Skift Take

In 2008, Venere became Expedia's great hope in Europe to play catch-up and take on Booking.com's dominance. Whether it was a lack of execution or Booking.com's scale advantages being too imposing to overcome, that dynamic never came to fruition.

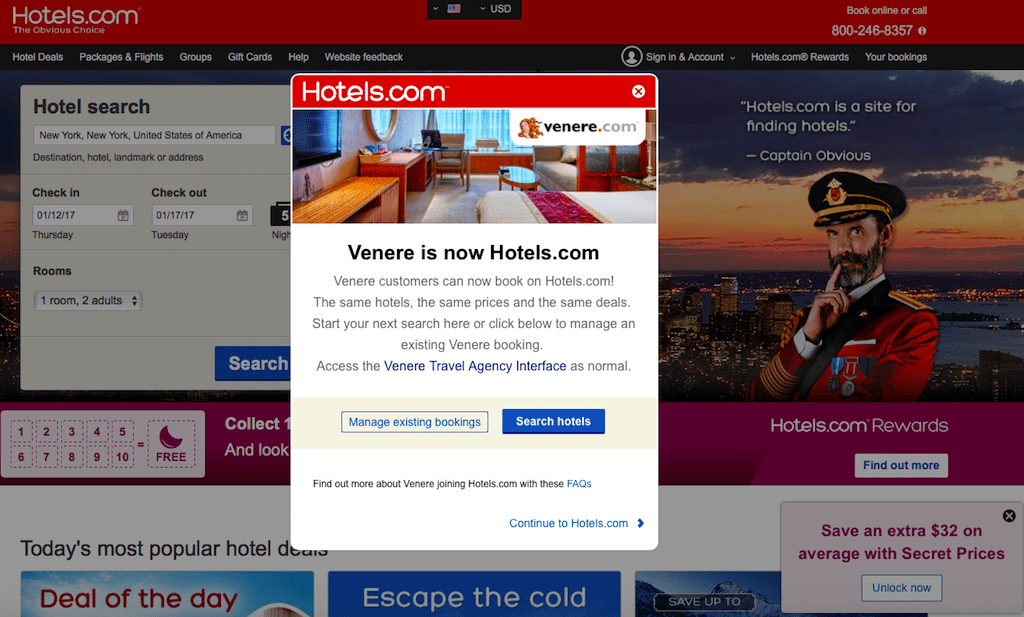

Expedia Inc. has quietly shut down consumer-facing Venere.com, the Italy-based hotel-booking site that was once seen as Expedia’s answer to Booking.com’s dominance in Europe.

And TripAdvisor confirmed it will soon be phasing out one of its content sites, Virtual Tourist.

Acquired in 2008, Venere.com now redirects consumers seeking to book a hotel to one of Expedia’s flagship brands, Hotels.com. In restructuring Venere, Expedia opted to continuing running Venere’s business to business operation in Italy for travel agents, which offers them 8 percent base commission on hotel bookings.

Expedia’s terminated Venere’s consumer business in December but it wasn’t widely reported.

Venere, like Booking.com, operated what’s called an agency model. Both companies paid a commission to hotels, and consumers didn’t have to prepay for their bookings but instead paid upon arrival.

Booking.com used the agency model to scale its business and plowed gains back into digital marketing while Expedia focused too long on the pre-pay and more complex merchant model.

Venere was supposed to enable Expedia to catch up to Booking.com in Europe but whether it was lack of execution or Booking.com’s scale advantages being too large to overcome, it never came to fruition.

“Booking.com was on such a tremendous growth trajectory at the time of the Venere transaction that the Italian team simply didn’t stand a chance,” says Johannes Reck, co-founder and CEO of Berlin-based GetYourGuide, a tours and activities site that has partnered with TripAdvisor and Booking.com at various times over the years. “The performance marketing, conversion optimization and sales force of Booking.com were already so far advanced and had built up such a competitive moat that it was impossible for Venere to compete.”

On the strategy to shutter Venere.com for consumers in favor of Hotels.com, Reck says: “It makes a lot of sense for the Expedia team to consolidate their resources into Hotels.com and compete with Booking on a global scale. There is no sense in fighting a war against Booking.com with a domestic player in a few European markets.”

Expedia also adapted Venere’s agency model and incorporated it into other Expedia brands, giving travelers the option to prepay for a room or pay at the hotel.

Wouter Geerts, travel analyst at Euromonitor, likewise believes that Booking.com had too much of a head start for Venere.

“Venere.com had a strong product when Expedia bought the company in 2008, but its reach did not extend beyond Southern Europe,” Geerts says. “This meant that it was always going to be tough to catch up with Booking.com, which by then had already spent three years aggressively expanding under the tutelage of Priceline.

“Expedia seems to have known for awhile now that it could not compete with Booking.com with a like-for-like product, which means it has spend most of its energy growing the highly successful Hotels.com brand in the past years to offer a competing, but operationally different, product to consumers.”

Ironic Twist

In an ironic twist in terms of today’s developments, it was Expedia Inc. that acquired both Venere and Virtual Tourist in 2008 among seven acquisitions Expedia carried out that year for $475 million. The deal for Virtual Tourist is believed to have cost Expedia in the $85 million to $88 million range. At the time, Expedia owned TripAdvisor before spinning it out into a public company in 2011.

Expedia had acquired Virtual Tourist, which was a social site that dispensed travel advice and was geared to attract both domestic U.S. and international advertisers, for its TripAdvisor unit. Under TripAdvisor today, Virtual Tourist was among a dozen travel media sites, including airfarewatchdog, bookingbuddy, Jetsetter and Cruise Critic, that fall within the Smarter Travel division, and transitioned with TripAdvisor when it separated from Expedia.

TripAdvisor officials confirmed that Virtual Tourist’s engagement with consumers had waned in recent years and that led to the decision to phase out the site. Tnooz first reported the development.

J.R. Johnson, Virtual Tourist’s founder and its first CEO, left the company soon after Expedia/TripAdvisor acquired it in the summer 2008 and wonders today what TripAdvisor’s rationale was for the deal.

“In hindsight, I don’t know what it was,” Johnson says. “They didn’t take advantage of the best things about it — its community and contributors.”

During the intervening years. TripAdvisor focused on building applications on top of Facebook, which Johnson says did crimp Virtual Tourist’s growth path.

Virtual Tourist, he says, was doing some things Facebook never focused on such as creating trips for users to meet other passionate travelers beyond people’s social graph, as well as people within it.

It’s obvious that Virtual Tourist was not a priority for TripAdvisor over the last few years, although Johnson argues that its community still harbors passionate travelers and the site was still holding meet-ups around the world.

Have a confidential tip for Skift? Get in touch

Tags: expedia, tripadvisor, virtual tourist

Photo credit: Expedia phased out Venere's consumer-facing business and it now redirects to Expedia's Hotels.com. Hotels.com