Skift Take

Some U.S.-based travel brands aren't overly worried about a potential Trump slump but Foursquare's data is an indication that they should be braced for some tough-going.

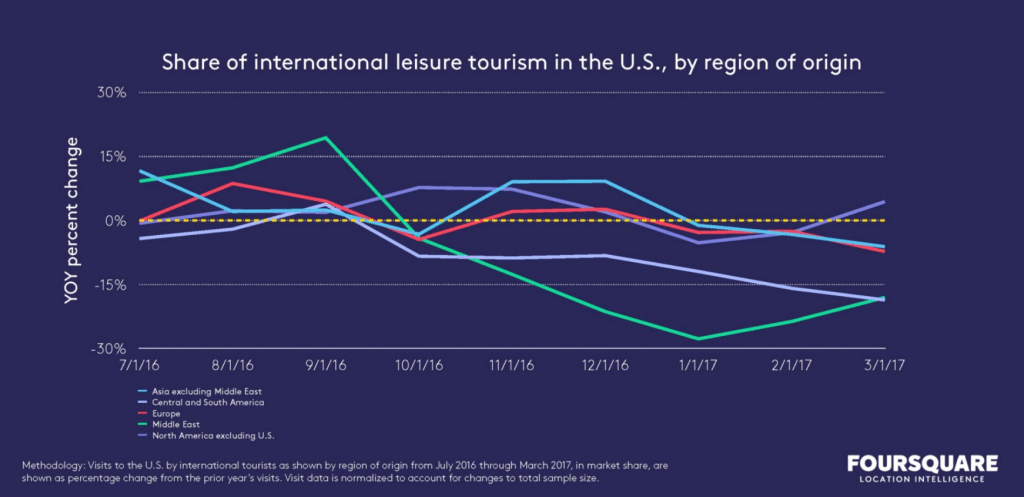

Foursquare claims that U.S. tourism is in dramatic decline, losing 16 percent market share of international arrivals from November 2016 to March 2017.

The decline, according to a Foursquare analysis, actually began in October — when it looked like Hillary Clinton would be the next president and not Donald Trump — as U.S. market share in international tourism dipped 6 percent year over year that month.

Data show that during this time, other countries’ share of international tourism has been increasing as the U.S.’ has declined [see chart below].

Official U.S. government data on international tourist arrivals hasn’t been updated since August 2016. but Foursquare said its own data show foreign visitation has thinned out so far this year before and after President Donald Trump took office in January.

Foursquare earlier found that visits to U.S. Trump-branded properties were down last year.

We are not ready to take Foursquare’s analysis at face value. The data may skew toward a tech-savvy demographic as it is partly based on people who opt into having their locations tracked through the company’s Foursquare and Swarm apps.

But Foursquare’s data contradicts reporting from most booking sites, hotels, travel associations and city and state destinations in the U.S. Although many brands haven’t reported any negative impact so far in overseas visitors, they are also worried.

In fact, official government data for January, February and March show international visitor spending in the U.S. is at a record high, although these numbers data don’t include retail spending, which Foursquare says is likewise under pressure.

Foursquare looked at explicit check-ins where its app users shared their locations as well as implicit visits from Foursquare and Swarm app users who didn’t explicitly share their location but have their app’s location services running in the background on their mobile devices. Foursquare also said it normalized its data for adjustments in its panel size, which grew during the past six months. (See more details about then methodology below.)

Some booking sites such as Kayak, Expedia and Hopper have said bookings from some markets such as the Middle East have been down for the past few months compared with a year ago.

Visit Florida, for example, estimates that the state’s international arrivals were down 2.6 percent overall for 2016. California’s overseas arrivals were up 2.2 percent year-to-date as of August 2016 (the most recent month data is available) but its European arrivals were down -2.7 percent for the same period and its Mexican arrivals declined 2.1 percent.

Foursquare points out that California, and in particular Los Angeles and San Diego, was most impacted by the decrease in international travelers. Last month, Discover Los Angeles launched its “Everyone is Welcome” marketing campaign to help reinforce its message that the city welcomes international travelers.

California, however, found its arrivals from Africa, the Caribbean, Middle East and elsewhere in Latin America were all up as of August with the Middle East up by 11.4 percent. However, Foursquare’s analysis began later — in October 2016.

A strong U.S. dollar, coupled with the U.S. political climate, all play into factors impacting U.S. tourism.

Some business travel associations have cited recent studies that show European meeting and event planners, for example, are less likely to plan events in the U.S. because of President Trump’s travel ban.

International travelers make up 10.7 percent of all visits to leisure locations that Foursquare tracks.

“This means that the drop in international tourism to the U.S. is resulting in an opportunity cost of about 1.2 percent in total visits to U.S. shops, restaurants, attractions and the like,” the company wrote in a blog post. “And it’s a fair bet that international shoppers spend more than the average domestic shopper.

Official U.S. government data for full 2016 won’t be available for several months — and also won’t capture the U.S. tourism climate so far in 2017.

Travel data firm ForwardKeys, however, found that bookings for U.S.’ international arrivals were down one percent for January to April 2017 and aleady down four percent year-over-year for May to August 2017 as of May 1.

It’s clear that many destinations like New York City are concerned about the impact of the president’s anti-tourism policies.

International visitor spending, which is up heading into the summer travel season, will be one of the key metrics destinations and brands use to determine how much of a Trump slump they will have to deal with — if it materializes.

The chart below shows the U.S.’ international tourism market share compared to the rest of the world, according to Foursquare’s tallies.

Source: Foursquare

Foursquare Methodology

“In this analysis, we looked at international users of the apps who are based around the globe, in over 150 countries. We analyzed market share to remove seasonal bias and to mitigate against global trends such as general increase or decrease in travel overall. To assess business travel, we looked at visits to places categorized within the Foursquare category of Professional and Other Places; “leisure only” includes casinos, department stores, monuments/landmarks, malls, museums, nightclubs, restaurants and theme parks.

“Airports and hotels were excluded from both business travel and leisure categories because visits to those venues could be for either work or play; these categories were included in a third group (‘other’), which also includes any category not listed above, from libraries to grocery stores.

“A proxy for home and work was used to determine international residence. Data was normalized by dividing by all international tourist visits by a user in a country that is not their home country; we have controlled for changes in both the overall volume of global tourist visits and our panel size. (To confirm accuracy, we have backtested to confirm our data historically correlates closely to US government tourist arrivals data.)

“U.S. residents are excluded from analyses of international visits, and global travel excludes American travelers. Foursquare data is always anonymized and aggregated. For regional comparisons, one region, Africa, was removed for lack of statistical significance.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: foursquare, tourism, trump

Photo credit: Foursquare data point to fewer international arrivals in the U.S. in 2017. Pictured are tourists exploring the U.S. Capitol grounds in Washington, D.C. Let Ideas Compete / Flickr