Consumers Are Facing a Glut of Loyalty Programs in Hospitality

Skift Take

Late last month we launched a new report in our Skift Research service, The State of Loyalty in Hospitality 2017.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Hotel loyalty programs have seen a lot of changes in recent times, particularly with Marriott’s acquisition of Starwood and AccorHotels’ FRHI acquisition, which brought Fairmont, Raffles, and Swissôtel under the brand; Fairmont, Raffles, and Swissôtel each continue to operate their own loyalty programs, just as they did prior to the acquisition.

Things look a bit murkier over at Marriott, which has been encouraging its guests to link their Starwood Preferred Guest and Marriott accounts, though both programs are anticipated to continue to operate separately for at least another year. Outside of the big hotel brands, there are also plenty of alternative rewards programs, from Stash Hotel Rewards, which offers a cross-brand loyalty program with a few hundred carefully vetted independent hotels, to Chase Ultimate Rewards, which allocates points to a credit card, redeemable for travel like cash.

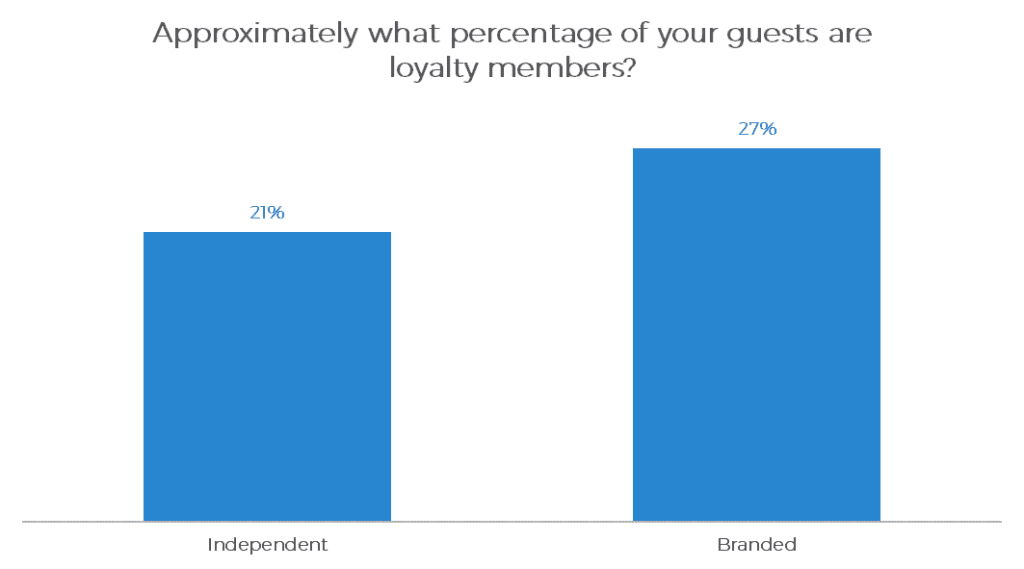

According to Skift’s 2017 Outlook On Hotel Direct Booking, just over a quarter of guests at branded hotels are members of the hotel’s loyalty program, while 21 percent of guests at independent hotels are loyalty members.

Preview and Buy the Full Report

Many consumers find themselves members of multiple programs for the sole purpose of collecting points, without really having any strong loyalty to one brand. Often, points-focused travelers instead opt to book through Online Travel Agencies (OTAs), which have their own rewards programs, simply because it gives them more realistic chances to earn free stays than traditional brand-based memberships might.

OTA loyalty programs such as Expedia+ and Booking.com’s Genius program have gained in notoriety over the past years by offering special flash deals, discounted rates for certain hotels, as well as included freebies such as late checkout, free drinks upon arrival, etc. Even for travelers who want to remain loyal to a brand and who travel (or use loyalty credit cards) frequently enough to make earning free nights possible, hurdles such as extensive blackout dates can cause issues for both travelers and hoteliers alike.

For travelers, it can make actually redeeming points tedious at best, impossible at worst. For hoteliers, particularly independent franchises, rooms booked through loyalty points at a fixed rate can significantly undercut their bottom lines, especially if they normally use dynamic rates for selling inventory and the number of loyalty points required is a fixed number.

This is the latest in a series of research reports, analyst calls, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst calls, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.