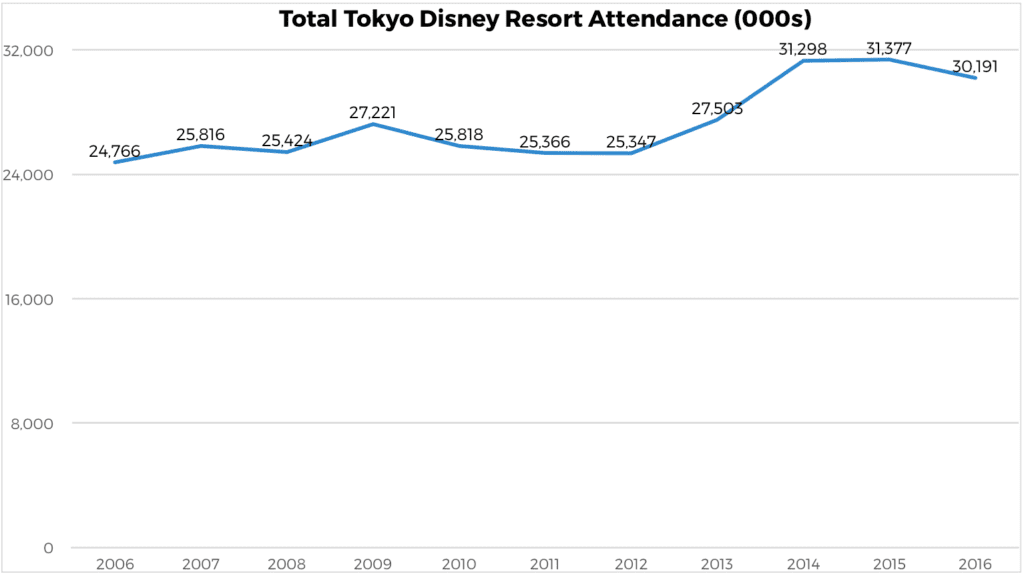

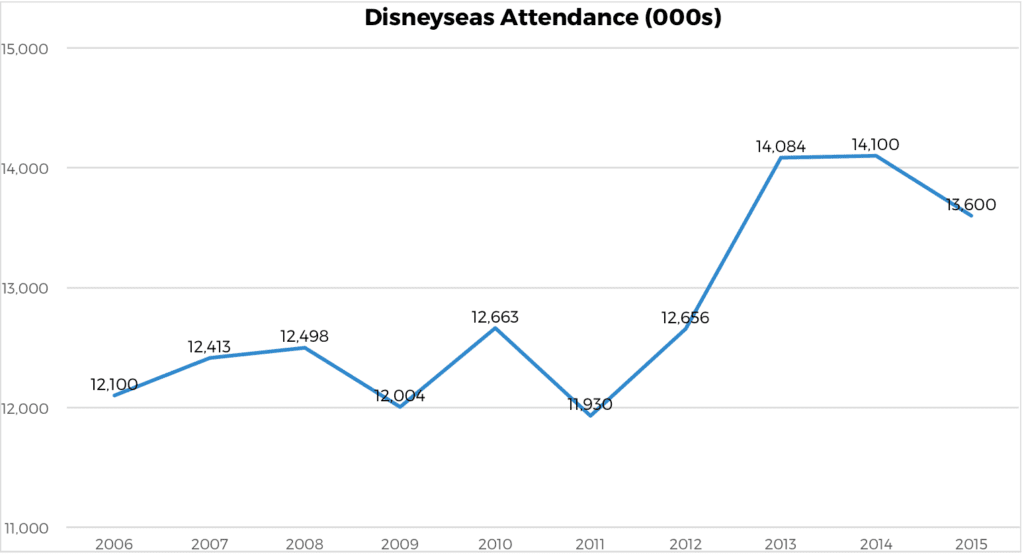

Attendance

Combined annual attendance for the two parks has hovered at around 30 million for the past few years. It dominates Japan with 50 percent market share. The jump in 2013 was associated with the 30th anniversary of the first park. The dip in 2010 to 2012 was caused by lingering tourism impacts from the earthquake northeast of Tokyo.

The park is heavily domestic with 65 percent of guests coming from the Tokyo Metropolitan area, and only six percent come from overseas.

