Skift Take

The Priceline Group continues to put up strong growth numbers despite its large size. Its massive advertising budget combined with improving conversion and growing inventory position the company to take further share of online and offline bookings.

The Priceline Group’s fourth quarter and full-year 2016 financial results were excellent across the board and that’s why the stock is up six percent to an all-time high as of this writing.

We looked at five key metrics that shed light on the trends at the company. These include revenue, online advertising expense, operating margin, gross bookings, and total properties.

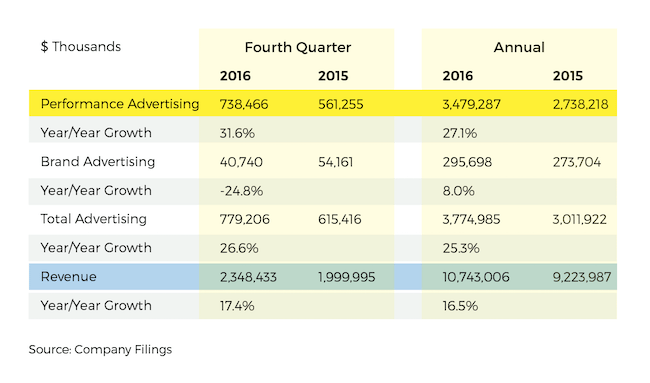

Online Advertising Expense Continues to Outpace Revenue Growth

Digital advertising, and Google specifically, has been a headwind for the travel industry. For more on this trend, please see our Research Report that launched this week.

For Priceline, performance advertising includes search engine keyword purchases (mostly Google), referrals from metasearch and travel research websites, affiliate programs, and banner, pop-up and other Internet and mobile advertisements. Brand advertising primarily is from television, but also includes parts of online advertising.

Prior to 2016, Priceline broke down ad spend by online (approximately 95 percent) versus offline rather than by performance and brand. Looking at older filings, we can see that performance advertising is roughly synonymous with the former online advertising designation.

In the most recent quarter and for 2016, online advertising expense once again outpaced revenue growth with online ad spend jumping 27 percent for the year. This compares to 17 percent revenue growth; excluding currency headwinds, revenue would be up around 20 percent.

The large ad spend and timing of Easter makes the forward guidance for the first quarter of 2017 look superficially weak. Ad spend is expensed as incurred, but revenue is not counted until the guest stay rather than at booking. This creates a short-term headwind on first quarter reported numbers due to delayed revenue recognition. This is meaningless to longer-term results, but explains the guidance along with Easter being shifted out to Q2 this year versus Q1 last year.

Priceline’s results show that competing in online travel requires a large advertising budget to build and reinforce the brand and then drive traffic from online search, where competition is intense. Smaller players continue to struggle to compete and is a key reason why we have seen Priceline, Expedia, and Ctrip consolidate the industry both in the online travel agency model and more recently, with metasearch. This consolidation trend should persist.

Operating Margin Stable Despite Digital Ad Headwind

Even with digital advertising expense growing faster than revenue, Priceline kept its operating margin steady. After removing the impact of the OpenTable write-down, which is not indicative of operating trends, operating margin actually ticked up on the year.

The results show that Priceline has improved conversion and continues to see positive operating leverage in other expense line items (those expenses are growing more slowly than revenue). This is important as the travel industry’s trend of digital ad spend growing at well above 20 percent will likely continue.

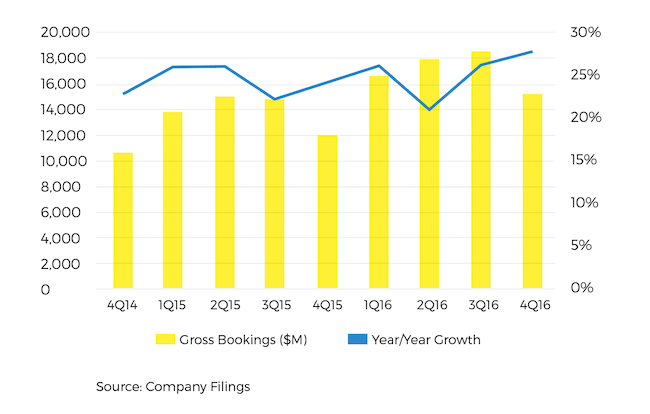

Gross Bookings Remain Well Above 20 Percent

Given its size, Priceline’s ability to generate constant currency gross bookings growth consistently in the mid-20 percent range is remarkable. This reinforces the view that the move from offline to online travel bookings has a long way to go, especially internationally.

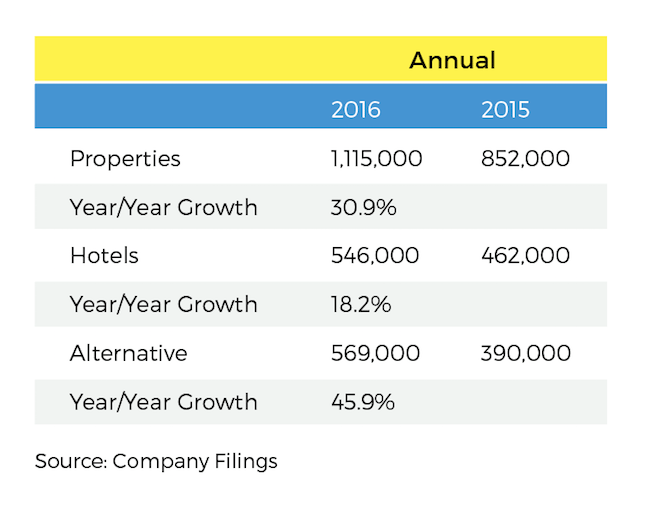

Booking.com Gets Even Larger

Booking.com, which drives between 80 and 85 percent of Priceline’s gross profit, is getting larger. The site had 1,115,000 properties on its website at year end 2016. This total includes 568,000 vacation rental properties. This compares to 852,000 and 390,000 listings, respectively in 2015. Of note, alternative lodgings — instantly bookable ones and without charging fees to consumers — are becoming a more important part of the story for Booking.com from an inventory perspective. However, the business is lower margin and provides far fewer bookings per property than hotels, so hotels remain the key driver of growth with alternative lodgings adding to the story.

With the mix of a large and growing hotel business that continues to churn out impressive numbers combined with new revenue from alternative lodgings and further market share gains across its markets, Booking.com should continue to be the envy of the online travel industry.

Source: Company Filings

Chart Design: Ping Chan, Skift

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising, booking.com, otas, priceline

Photo credit: The Priceline Group, including Booking.com, is winning the advertising wars, particularly on Google. Pictured is a Booking.com ad. Booking.com