Majority of Americans Still Don't Want to Stay in a Trump Hotel

Skift Take

As with the general election for President of the United States, the majority of respondents in our latest survey of consumer sentiment of the Trump Hotels brand are turned off by Trump the politician.

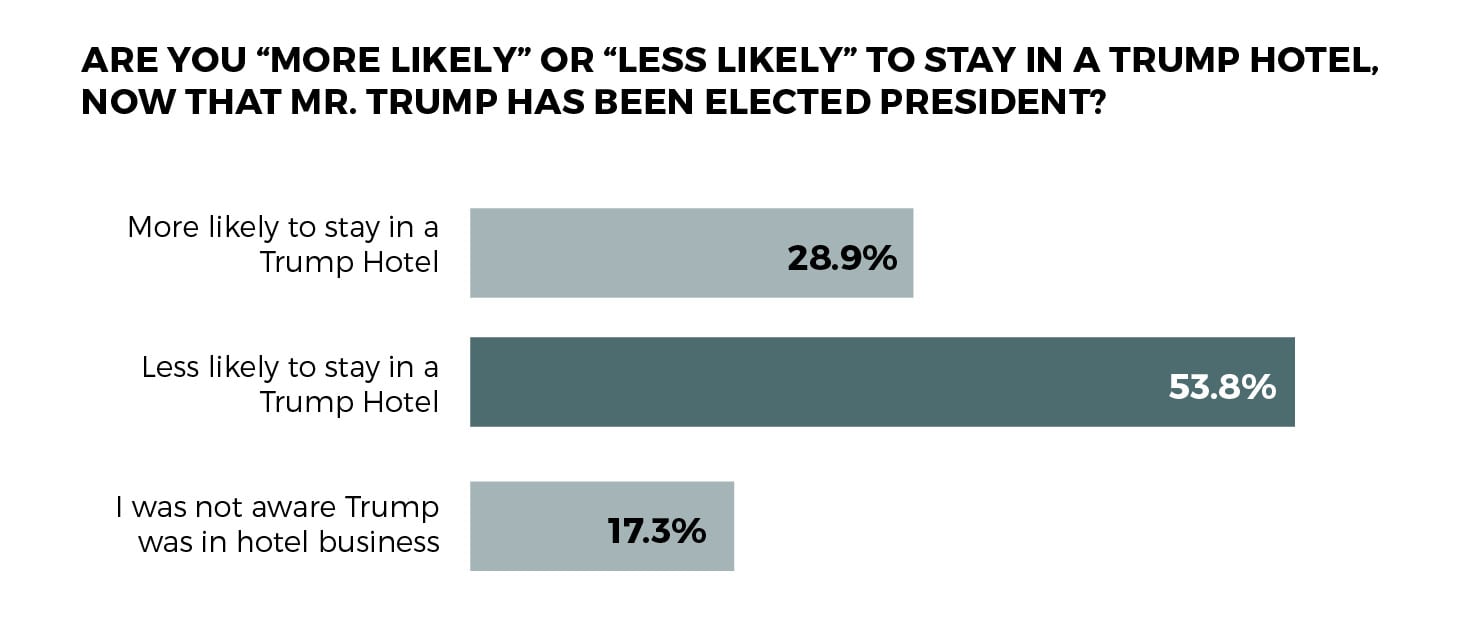

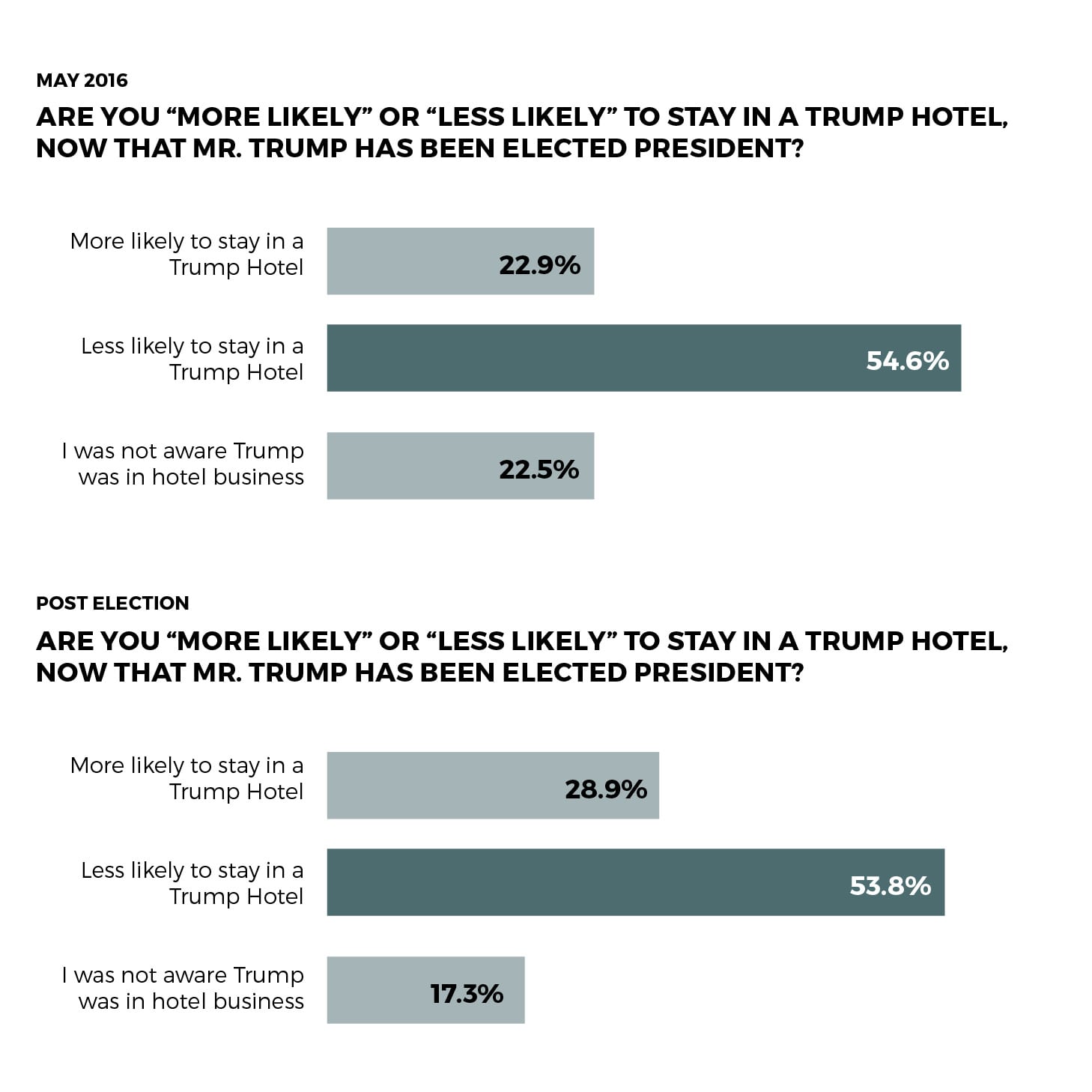

In an updated survey of the general Internet population that we did in May, more than half of all consumers are still less likely to stay in a Trump property following his insertion into politics.

In a bright spot for the president elect, nearly six percent more people say they're more likely to stay in a Trump property than we saw in May. Unfortunately, this six percent comes from the category of people who say they did not know Trump had hotels — a victory, perhaps, over ignorance — than cut into the majority of consumers who said they were less likely to stay. The rejection of the Trump brand was relatively consistent.

Trump's hotel brand, which operates with its own CEO and strong leadership from daughter Ivanka Trump, has little to do with the man/candidate beyond the name. But that doesn't mean consumers have been less turned off by it. Multiple studies have shown that foot traffic and bookings have decreased to the brand's properties. As a luxury brand that's based in major urban centers in the U.S. and abroad it scores terribly with the consumers in income brackets that are most likely to be able to afford it. The company has admitted as much by removing the name — something the candidate won't even do for re-bottled water and second-rate stakes — in favor of the new Scion brand name (not the Toyota car company) for its new product.