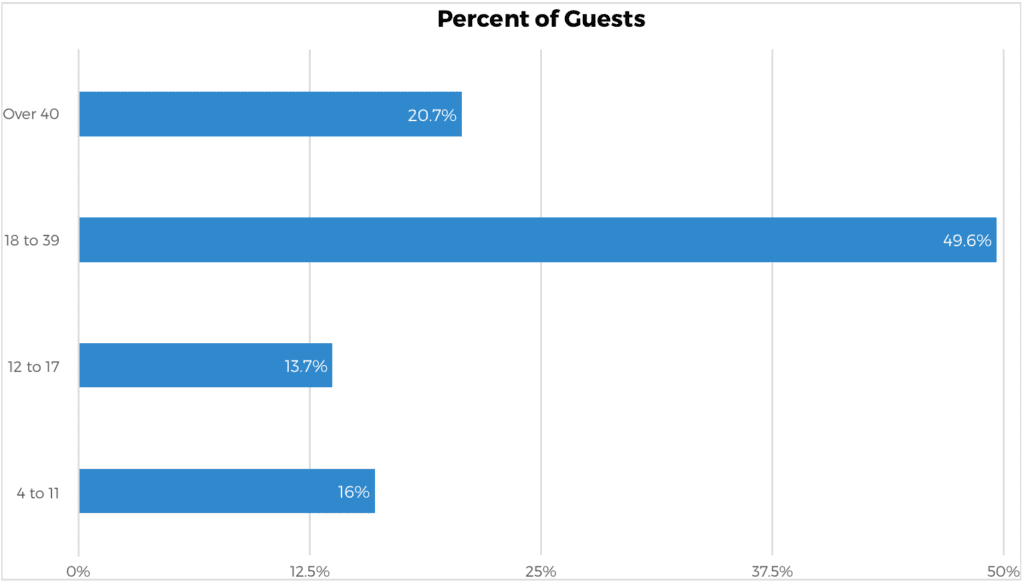

The demographics, like Japan in general, skew older with approximately 70 percent of guests older than 18 years old.

Source: Company Filings

Source: Company Filings

The average length of stay has been consistent since 2006 at between eight and nine hours.

Unlike in the U.S., where ticket prices have increased consistently each year, Japanese price increases come sporadically, though the company hints in its filings that price increases are likely as the value to customers will increase with new expansion projects.

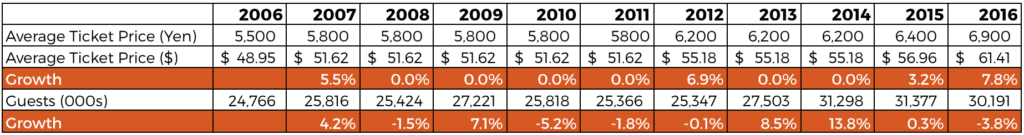

TOKYO DISNEYLAND PARK

This was Disney’s first international park and was modeled after Disneyland in California. It is 115 acres with lands including Adventureland, Critter Country, Fantasyland, Tomorrowland, Toontown, Westernland, and World Bazaar.

