Skift Take

If you're a hotel company planning to launch and/or reinvest in a midscale brand, please make it interesting.

If you’re a major hotel company, chances are you’re planning to launch — or have just launched — a new midscale brand.

The most recent case in point: InterContinental Hotels Group (IHG), which just announced its 13th brand Wednesday, but doesn’t yet have a name for it.

During the annual NYU Hospitality Industry Investment Conference earlier this month, other hotel companies also announced their plans to launch (or in some cases, relaunch) midscale brands. They included Trump Hotels’ new American Idea, Red Lion Hotel Corporation (RLHC)’s reinvention of the Signature Inn brand, and Hard Rock Hotels’ Reverb brand, which has a name, but not much else beyond this brand video.

What Makes a Hotel “Midscale”

The definition of a “midscale” hotel brand used to evoke, like most hotels in years past, images of conformity. This used to be a hotel category concerned solely with the basics, and more often than not, hotels in this segment were standard in every way (translation: boring).

Even so, this type of hotel product has long been a favorite among hotel owners and developers.

“This all relates to economics on both sides,” said veteran lodging analyst David Loeb, founder of Dirigo Consulting LLC. “Midscale is the intersection of consumer economics.”

He explained that the midscale category — with higher margins, fewer operational complications, and simpler staffing models than the upscale subset — was developed to make cheaper hotels attractive both to own and stay in.

“They were offering consumers the space they like and the layout they like, and a simplicity of experiences that even predates millennials,” Loeb said. “Consumer preferences have really shifted to that, and owners have responded by building those hotels. It’s profitable for owners and for brand families. The reason why I think midscale is more of a focus than upscale hotels is that upscale is more built out. The lower end of select service is less saturated. That’s part of what’s driving these new midscale brands.”

Lindsey Ueberroth, CEO of Preferred Hotels & Resorts, however, has a differing opinion on midscale versus upscale development. “Previously there’s been a lot of focus on the limited service, midscale segment. [But at the NYU conference] I talked to a lot of hotel owners who are actually trying to sell those assets and they want to all trade up. They’re now more interested in the full-service, upper upscale properties. I think there’s been a shift in the interest in that segment.”

Even if Ueberroth is sensing a change among hotel owners and developers away from the midscale segment, it’s very clear that the sector is seeing continued growth, not just with the number of new brands being introduced but with the success of one brand in particular: Tru by Hilton, which was first announced in January 2016.

Earlier this month, Alexandra Jaritz, global head of Tru by Hilton, told Skift that the brand has a “total of 425 deals in various stages of development.” That makes it the fastest new development pipeline in the history of the hotel industry, according to travel research firm STR.

And with the new brands that have been announced, and those currently in the market such as Tru by Hilton, it’s clear there’s been a slight shift in emphasis in the development of these brands. The midscale hotel brand of tomorrow is still focused on getting the basics right — but doing it in a way that doesn’t sacrifice style and design, or technology, either.

A Closer Look at the Newest Midscale Brands to Emerge

Tru by Hilton is a prime example of how hotels are focusing more on tech and design in the development of their midscale properties.

In December, Jaritz told Skift that early criticism of the brand’s design and marketing as having too many colors or being too loud have been “toned down” and that Hilton is continuing to modify the models according to feedback from owners so that “every single dollar is scrutinized” in a way that is “value engineered to drive the returns necessary [for owners].”

“We want to set expectations [for the brand] right from the beginning,” Jaritz said. “With Tru by Hilton, we want to shift the game, shift the paradigm for guests in the midscale category now.”

And given what we do know about IHG’s as-yet-unnamed midscale brand, it’s clear the company is also placing an emphasis on design and technology.

RLHC’s Signature Inn, which the company acquired in its $27 million purchase of Vantage Hospitality, is an opportunity for the parent company to add more of a lifestyle feel to the midscale space.

