Skift Take

Online hotel bookings remain much more valuable than online short-term rental bookings and will see larger long-term online growth as more travelers use their devices to book a room and move away from alternative booking methods.

There’s no question short-term rentals made a splash around the world this year — mainly from the likes of Airbnb — even amidst the backdrop of ongoing regulatory battles, discrimination debates, and fresh product launches aimed at owning more of travelers’ trips.

As of March, some 32 of the 59 largest U.S. cities (54 percent), for example, had some kind of restriction in place for short-term rentals and 28 of those cities’ restrictions are considered hostile.

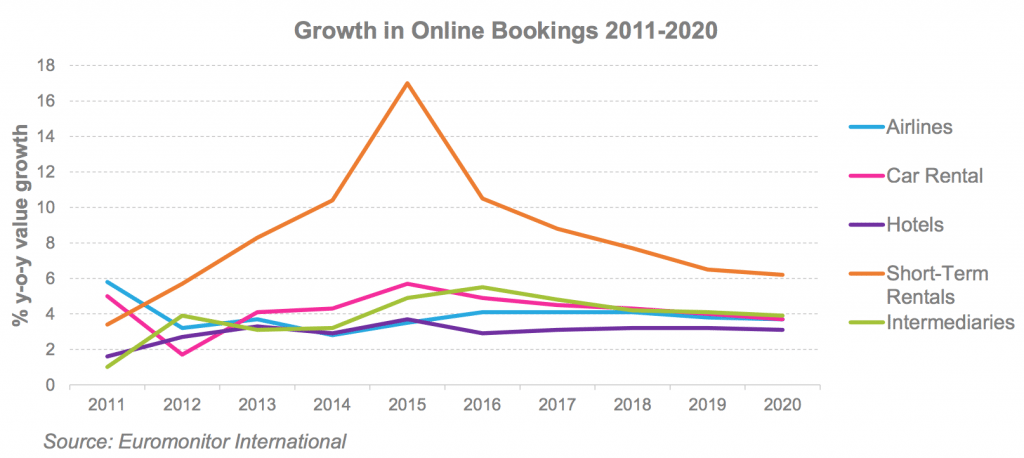

While short-term rental year-over-year online bookings growth each year looks much healthier than that of hotels through 2020, according to data from market research company Euromonitor International, hotels definitely aren’t the underdog when comparing growth from 2015 to 2020, and that’s highlighted in the charts below.