Attendance

Source: Themed Entertainment Association/AECOM

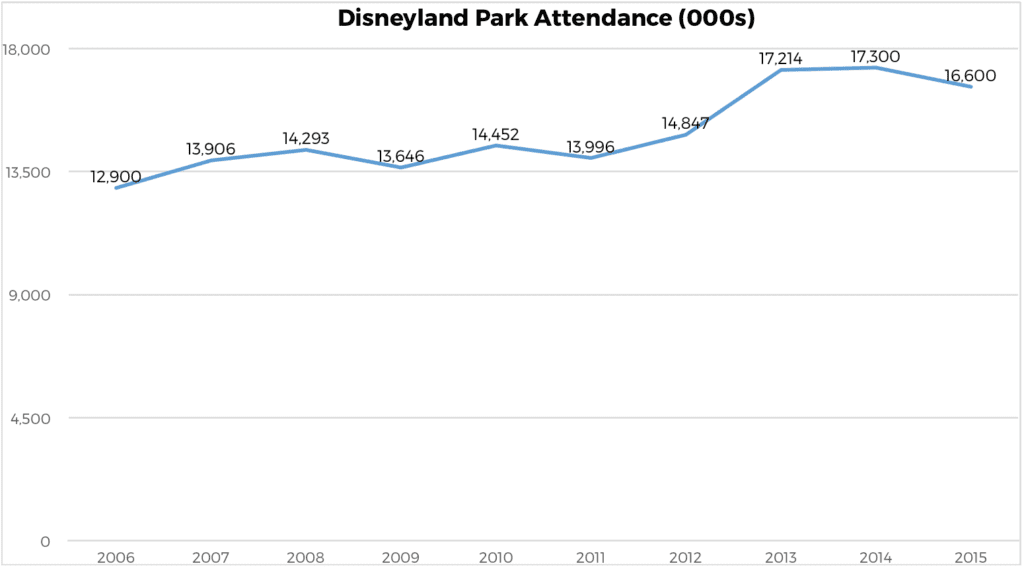

TOKYO DISNEYSEA

The park is family friendly, but targets adults more than a traditional Disney park. It’s ocean-themed with seven “ports of call,” including American Waterfront, Arabian Coast, Lost River Delta, Mediterranean Harbor, Mermaid Lagoon, Mysterious Island, and Port Discovery.

Attendance

Source: Themed Entertainment Association/AECOM

Oriental Land Company (OLC) Analysis

While Walt Disney does not have an ownership stake here, the financial results and strategy from OLC directly impact the fees Disney will receive and how the brand is marketed in Japan.

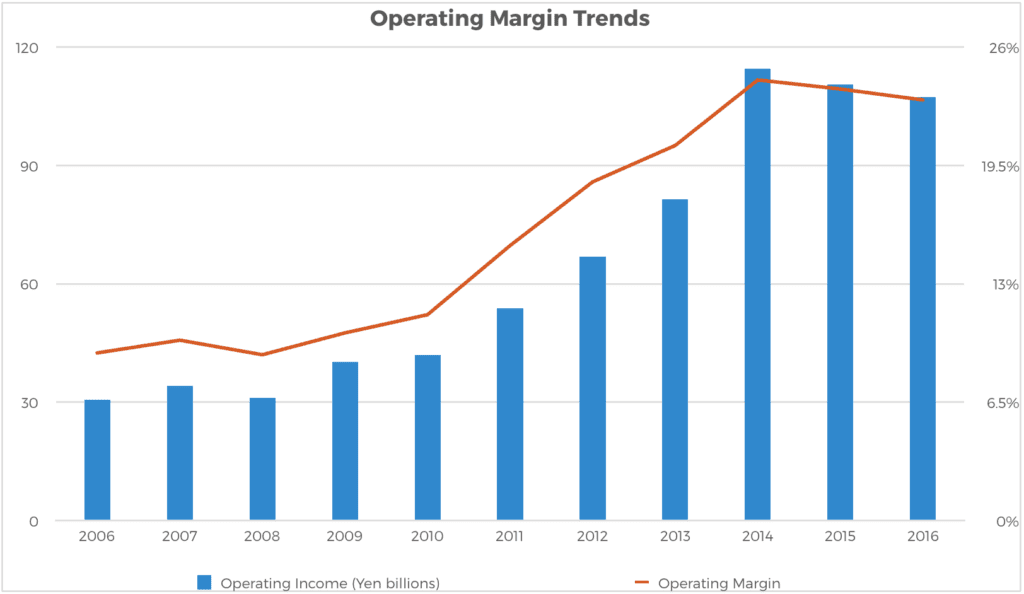

Operating income was in the ¥30 billion range from 2006 until 2008. After that, increased revenues combined with better fixed cost controls and a decrease in depreciation and amortization related to Tokyo DisneySea led to a substantial increase in margin and operating income. Operating income and margin have stabilized in the ¥110 billion and 23 percent range.

Source: Company Filings

The company is continuing to invest for growth and will take capital spending up from ¥40 billion to ¥50 billion per year for the next five years. For context, this is roughly $445 million or 11 percent of revenue. Walt Disney’s parks and resorts capital intensity has been in the 25 percent range recently as they are in the midst of meaningful park expansions (Shanghai opening, Star Wars lands, Avatar, etc.). The Japan percentage suggests steady and conservative expansion.

The expansion plans include:

- ¥75 billion over five years at Tokyo Disneyland for a Beauty and the Beast area, live entertainment theater, a Big Hero 6 attraction by 2020, and a new character greeting facility.

- ¥25 billion over five years at Tokyo DisneySea for Out of Shadowland at Hangar Stage, Nemo & Friends SeaRider, and new attractions at Mediterranean Harbor including a major attraction tentatively called Soarin’ set to open by Fiscal Year 2020.