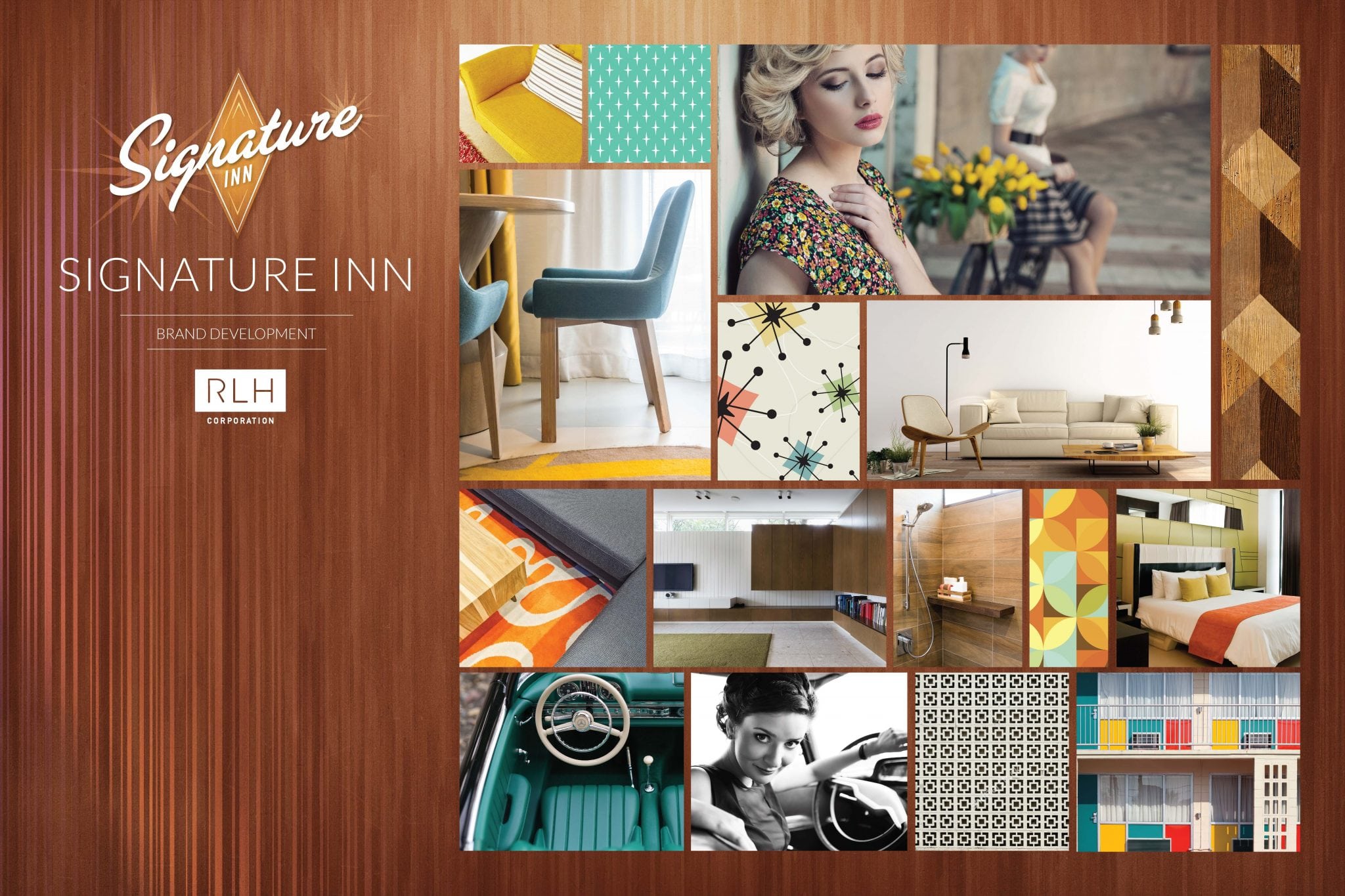

RLHC CMO Bill Linehan described Signature Inn as a brand that’s designed around a “midcentury modern” aesthetic and “pop Americana” that’s more in line with a boutique hotel.

“They thought, ‘Here’s a chance to start with a blank slate and create something new and different.’ It’s a small company looking to grow market share,” Loeb said of RLHC.

“Why are boutique hotels and design hotels really only focused at the upper-upscale and the luxury segments?” Linehan asked. “They don’t need to be, and that’s our answer in Signature Inn. It’s having a midcentury American design with the celebration of pop culture, and have economy labor standards, but offer some rate elasticity. There are several examples of this independently, but there is no brand for it yet. So, we’ve made it a brand with Signature Inn.”

Trump Hotels hasn’t disclosed much information about its new midscale brand, American Idea, but a press release described it as “a concept rooted in local history and neighborly service” and said that the “hotels will be an alternative, for both guests and hotel developers, looking for an answer to the run-of-the-mill offerings currently in the midscale space.” The first three American Idea hotels will open in the Mississippi Delta area of the U.S.

Loeb, for his part, thinks that the expansion into the midscale space by a company best known for its luxury properties is a move designed to, in part, capitalize on now President Trump’s fan base.

“I’m sure Eric [Danziger, CEO of Trump Hotels] is thinking, ‘All these people voted for Trump. But if I can just appeal to a few of them, that would be great,'” Loeb said. “How would Trump profit form this? Are Trump voters going to stay at Trump International in New York or D.C.? Most of them probably couldn’t afford it. Maybe [American Idea is about] having a brand where they could afford it, possibly?”

Have a confidential tip for Skift? Get in touch

Tags: hard rock, hilton, ihg, red lion, tru by hilton, trump hotels

Photo credit: A mood board for RLHC's Signature Inn midscale brand was inspired by midcentury modern design. Red Lion Hotels Corporation