Skift Take

In a good year, American families spend as much as $150 billion on travel, according to our most recent market sizing estimates. It's a huge yet often misunderstood opportunity. Knowing what makes families tick, i.e. their motivations and obstacles to travel, as well as preferences for different types of experiences, is of paramount importance for travel marketers, especially in this era of personalized and bespoke travel.

Today we are launching the latest report in our Skift Research Reports service, Sizing, Behavior, Preference: Decoding The Lucrative U.S. Family Traveler Segment.

In our ongoing efforts to understand what compels the travel consumer, we have taken a big step in decoding a surprisingly under-researched segment of the U.S. travel market. In a good year, American families (with children at home) can spend as much as $150 billion on travel. It’s a huge opportunity; just over 80% of the total U.S. population lives within some form of family household, connected by either birth, marriage, or adoption.

Trips and leisure travel in general is something that we, more often than not, experience with others. Results from Skift’s 2016 Experiential Traveler Survey indicate that nine out of ten leisure trips typically involve two or more people. In other words, most travel memories are made with life partners, family, friends, or children when taking into account trip composition, but also during the decision-making process on where to go and what to do once there.

Understanding what makes families tick i.e. their motivations and obstacles to travel, as well as preferences for different types of travel experiences is tantamount in this era of personalization and bespoke travel.

And don’t forget, for a limited time, receive 20% OFF Skift Research Reports with code: HOLIDAY at checkout. End your year catching up on 2016’s most prevalent travel trends to make smarter business decisions come January.

Preview and Buy the Full Report

Enablers and Obstacles to Family Travel

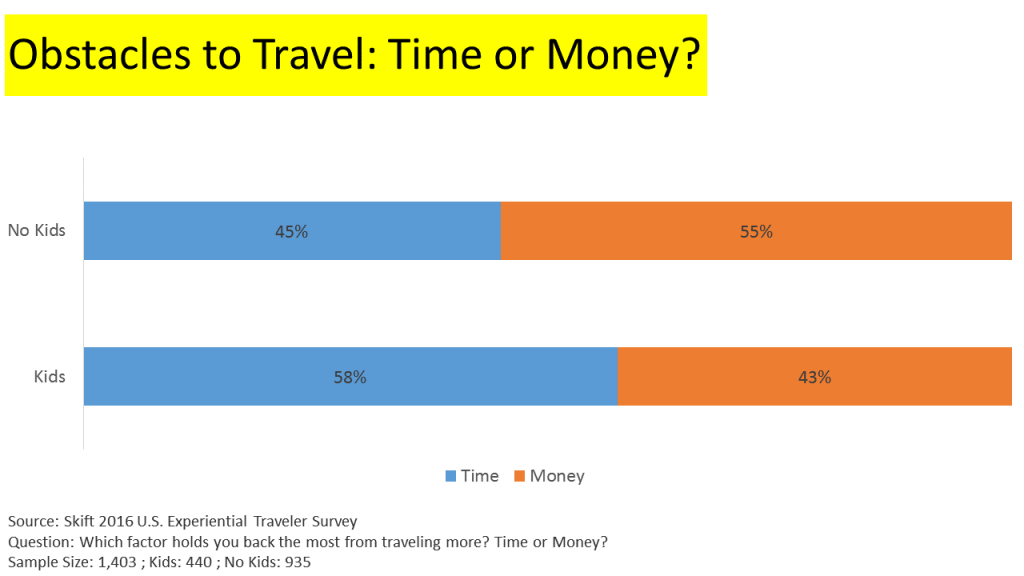

For most families, travel is a huge investment in both time and money. Contrary to some European societies where travel is often considered a basic right, in the U.S. travel rests further toward the discretionary end of the household spend spectrum. Children can also add considerable strain on budgets and time resources. In our recent Experiential Traveler Survey, we asked our panel whether “time” or “money” was the bigger hindrance to travel. On the aggregate, our panel was split close to 50/50 although we did observe variations when cross-tabulating for children and age. Respondents with children have a tendency to value their time, rather than money.

Variations become much more extreme when we factor in age. In other words, younger travelers tend to have the time but not the money to travel. These polarities switch once we get into the child-rearing years of life, then flip back to money as the main obstacle to travel, likely due to the transition into retirement.