- ¥30 billion per year for renewal of attractions and entertainment programs, development of special events, development of shops and restaurants, development of other facilities, such as restrooms, and investment for update improvement. They are also adding more hotel rooms.

Other things being pursued through R&D investments include a new

Frozen-themed port at DisneySea.

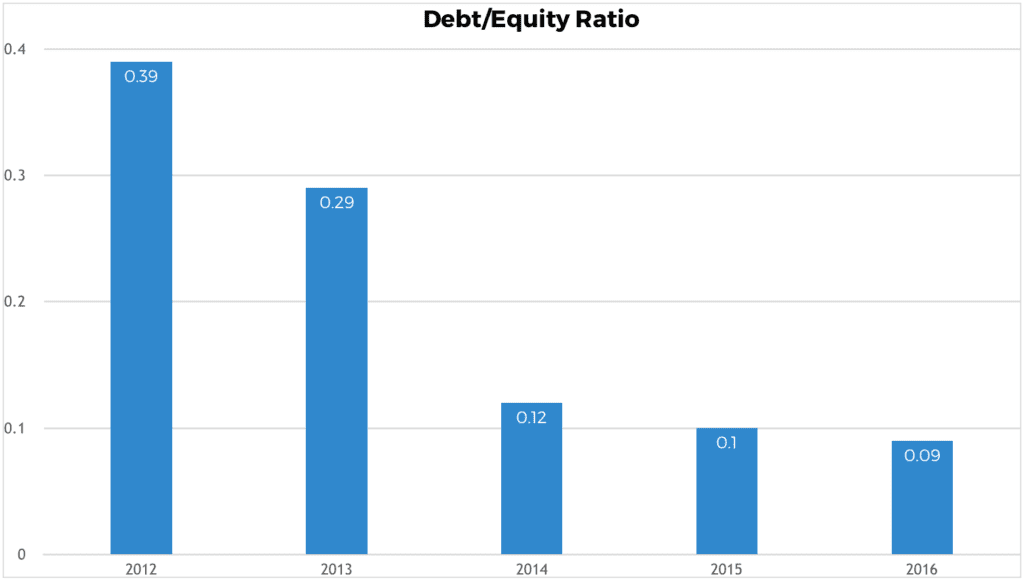

Unlike in Paris, OLC has a conservative capital structure with debt/equity at 0.09 last year. This means that company has less than 10 percent of its capital in debt.

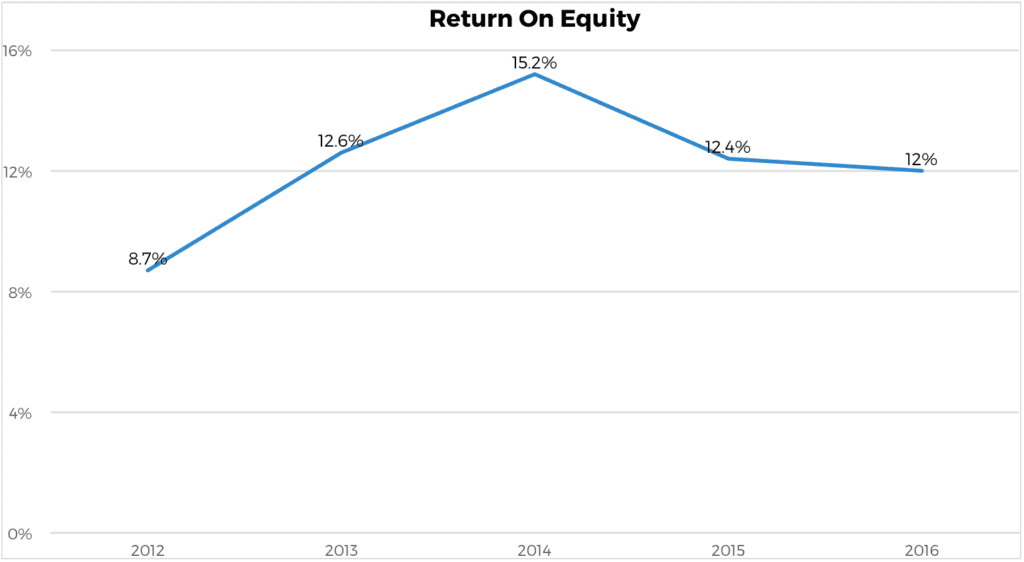

Meanwhile, return on equity, or how much OLC earns on its equity capital, has been over 12 percent for the past four years. With low interest rates in Japan and OLC’s operational strength, their cost of equity should be well below the 12 percent mark. Simplistically, this means that OLC has continued to create value for shareholders. For Walt Disney, the impact is subtle. They do not share in profits, but if the Japanese parks struggled to earn profits, they would not invest back in the business, and revenues (and thus, fees) to Walt Disney would drop. The more successful OLC is, the more likely Walt Disney will see its steady royalty fees, which are essentially pure profits.