Important: This survey — not served to Skift users — was administered to members of the adult internet population in the U.S. last week, through Google Consumer Surveys. The methodology is explained here.

The Bottom Line: In our latest survey, which ran from Wednesday to Friday last week and was based on the responses of 1,542 people, a majority of repondents said that they were less likely to stay in a Trump hotel following the presidential race.

It should be noted that the Trump Hotels brand is one of the smaller luxury brands.

This survey's numbers are very similar to ones we received earlier in the year when we surveyed the public with a very similar question. One key difference is that more people are more likely to stay in Trump properties than before. Still, that comes at the cost of ignorance; none of the gains seemed to have come from people changing their mind. Rather, they came from people realizing that the candidate actually owned hotels.

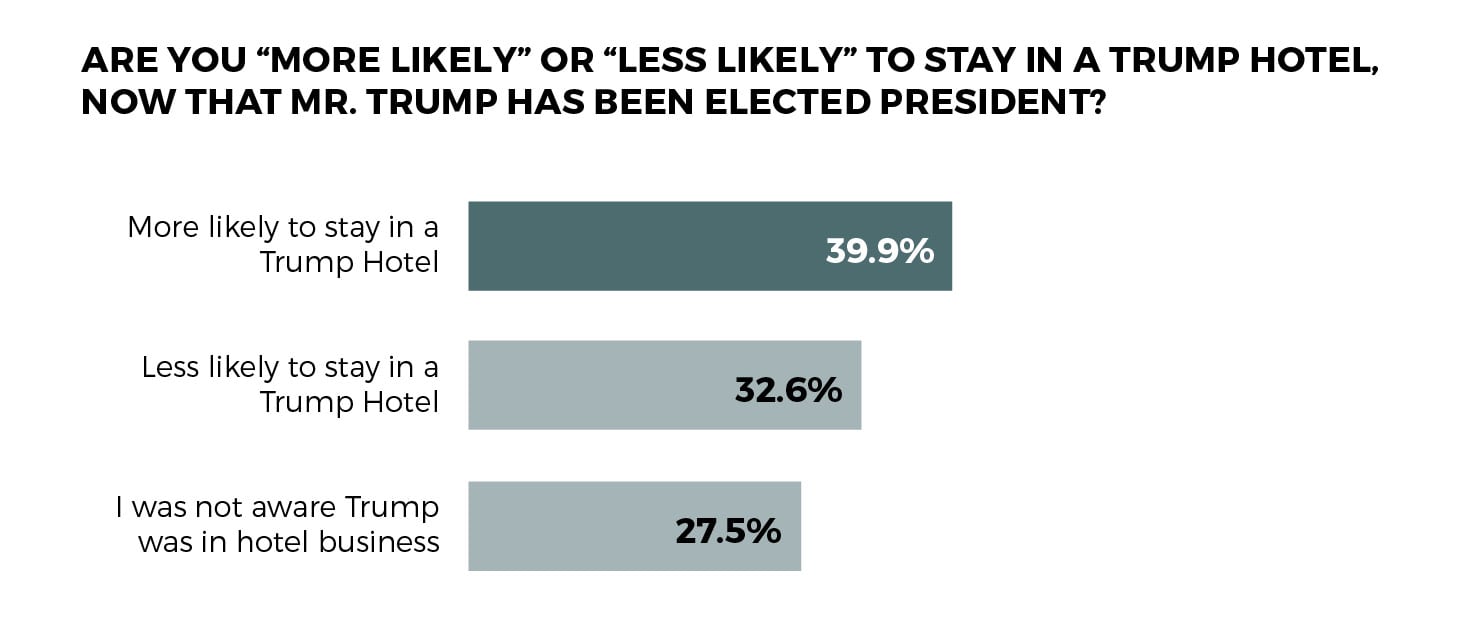

We do see differences in demographics, though, both at region and state level. This is perhaps best illustrated but the difference between New York State and Mississippi.

