Google Making Gains in Hotel Advertising, Updates Website for Hoteliers

Skift Take

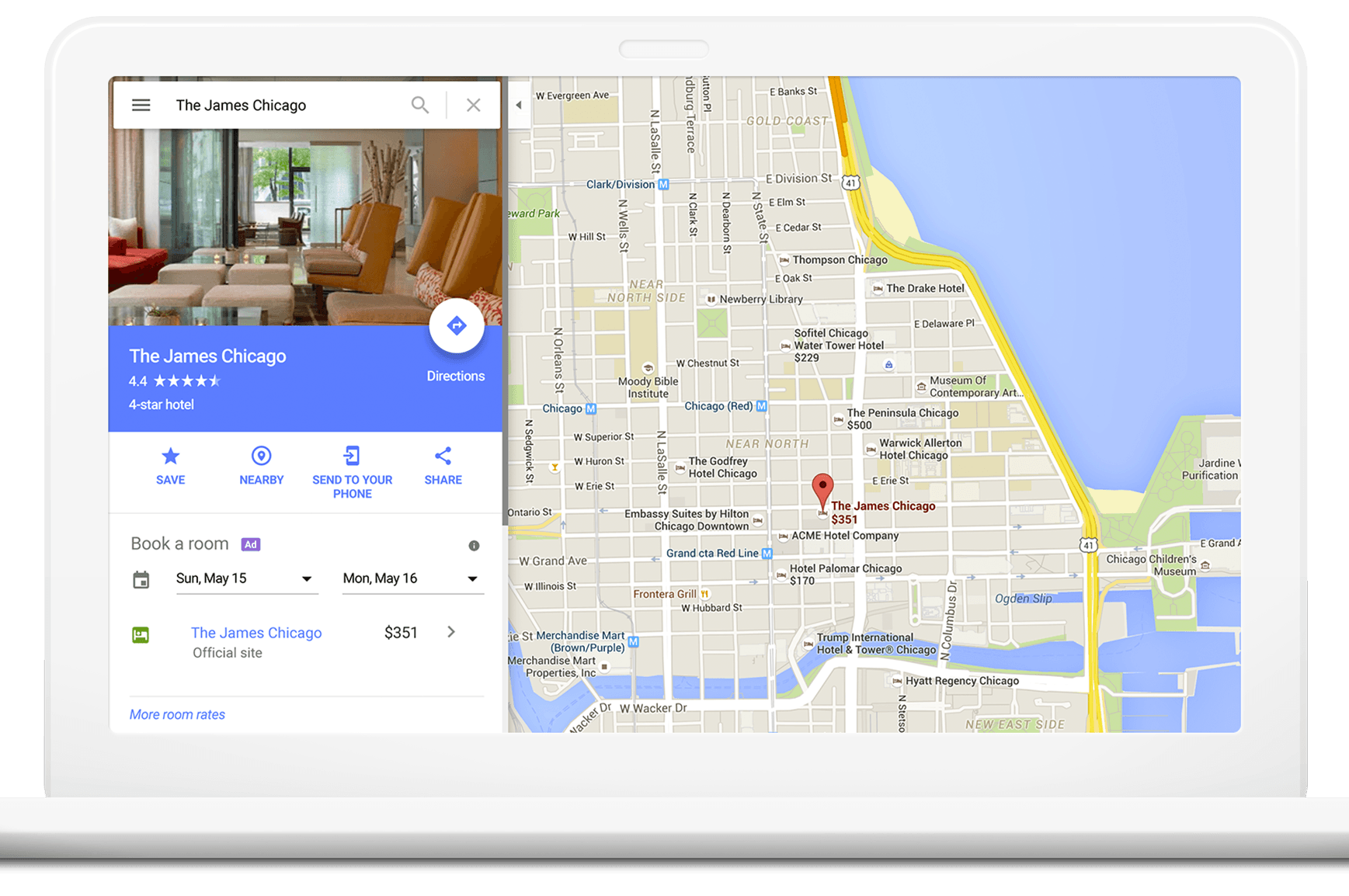

Google may not be on the road toward becoming an online travel agency, but the search engine is inserting itself more aggressively in the travel research and hotel-shopping process.

Google already has a gigantic travel advertising business, and now the company states that its hotel-related searches jumped 25 percent year over year in July 2016.

Competitors tacitly acknowledge that Google is taking market share.

With Google's and other competitors' apparent gains as a backdrop, TripAdvisor CEO Stephen Kaufer's briefly mentioned during the company's third quarter earnings call Wednesday that "market and competitive forces at play" have impacted the company's difficult transition toward becoming a hotel booking site. His remarks highlight how the hotel metasearch competitive climate is apparently heating up.

In classic hotel metasearch, companies such as Google, TripAdvisor, Kayak and Trivago display hotel listing from chains, independents and online travel agencies, and collect revenue from these partners when consumers click on links and navigate to the hotel or online travel agency sites for booking. Google, TripAdvisor and Kayak, meanwhile are also branching out from such lead referrals and are processing hotel bookings on their own sites for partners, which pay a commission or pay per click and handle customer service.

Goog