Source: Company Filings

Estimated Financial Impact to Walt Disney

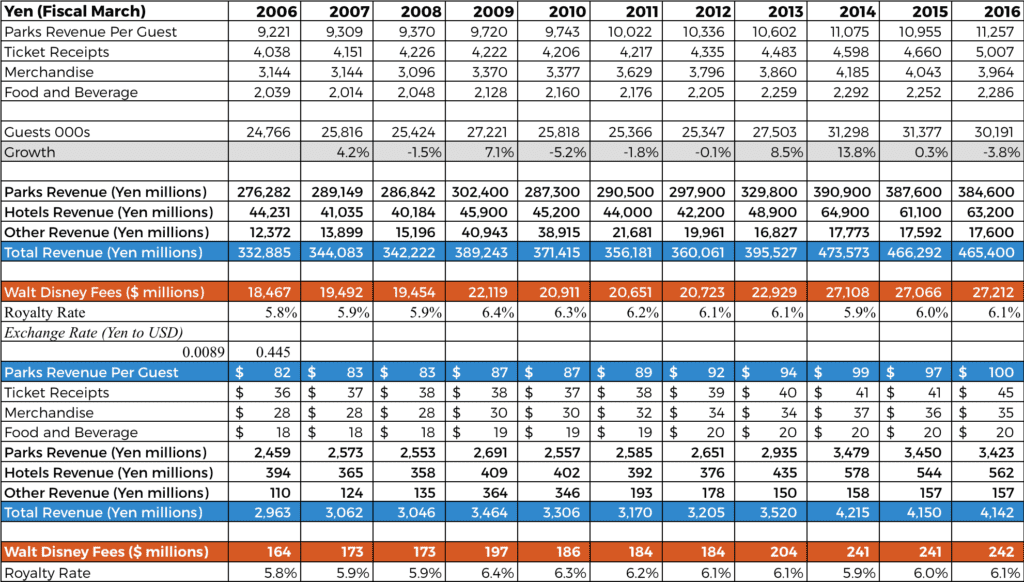

The effective royalty rate (based on parks and hotels) to Walt Disney has averaged 6.1 percent over the last eleven years. In Fiscal Year 2016, the fee equates to $242 million or seven percent of Disney’s parks and resorts segment of operating income.

To have generated that amount of operating profit, Disney would have needed to own a park that generated $1.2 billion in revenue, assuming 19.4 percent margin equal to the broader parks. By having a licensing agreement in Japan, they are not responsible for capital spending or running the park, so this is a very nice source of incremental profits to Disney. The risk with a licensing agreement is that the operator may not operate well and damage the brand. Fortunately for Disney, Oriental Land Company has done a great job with the parks.

