Skift Take

Travel metasearch sites such as Kayak, Trivago, TripAdvisor and Skyscanner would fall on hard times if they weren't attracting advertising spend from their parents' -- or former parents' -- rivals.

On its path toward an initial public offering last year, hotel price-comparison site Trivago turned heads when it disclosed that its largest advertising customer was not parent-company Expedia and its brands, as was expected.

Instead, it turned out, the Priceline Group, which owns rival Kayak, was the largest spender in Trivago’s hotel search results.

In fact, the Priceline Group and its assorted brands, including Booking.com, Agoda, Priceline, and Rentalcars.com, accounted for 43 percent, or some $352.5 million, of Trivago’s total revenue in 2016, while Expedia companies such as Expedia, Hotels.com, Orbitz, and Travelocity, chipped in 36 percent, or around $295.1 million, according to Trivago financial filings.

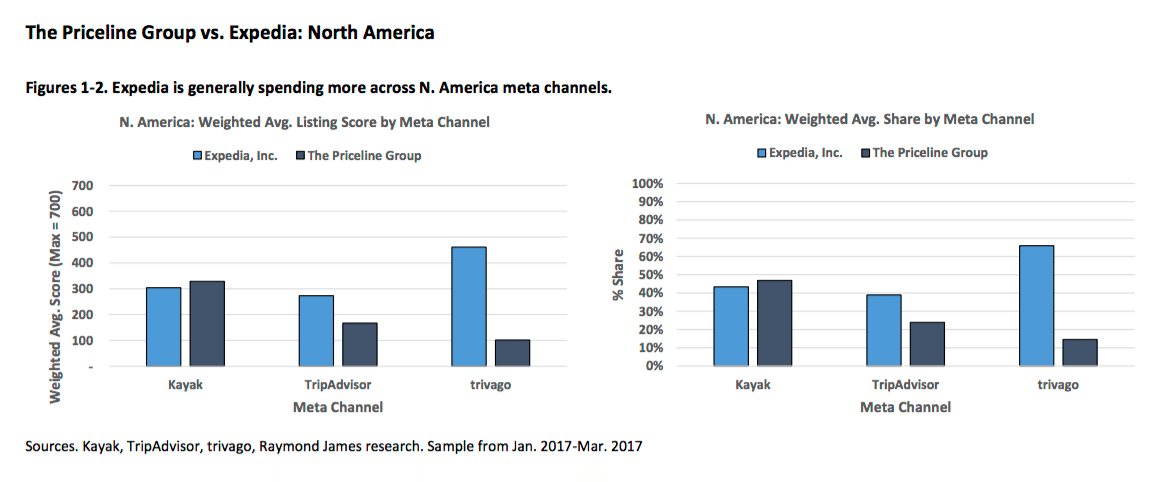

But a new report, Quarterly Meta Tracker, from financial firm Raymond James, states that Expedia reversed the pattern, which had been the norm in 2015 and 2016, and in the first quarter of 2017 spent four times as much as the Priceline Group in the Trivago hotel-search platform.

This was true on Trivago sites in North America, where Expedia’s share was 66 percent, European sites (66 percent) and on Trivago sites in the rest of the world (64 percent), according to Raymond James.

“We attribute this to Expedia’s majority stake in Trivago and goal of reaccelerating room night growth in 2017 (Trivago has historically been an effective channel for Expedia),” Raymond James states. Of course, when Expedia spends money in Trivago or Priceline commits money to Kayak, the parent companies are essentially paying themselves.

In the third and fourth quarters of 2016, Expedia, which had been grappling with issues related to the integration of Orbitz Worldwide, notched hotel room night growth of just 17 percent and 15 percent, respectively, compared with the Priceline Group’s 29.4 percent and 31 percent. Expedia’s numbers were also ghastly compared with its room night growth of 36 percent and 39 percent in the third and fourth quarters of 2015, respectively.

Expedia’s heightened spending in Trivago in the first quarter of 2017 — at a pace far ahead of the Priceline Group’s marketing commitment to Trivago — signals that Expedia’s site and conversion problems may be behind it and that it feels ready to market itself full-throttle again.