Preview and Buy the Full Report

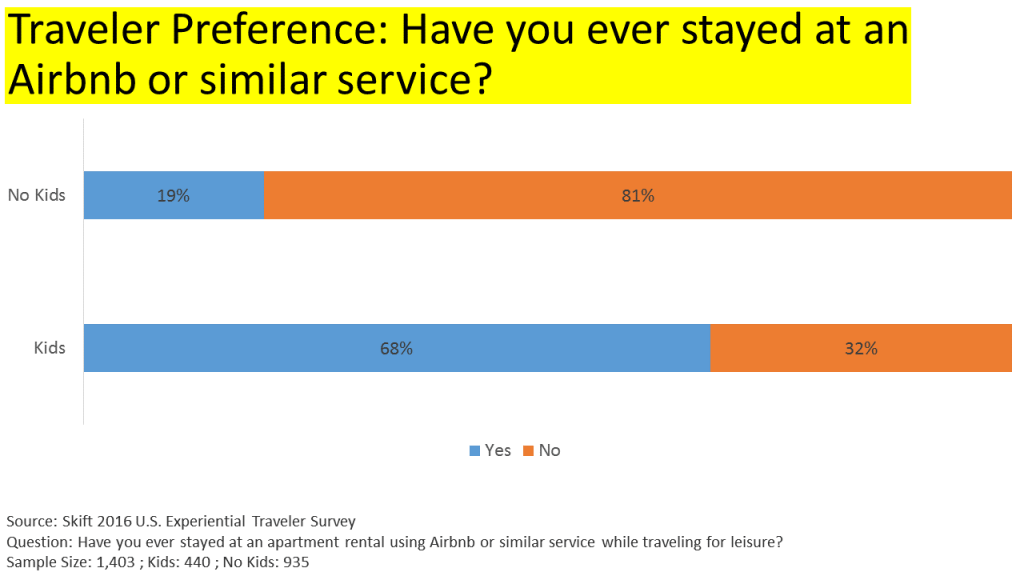

Some accommodations brands target unique segments of the family travel market. Home rental brand Kid & Coe is a startup targeting the more affluent family traveler, with an inventory of properties curated for families looking for upscale experiences and destinations. While serviced apartments and vacation rentals is not a new concept, travel has in many ways been redefined within the mind of the everyday traveler by companies like Airbnb that focus on local experiences and deep connections with destinations as core to their overall value proposition. Many of these upscale destinations are cities including New York and San Francisco.

Other brands such as Best Western and Wyndham Hotels have the “everyday” family traveler very much front-and-center in how they market their properties, as well as the programs and amenities offered onsite. When it comes to travel within the U.S., the quintessential road tripper and roadside hotel stay represent a significant portion of the market. Lisa Checchino of Wyndham stated that people and families in particular aspire to travel regardless of income. “Even those with limited incomes show huge aspirations for travel.”

Preview and Buy the Full Report

List of Figures

The following figures highlight detailed findings from our most recent consumer survey research conducted including Skift’s 2016 Experiential Traveler Survey and Skift’s Future of Work in Travel Survey:

• Leisure Trip Composition: Avid Travelers

• The Modern Family: Smaller in Size, Larger in Numbers

• Work / Life Balance: Career Satisfaction

• Obstacles to Travel: Time or Money?

• Work / Life Balance: Stress At Work

• U.S. Population: Age Distribution (2014)

• Age Distribution Among Avid Travelers: By Family Type

• Estimated Family Trip Spend

• U.S. Family Household Income Distribution

• Select Stats: American Households and Families (2015)

• Trip Frequency Among Avid Travelers: By Age

• Income Distribution Among Avid Travelers: By Family Type

• Planning Family Travel

• Traveler Preference: Pre-Packaged or DIY?

• Traveler Preference: Long-Few vs. Short-Often

• Traveler Preference: Accommodation Type

• Traveler Preference: Have you ever stayed at an Airbnb or similar service?

• Traveler Preference: Would you ever stay at an Airbnb? By Age

• Traveler Preference: Would you ever stay at an Airbnb? By Family Type

• Traveler Preference: Traditional Hotel or Airbnb?

• Better Amenities or Better Experiences: By Family Type

• Better Amenities or Better Experiences? By Income

• Better Amenities or Better Experiences? By Age

• Local Engagement: Community Service, By Age

• Local Engagement: Community Service, By Family Type

• Local Engagement: Environment, By Age

• Local Engagement: Environment, By Family Type

• Local Engagement: Exploration, by Age

• Local Engagement: Exploration

• Picture Taking: Liberal or Conservative?

Subscribe to Skift Research Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch