Skift Take

The low-cost, long-haul revolution is only just starting to take off. Will full-service carriers be able to adapt to this new reality or are we about to see a total realignment?

The liberalization of air travel has been one of the biggest successes of the European Union. The creation of one internal market created an environment where the likes of EasyJet and Ryanair could thrive.

In many markets the pair, along with other low cost carriers, have replaced the previously dominant legacy airlines, helping to drive down prices for consumers.

Airports Council International Europe highlight this change in its latest Airport Industry Connectivity Report.

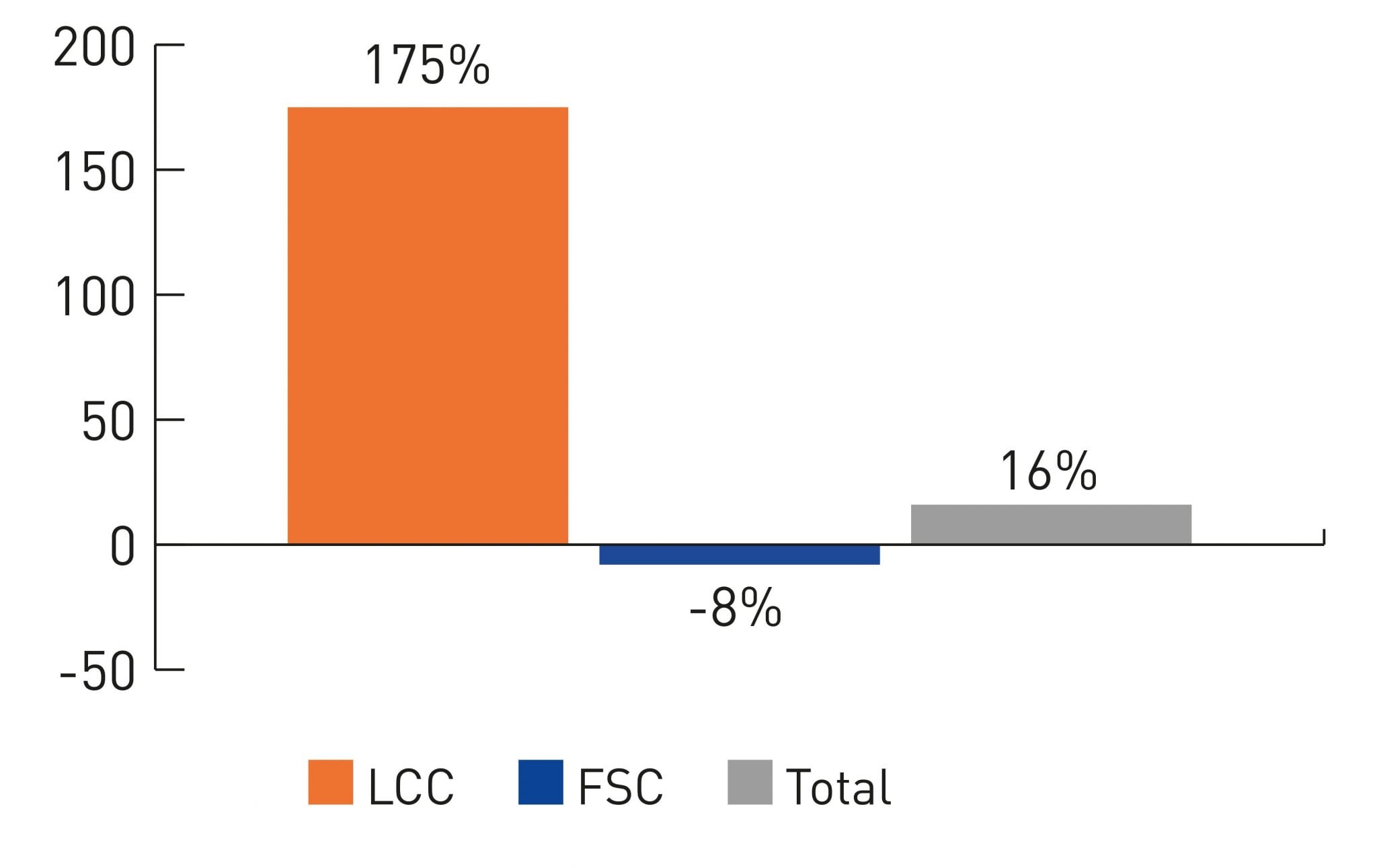

In the last 10 years, direct air services within the EU have grown by 16 percent (see below). Low cost carriers have driven the growth though a 175 percent increase in direct routes, and this comes despite the retreat of full-service airlines, which actually saw their connectivity decrease by 8 percent.

Direct Connectivity 2017 vs 2007

Source: ACI Europe

At the moment almost all (98 percent) of this low cost carrier direct connectivity is consigned to intra-European flying but with the likes of Norwegian and IAG’s Level expanding their long-haul offering, this is likely to change.

A 146 percent increase (see below) in direct connectivity to external markets since 2007 underlines the growth potential. Of course, the base point for such a rise was incredibly low but it shows the trend. For the time being, this market is still dominated by the full-service carriers, which increased their share over the same period by 30.6 percent.

DIRECT CONNECTIVITY OUTSIDE EUROPE BY AIRLINE TYPE

Source: ACI Europe

One consequence of the change in the low-cost carrier mindset has been the gradual move to larger markets and primary airports. The below chart shows how much they have improved their connectivity from Group I (more than 25 million passengers a year) airports.

DIRECT CONNECTIVITY SHARE 2007/2017 LCCs vs FSCs

Source: ACI Europe

Note: Group I: Over 25 million passengers a year; Group II: 10 to 25 million passengers a year; Group III: 5 to 10 million passengers a year, and Group IV: 0 to 5 million passengers a year

With the low-cost model encroaching into long haul, full-service carriers will have to adapt — either by creating low-cost spin-offs or through the introduction of a new type of economy ticket. The latter, however, is fraught with difficulty as British Airways has seen.

Olivier Jankovec, director general of ACI Europe, said: “The low cost revolution is marching on – and nothing will stop it. Low cost carriers have moved into larger airports and hubs, and they are now making inroads into the long-haul market.

“Europe’s airports will see 87 long haul routes being operated by low cost carriers this summer, up from 14 just four years ago. The next step – which Ryanair has just started experimenting — is to offer feed to network carriers or even develop their own connecting product.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: low-cost carriers, low-cost long-haul

Photo credit: A Norwegian Dreamliner lands at London Gatwick. Low-cost carriers are gradually moving into the long-haul market. Gatwick airport