Skift Take

The IPO that we all knew was coming is finally here.

European metasearch giant Trivago filed its long awaited initial public offering (IPO) in the U.S. today as parent Expedia tries to further monetize a fast-growing marketing vehicle in a manner that has similarities of its spinoff of TripAdvisor several years ago.

Trivago will be listed on the NASDAQ under the ticker symbol TRVG, using a holding company named Travel BV. Expedia Inc. owns a large chunk of the company after buying into 63.5 percent of Trivago for $628 million in cash and stock in 2012. Expedia plans to retain its stake in Trivago following the IPO, which it has entrusted to banks J.P. Morgan, Goldman Sachs, and Morgan Stanley.

Trivago’s IPO filing shows that it is performing well, especially with respect to driving visitors to its site.

“In the twelve months ended September 30, 2016, we tracked approximately 1.4 billion visits to our websites and apps, resulting in 487 million qualified referrals, and offered access to approximately 1.3 million hotels in over 190 countries,” reads the filing. The company’s net loss was $57.8 million in the first nine months of 2016.

Expedia accounts for a significant amount of the company’s revenue, as well, to the point where it is essentially carrying Trivago along with it.

“In the years ended December 31, 2014 and 2015 and for the nine months ended September 30, 2015 and 2016, Expedia accounted for 32 percent, 39 percent, 39 percent and 35 percent of our revenue, respectively,” states the filing.

Expedia Inc. and its affiliates accounted for a whopping 55 percent of total accounts receivable as of the end of 2015, while Priceline Group accounted for 21 percent.

Unsurprisingly, Trivago lists its explosive growth as a projected risk factor for investing in the company.

“Our failure to manage our growth effectively could negatively affect our corporate culture, harm our ability to attract and retain key personnel and adversely impact our results of operations and future growth” is the top risk factor listed, followed by “we may not be able to maintain our historical growth rates in future periods.” The document also reflects that Expedia’s ownership of 63.5 perent of Trivago will lead to Expedia controlling the company post-IPO.

Contrasting the placeholder pricing of Trivago’s IPO with previous travel industry public offerings is a bit surprising. Kayak went public in in 2012 at around a $1 billion valuation, and was purchased by Priceline Group for $2.1 billion the following year.

Expedia’s public spin off of TripAdvisor in 2011 is a model for what it hopes to accomplish with Trivago, which is known to spend more than two-thirds of its revenue on marketing to bolster its growth.

Here is a link to Trivago’s F-1 filing with the SEC.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: expedia, ipo, metasearch, trivago

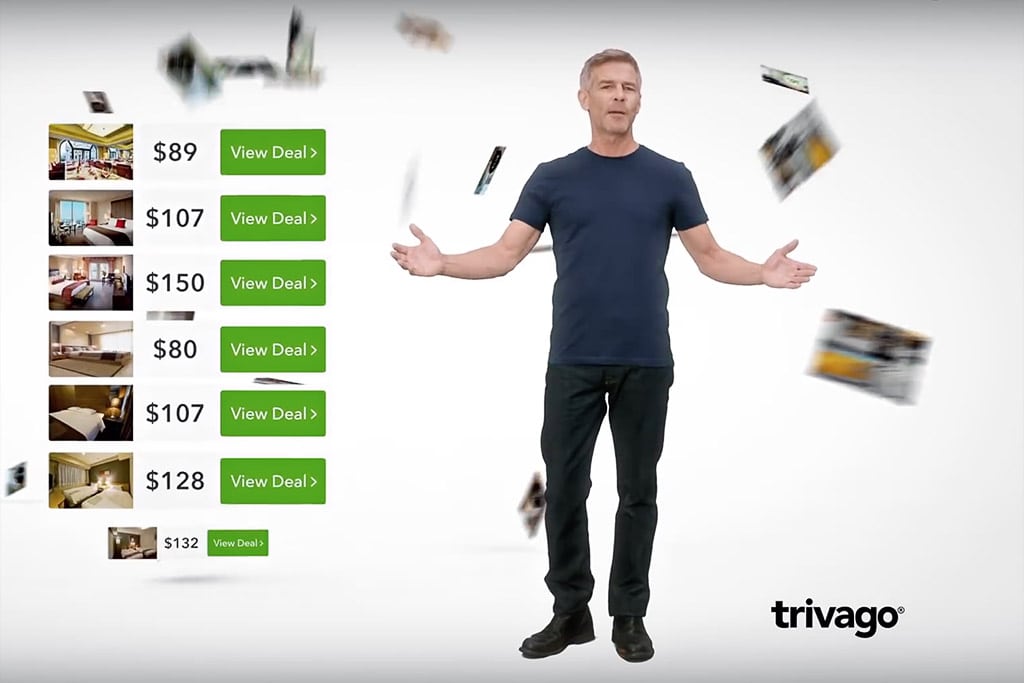

Photo credit: A still from one of Trivago's ubiquitous television ads. The Expedia-owned metasearch site has filed for an IPO.