HomeAway President Says Company Needs to Win Back Credibility From Homeowners

Skift Take

Consider the issues facing John Kim, formerly a top product guy at Expedia Inc., when he was tapped to lead vacation rental giant HomeAway's transformation as its new president in September.

A group of 40 or so sites ranging from HomeAway and VRBO in the U.S. to Arbitrel in France and Stayz.com in Australia, with 1.2 million vacation home listings in 190 countries, HomeAway was acquired by Expedia Inc. late last year in the midst of a major transition. HomeAway was moving away from a tiered subscription-only business model toward a single subscription plan plus a new pay-per booking model, and there also came a new emphasis on making vacation rentals online bookable.

To complicate matters, Kim, who joined HomeAway from Expedia in March before becoming its top executive seven months later, took over after HomeAway had instituted its first booking fee leveled at travelers in an effort to better monetize the site. But it drew the wrath of a considerable number of vacation home owners, who cited a decrease in demand because of the new fee.

Kim says HomeAway needs to "win some credibility back" from some vacation rental owners, communicate with them better and provide them with better tools and data to solve problems. The fee created some "bad feelings," he acknowledges.

As part of the changes under way, when Kim was appointed HomeAway president, HomeAway co-founder and then-CEO Brian Sharples became company chairman. Meanwhile, Expedia and HomeAway are busy integrating HomeAway's vacation rental listings with Expedia's and sister company Hotels.com's hotel displays.

Transformation of HomeAway

Talking to Skift outside the Phocuswright conference in Los Angeles Tuesday, Kim says HomeAway needs to become more tech- and product-focused than it was in the past when the emphasis had been on collecting subscription fees in an era when traffic could be generated from organic search on Google. Google, meanwhile, has vastly downplayed organic search.

Over the last couple of years, HomeAway put its energies into spearheading new business models instead of being able to focus solving problems for users and owners, Kim says.

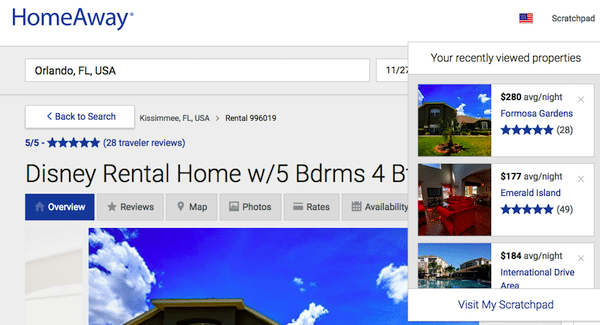

Among new tech-focused products, Kim points to a new Scratchpad feature, which is being tested with a subset of users. Unlike when searching for hotels, HomeAway found that users had big problems in trying to remember the large number and widely diverse makeup of vacation rentals they previously searched and the Scratchpad is geared to make the search process easier.

HomeAway's version of Scratchpad -- Expedia has a different one -- collects users' past vacation rental searches and groups them in a trio of photos with ratings, rates and review information. Users can click through to handily revisit each listing.

Scratchpad's 3-pack photo design is "radically different" than website and mobile results, Kim says, and provides an aesthetically pleasing and efficient way for users to recall their searches.

Kim says another of his priorities is hiring -- an oft-overlooked art -- and he's trying to bring in the best designers and developers with experience in e-commerce.

"We are trying to hire the right people," Kim says.

As part of the emphasis on product development, HomeAway has opened its first user lab in headquarter-city Austin, Texas, and also uses Expedia labs in London and Singapore.

Racism and Competitive Threats

On hot-button issues in the vacation rental sector, such as alleged owner racism in excluding guests, Kim says HomeAway has "zero tolerance" for racism. He says he's sure that owners who are guilty of racist patterns get kicked off the platform, and argues that HomeAway is more opaque than Airbnb, which mitigates somewhat against racist patterns.

For example, Kim claimed that HomeAway guests don't have profile photos so owners wouldn't be able to eliminate people by race unless the potential guest has an ethnic-sounding name.

There is certainly plenty of opportunity for racial bias, though, apart from accessing photos, and especially when many vacation rentals aren't instantly bookable online and still get booked over the phone.

HomeAway urges customers to report owners who they feel treated them shabbily or excluded them on racial grounds.

Kim, though, emphasizes that owners might be threatened, as well. He says he wouldn't want a system that would lead to owners getting falsely accused of racism.

Airbnb and Booking.com

On competitive issues, Kim was asked whether it was true that Airbnb has flopped so far in its push to sign up property managers in the U.S. and Europe, for example.

The context for the question is that separately, Steve Milo, founder and owner of Vacation Rental Pros Property Management in Ponte Vedra Beach, Florida, tells Skift that Airbnb has tried to make the vacation rental industry adapt to Airbnb rather than the converse and has offered inadequate tools given the complexity of booking settings and rules that owners need to use.

Milo argues that Airbnb is great at public relations and is building its roster of vacation rental listings but isn't getting a corresponding surge in vacation rental bookings, and that the revenue per listing on average through Airbnb falls way below the comparable numbers on HomeAway.

Kim says he isn't sure you can characterize Airbnb's performance in vacation rentals with a broad brush since he believe it likely varies widely from market to market.

Meanwhile, Woody Marshall and Erik Blachford, general partner and venture partner, respectively, at Technology Crossover Ventures, argue that if Airbnb's current tools for vacation rental owners and property managers are inadequate -- and they weren't saying they are -- then don't consequently count out Airbnb in vacation rentals.

Blachford says Airbnb is a technology- and product-focused company and there is no barrier to the company learning and developing excellent tools for property managers.

Technology Crossover Ventures is an Airbnb investor.

Booking.com has been ramping up its vacation rental inventory over the last couple of years. In the third quarter, the Priceline Group's Booking.com reported that it grew its vacation rental portfolio 39 percent year over year to 529,000 properties. Booking.com states that all of these are instantly bookable online, which is not the case with a big portion of HomeAway's selections.

Asked about any competitive heat from Booking.com, Kim of HomeAway says his company and Booking.com to a large degree operate in different markets -- urban versus resort locations, respectively -- and that he hasn't heard from vacation rental owners that Booking.com is making any appreciable gains.

However, all of the major players in vacation rentals, from Expedia/HomeAway to Priceline/Booking.com and Airbnb, for example, are making overtures in each others' respective markets and there undoubtably will be clashes to come as the hospitality industry undergoes revolutionary changes.