Skift Take

Venture capital's returns are usually achieved in the long-term, a great match for pension funds. However, European pension funds are still reluctant to allocate money to VC, considering it a risky venture.

Last week we launched the latest report in our Skift Research service, European Venture Investment Trends in the Travel Industry 2017 accompanied by our comprehensive Data Sheet: European Venture Capital Investment Landscape 2017.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

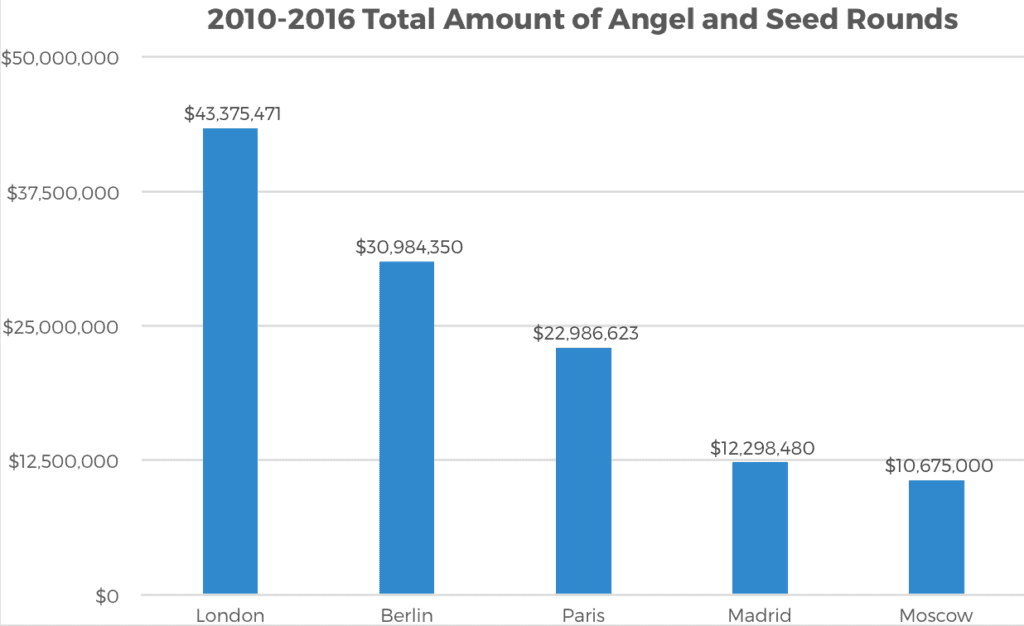

Although Europe has been attracting a growing amount of venture capital (VC) over the past years it still remains a fraction of the capital flowing through the U.S. The allocation of capital within Europe has traditionally seen its epicenter in London, with Paris and Berlin fighting for second place.

In the U.S., roughly two thirds of VC money comes from endowments and pension plans, which are far less common, or don’t exist, in most European states. The lack of pension funds in Europe is a vast differentiator for the market, as pension funds are often considered ideal capital providers for VC where a return is usually achieved in the long term, something pension plans are capable of committing to. European pension funds manage roughly $4 trillion, meaning that even a minuscule percentage committed to VC could close the funding gap. Nevertheless, European pension funds still classify venture capital as a bad asset class.

Source: Skift’s 2017 European Startups Data Sheet

Source: Skift’s 2017 European Startups Data Sheet

Preview and Buy the Full Report

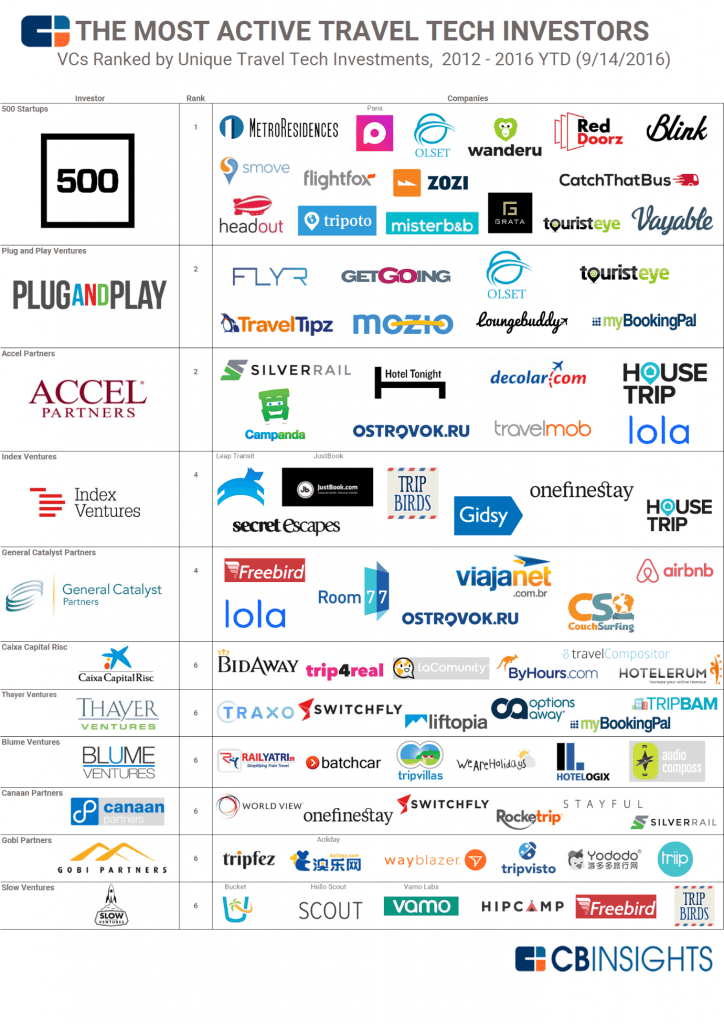

Among the most active travel tech investors, named by CBInsights, most trace their origin back to the U.S. although some have local offices in Europe. Nevertheless, the travel companies in which they invest are spread throughout the world. Index Ventures traces its origins back to Europe, being founded out of Geneva in 1996 and operating out of London and San Francisco today. Caixa Capital Risc is based out of Barcelona and invests mostly in Spanish companies.

Seed and angel funding is harder to raise in Europe, particularly if the company is based outside of the traditional tech hubs. Although later stages could be considered less risky, Europeans alone are not able nor accustomed to fund companies with astronomic amounts. The larger the amount raised, the more likely it is that American VCs step in, particularly at the later funding stages.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst calls, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst calls, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: europe, european funding, research reports, startups europe, venture capital

Photo credit: Vayable, along with 15 other venture-backed firms in Europe, has received funding from 500 pixels. Vayable