Skift Take

Amadeus says it is pulling off its promised trick of staying profitable despite margin pressure on its mainstay airline services business. This year much depends on how well its reservation system projects with Southwest Airlines and IHG go.

Travel technology group Amadeus has two big stories to tell in 2017: one is about its linchpin technological services for airlines, and the other is about its new IT services for hotels.

Amadeus’ largest airline project this year has a milestone moment coming in May, when Southwest Airlines, the largest U.S. carrier in domestic passengers boarded, switches over to Amadeus’ reservation system for domestic bookings. (Southwest has already made the switch over for its (smaller) international bookings.) A flawless cutover would be used by the Madrid-based company to try to lure other airlines onto its system.

In its budding hotel services business, Amadeus’ largest effort this year involves InterContinental Hotels Group (IHG), the biggest hotel group to join the Amadeus hospitality system. If the operation goes well, Amadeus will use the example to woo other major hotel chains.

Both stories dovetail in a broader narrative Amadeus told investors in a fourth-quarter 2016 call on Friday. The company is trying to de-emphasize its current dependence on its airline distribution business, where profits are under pressure, and to emphasize the hospitality business it has been growing through a string of recent acquisitions.

HOSPITALITY IT SERVICES

To look to the future, Amadeus wants to offer a portfolio of IT services to hotels worldwide, which it sees as a multi-billion euro opportunity.

Having acquired hotel IT company Itesso in 2015, Amadeus is at work on launching a property management system for hotels, which would be the main software that hotels use to manage their digital operations and distribution. The company could cross-sell this cloud-based software product with its existing central reservation system product.

Maroto said that in the past, the two solutions were products that hotels typically bought (or developed in-house) separately. “We believe there is a big advantage to having a consistent view across the systems.”

If hotels are impressed by the new products, Amadeus might be able to escape from its legacy reputation for being a services company for airlines and could broaden its business to hotels, a potentially lucrative sector. The company says early signs point to success in the strategy.

EVOLUTION OF CONTRACTS WITH AIRLINES

In December, Amadeus’ U.S.-based rival Sabre, lost a lawsuit against US Airways (a now-defunct brand owned by American Airlines). If courts uphold the verdict on appeal, the decision will give airlines a stronger hand in the kinds of permissible contract terms Sabre, Amadeus, and similar ticketing middlemen can stipulate.

At issue are the contract provisions that require airline clients to provide the full airfare and inventory content that they sell on their websites or that they distribute to other parties like Amadeus (or Sabre, or Travelport) as well.

A separate issue beyond pricing is how well Amadeus and its competitors can keep up technologically when it comes to how airlines want to display and distribute their products to travel agencies. United Airlines last month signaled that it wants a better deal with the reservation middlemen partly because it worries about how well those companies will display its new products, like basic economy fares, to corporate travel managers and online travel agencies.

Analysts asked Luis Maroto, chief executive of Amadeus, about the issue. While not addressing the lawsuit itself, Maroto said that he expected a variety of factors would lead to an “evolution” in so-called full-content agreements.

“We will support the different commercial strategies that the airlines have in mind. It’s also true that, as airlines want more merchandising and dynamic pricing, they will try out alternatives [to companies like Amadeus]. So the way “full content” is defined [in our contracts] will have to evolve….”

“We will be flexible in the way we deal with contracts and agreements we have with them….Today with some airlines we have long-term, full-content agreements where everything is included. Other airlines have been trying in different geographies to have content for the base fare and then merchandising capabilities with alternative systems….That’s why we’re investing heavily in our merchandising capability for airlines …for direct and indirect channels.”

AGENCY MARGINS UNDER PRESSURE

Amadeus, like its rivals Sabre and Travelport, makes money by charging fees to airlines for distributing their tickets to travel agencies and then passes on some of those fees to its affiliated travel agents as incentives.

On that point, its largest rival in this sector, Sabre, signaled earlier in February that it would “make prudent, modest tradeoffs in gross margin, with a goal of driving growth and increasing share.”

Analysts asked Amadeus executives about the pressure on its margins.

Chief financial officer Ana de Pro said, “Yes, it’s true we have pressure from our competitors, who have been seeing their market share under pressure, so we see a higher cost of the bookings we acquire.”

The company says it has not yet seen a spike in pressure on its margins. For about five years, Amadeus has witnessed a margin decline of a half-percentage point a year, on average. (Analysts dispute the decline’s degree, arguing it may adversely contribute to the bottom line as much as .60 to .80 percentage points a year.) For 2017, executives won’t predict the decline in margin, other than to say it will be “a slight decline” that is “in line with the trend seen in other years.”

So how does Amadeus maintain profits despite margin pressure?

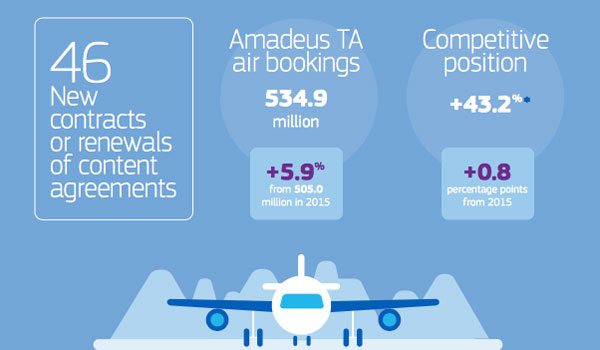

One way is by stepping up its share of the agency distribution business globally, especially in Asia, the Middle East, and Africa. In 2012, its share of travel agency air bookings worldwide was 39 percent. By 2016, its share was up to 43.2 percent.

The acceleration in growth compensates for the decline in margin. “Doing more for both the airlines and the travel agency providers has proven to be a good business where we continue to grow despite the fact that everyone believed that the distribution business was already quite mature,” said de Pro.

In Asia Pacific, in particular, Amadeus has seen success by using its second aviation arm —

which sells IT services to the region’s low-cost carriers — as a way to win over new clients and upsell them into their global distribution services that many have never used before. (Its Altéa Passenger Service Systems and New Skies reservation systems are high-margin businesses in their own rights, so this is a low-risk strategy.) Amadeus’ biggest reservation system win in Asia last year was China Airlines.

The company faces some Asia Pacific pressure from its rival Sabre, which in 2015 bought the largest distribution platform in the region, Abacus, for $415 million.

Still, investors may wonder about the viability of Amadeus’ model, where the company continues to gain market share to compensate for the declining fees from airlines. Can it maintain profitability for more than, say, five years?

One path it has is to target budget airlines as new customers. Many of these haven’t used any global distribution system services before. Amadeus now has 90 low-cost carriers on its system, a 15 percent rise in 2016, year-over-year.

But there is a lot of work to be done in that sector. Low-cost carriers still only represent an undisclosed, single-digit percentage of the airline bookings it processes.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airlines, amadeus, gds, hotels

Photo credit: Investors in travel technology group Amadeus hope the company can successfully diversify into hotel services. Pictured is Amadeus' headquarters in Madrid. Amadeus