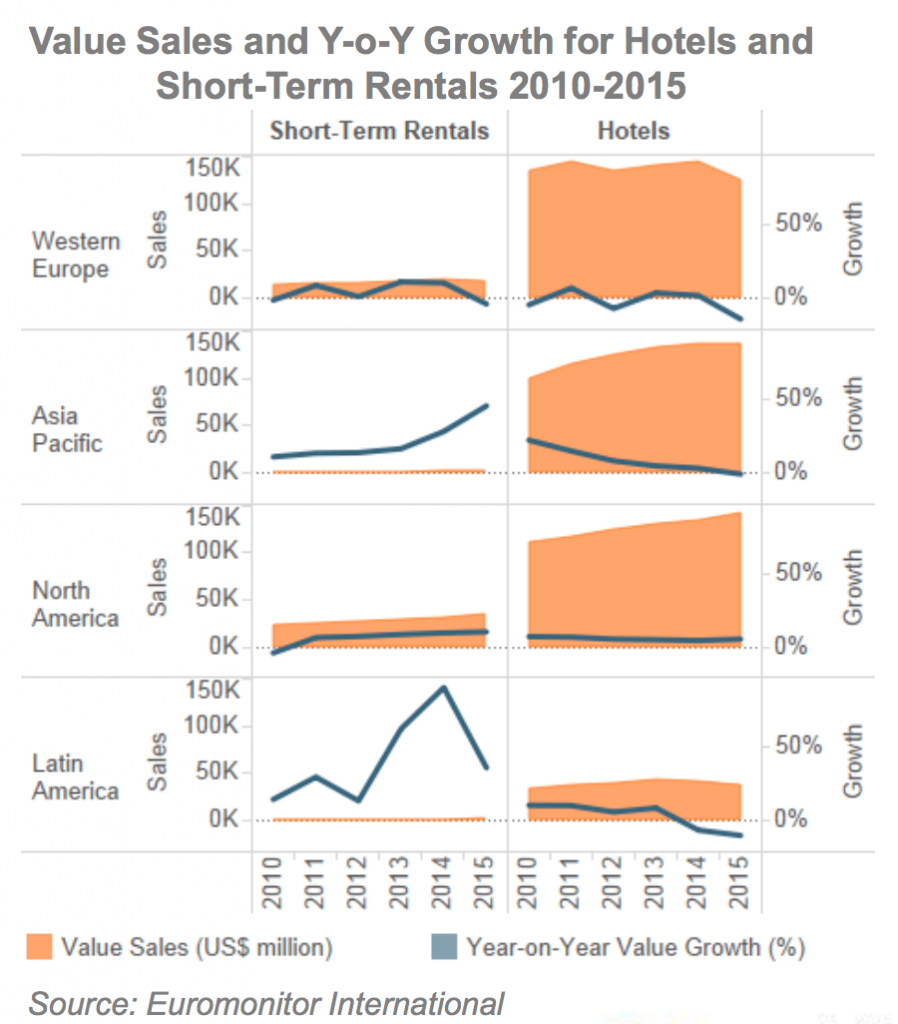

For one, the value of short-term bookings across all regions remains dramatically lower compared to hotels’, and Euromonitor’s forecast through 2020 shows hotels will continue to hold that leverage for the foreseeable future.

When a platform like Airbnb says it had a record number of guests on a single night or during the summer, those numbers are still a small fraction of the number of guests that stay at hotels around the world.

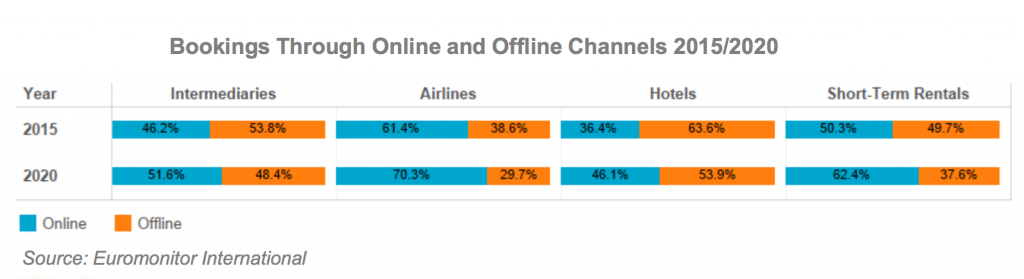

Albeit, the percentage of online short-term rental bookings dwarfed hotels last year, considering the breakdown of online and offline bookings (see Chart 2 below). Euromonitor found some 50.3 percent of the world’s short-term rentals were booked online in 2015 and estimates more than 62 percent will be booked online by 2020. Hotels, however, received 36 percent of their bookings online last year and will get about 46 percent of bookings online by 2020.

Most short-term rental platforms will have higher percentages of online bookings given their digital nativities. And, it’s telling that less than half of the global hotel business will be booked online by 2020.

The following charts outline online bookings growth and the value of short-term rentals versus hotel bookings:

Chart 1: Short-term rentals saw a 17 percent year-over-year increase for online bookings in 2015, but airlines remain the most valuable sector for online bookings. Airline online booking sales were nearly $390 billion last year.

It makes sense that online short-term rental bookings, such as those from Airbnb, are projected to show more year-over-year growth each year than hotels through at least 2020, given the former is a much newer sector that would naturally post stronger growth in its formative years as more travelers learn about and adopt it.

On the other hand, it’s notable that online hotel bookings are projected to show much smaller year-over-year growth each year than short-term rentals through 2020 as many major brands this year touted the benefits of booking direct versus using a booking site. Travel agency bookings (dubbed “intermediaries” in the chart below, and including both on and offline sellers) are actually forecast to post slightly stronger year-over-year growth than hotels during the next four years.

Although, the next chart shows this is hardly a nightmare scenario for hotels.

Chart 2: With the above chart in mind, online hotel bookings will see higher growth from 2015 to 2020 (about 28 percent) compared to short-term rentals which will see about a 24 percent increase in online bookings.

But by 2020, fewer than 50 percent of global hotel bookings will be made online while more than 60 percent of short-term rental bookings will be online. Of course, this is the global picture and doesn’t breakdown online bookings for the U.S. versus Latin America or Europe versus Southeast Asia, for example, where some regions may have far more than 50 percent of their hotels booked online.

In many cases it’s more difficult to make an offline short-term rental booking than it is an offline hotel booking, given travelers often can’t call short-term rental hosts with platforms like Airbnb or use a travel agent like they may for booking a hotel.

It’s also worth pointing out nearly half of all travel agency bookings will still come through offline channels by 2020.

Chart 3: Short-term rental bookings are growing faster than those of hotels, but hotel bookings are significantly more valuable than short-term rentals.

This chart includes data from offline bookings such as over the phone and travel agents and online bookings.

Source: Euromonitor International

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, euromonitor, short-term rentals

Photo credit: About 62 percent of the world's short-term rentals will be booked online by 2020. Pictured is an Airbnb rental in Aspen, Colorado. Airbnb