Source: OLC and Disney Filings

Source: OLC and Disney Filings

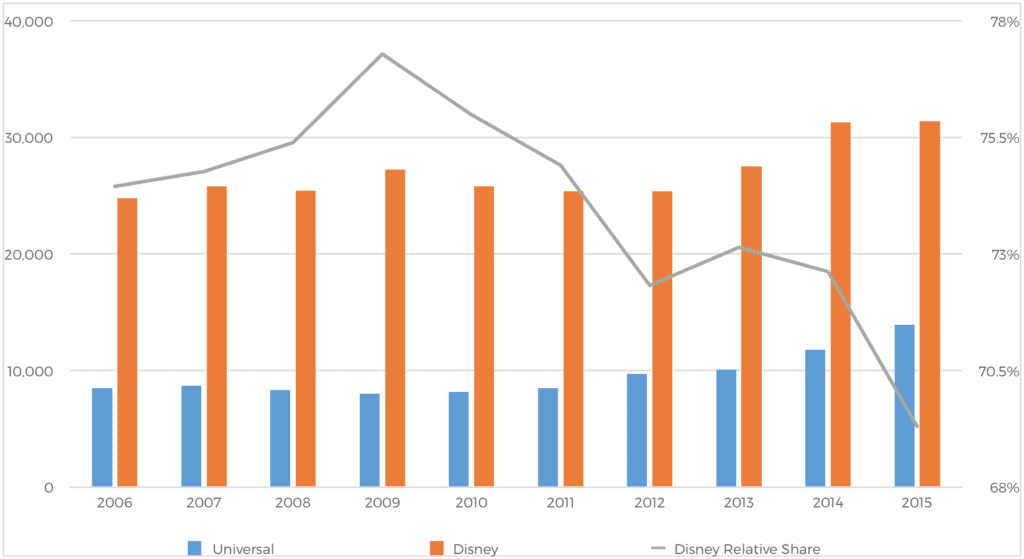

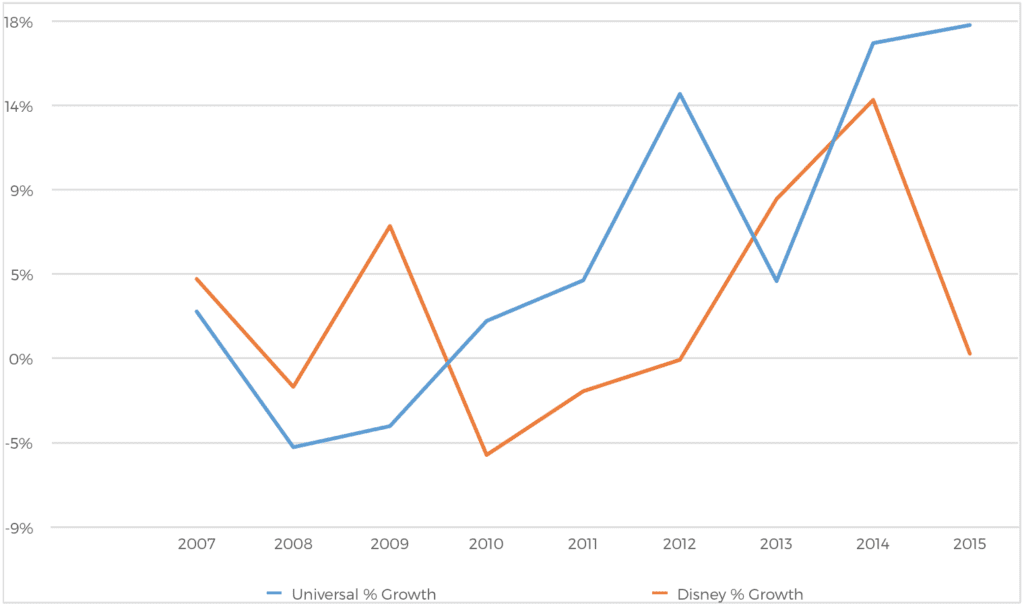

Competition

Interestingly, Universal is also a key competitor in Japan for the Disney parks with a similar dynamic, with Harry Potter driving very strong growth in 2014 and 2015. Universal is in Osaka, which is 330 miles from Tokyo. The parks compete in the sense that they are the dominant parks, but the reality is that given the distance between the parks, there is not much cannibalization of the guests. The next leading park with 6 million guests is Nagashima Spa Land in Kuwana, which is 230 miles from Tokyo and 100 miles from Osaka. With two-thirds of the guests to Tokyo Disney coming from the Tokyo region, we expect it to continue to put up steady attendance in the 30 million plus range. Modest volume growth, expense discipline, and ticket price increases should boost the fees that Walt Disney receives going forward.

Source: Themed Entertainment Association/AECOM

Source: Themed Entertainment Association/AECOM

Outlook

The Japanese parks should continue to churn out healthy fees for Walt Disney. The park expansions and Tokyo’s massive population should lead to continued 30 million plus attendance per year. It looks like we will also see some more price increases. Oriental Land Company is financially sound, so there is no reason to expect any need for fee cancellations. The branding in Japan will continue to be helped by these touchpoints.

Have a confidential tip for Skift? Get in touch

Tags: disney parks, theme parks

Photo credit: Tokyo Disney Resort is a key part of Disney's theme park empire. The resort is pictured here. takosaka / Flickr