Residents of Mississippi that are more likely to stay in a Trump hotel are in the majority here. For a luxury brand, this presents some challenges as Mississippi was ranked 46 of 50 in employment by the U.S. Bureau of Labor Statistics. It is also a perennial last place for education.

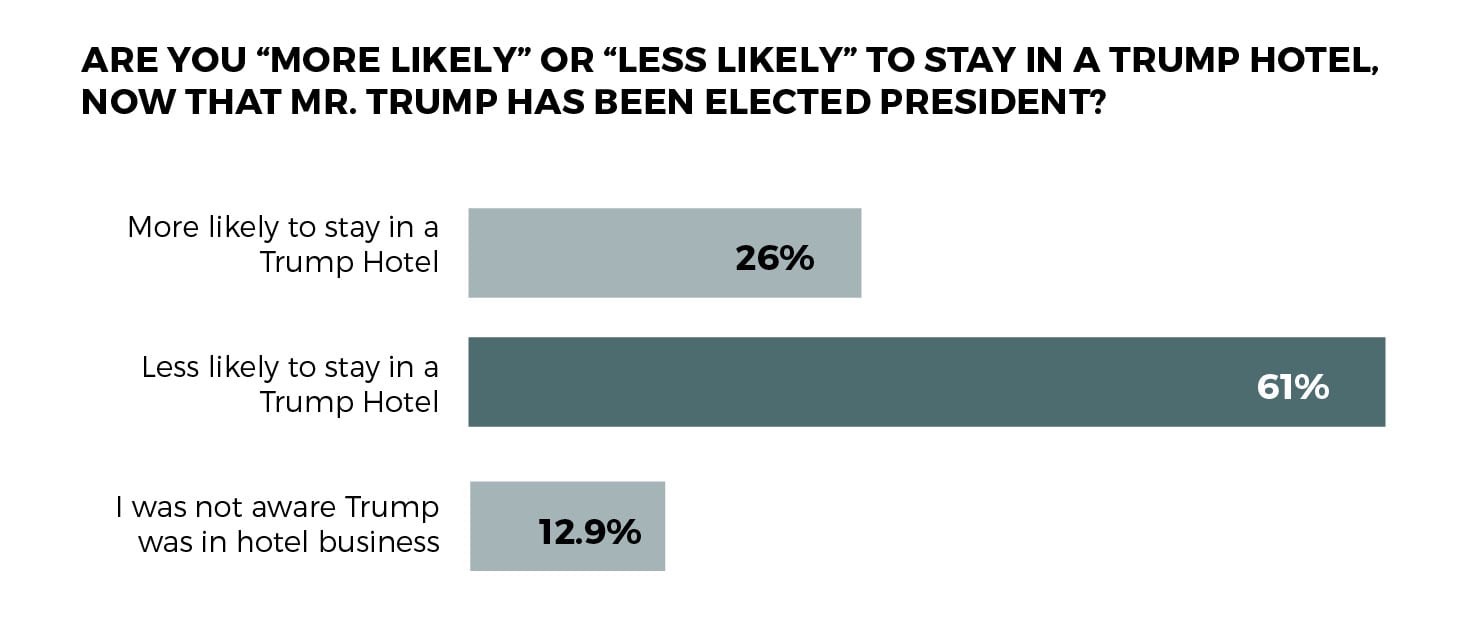

Conversely, New York was one of the states with a large majority that said it was "less likely" to stay in a Trump-branded property. Like California (66.1 percent) or Massachusetts (71.9 percent), it residents overwhelmingly rejected the Trump brand.

The Takeaway

Winning a bid for the president of the United States is not usually thought of as a crisis moment, but when 60 percent of consumers are turned off by your brand because of your politics, it becomes an issue. And at a time when you're launching new high-profile properties in the nation's capital, as well as battling off yet another lawsuit from disgruntled investors, as we're seeing in Toronto, it's a serious issue.