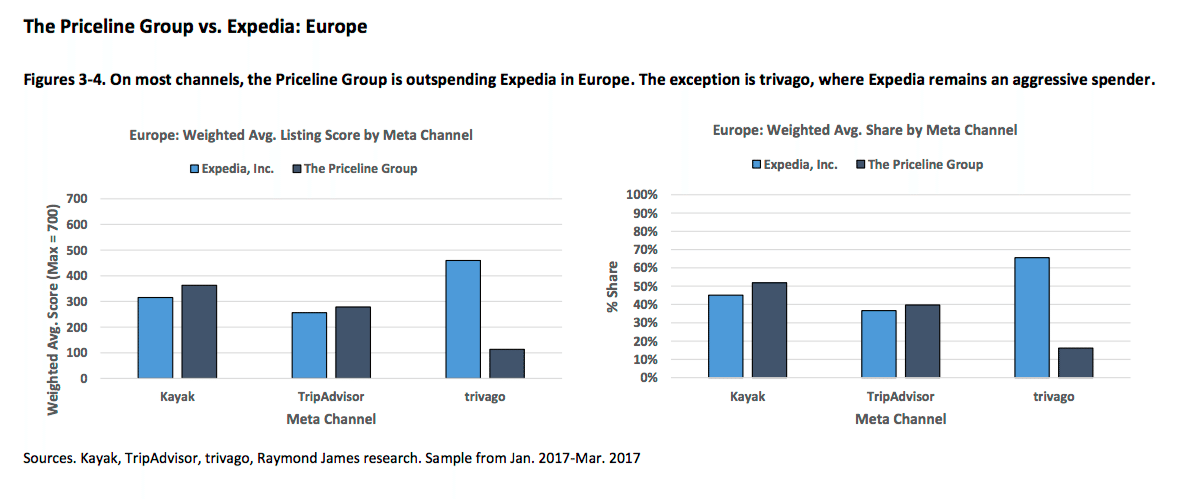

The Raymond James report, the first such survey that it’s done, tracked Expedia, Priceline and TripAdvisor’s hotel-metasearch advertising on Kayak, TripAdvisor, and Trivago in 30 markets — 10 each in North America, Europe, and the “rest of the world” over the first three months of 2017. The study, which computed a score based on the brands’ presence in the top three listings of each site, wasn’t comprehensive but was geared to be directional about trends.

Some of the findings were expected. Raymond James found, for instance, that Expedia advertises heavily in North America, its strongest market, and that Priceline leads metasearch spending in Europe, where its Booking.com unit dominates.

There were plenty of nuances, though. Setting aside Expedia’s advertising spend within its Trivago subsidiary, Raymond James found that Expedia outperformed the Priceline Group on TripAdvisor’s hotel metasearch platform (39 percent versus 24 percent) in North America despite the fact that the Priceline Group was TripAdvisor’s initial online travel agency partner in TripAdvisor Instant Booking. While the Priceline Group is compensating TripAdvisor for bookings, Expedia is apparently spending way more than Priceline on the metasearch side of the house on TripAdvisor.

TripAdvisor is transitioning toward becoming a hotel-booking site but will continue to offer metasearch, meaning it gets paid for clicks when travelers navigate to an online travel agency or hotel website to complete their bookings.

Priceline led hotel-marketing spending over Expedia in Priceline’s Kayak unit (47 percent to 43 percent) in North America in the first quarter of 2017, the study found.

In Europe, Priceline’s share was larger than Expedia’s on Kayak (52 percent versus 45 percent) and on TripAdvisor (40 percent versus 37 percent) in the first quarter of 2017, according to Raymond James.

In the rest of the world, mostly Latin America and Asia-Pacific, Expedia was the big-spender on Kayak (53 percent versus 44 percent for Priceline) and on TripAdvisor (37 percent versus 29 percent).

Meanwhile, TripAdvisor advertises “modestly on other meta sites,” according to the Raymond James report, although most of its digital marketing budget goes to Google.

Booking Sites Spend Big In their Own Metas But …

Ever since Expedia acquired Trivago and Priceline bought Kayak in 2013, and now that Ctrip picked up Skyscanner last year, a big concern was that the metasearch sites might be perceived by potential partners, and perhaps consumers, as being overly biased toward their parent companies.

If the Raymond James first quarter numbers hold up for a prolonged period, then it indeed would be true that Expedia is dominating spending on its own Trivago brand, although its high-spending status on Trivago is new and wasn’t the way things were in 2015 and 2016 when the Priceline Group was Trivago’s largest customer.

However, while the Priceline Group is the highest spender in its own Kayak unit in North America and Europe, it isn’t a wide gap, and Expedia outperforms Priceline in Kayak in the rest of the world, Raymond James states.

In other words, the metasearch sites don’t appear to be rigged to benefit the home team, or parent companies, although they are playing with house money when parent money funnels marketing spend toward its subsidiary.

Still, Kayak, Trivago and TripAdvisor provide opportunity for partner/rivals to compete on their platforms if the online travel agency advertisers are willing to plunk down their money — and largely they still are.

A 2017 Milestone for Trivago

Meanwhile, as far as full-year 2017 is concerned for Trivago, it could establish a milestone. A Cowen and Co. report two weeks ago projects that Trivago will overtake TripAdvisor in attracting a greater share of the combined Priceline and Expedia advertising budgets this year.

Given that TripAdvisor over the years has been viewed in much of the travel industry as a must-have adverting vehicle, and still is, the fact that Trivago would get more of Priceline-Expedia’s advertising spend than TripAdvisor is a watershed moment.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: kayak, metasearch, tripadvisor, trivago

Photo credit: This is the Trivago 'Girl' — Australia-style. Parent company Expedia is outspending the Priceline Group in Trivago advertising spend, reversing a two-year trend when it didn't. Trivago