Threats Facing Hotel Food and Beverage Intensify

Skift Take

This sponsored content was created in collaboration with a Skift partner.

Luxury hotel food and beverage options have consistently followed along a similar path — applying a single view of the guest, often making the assumption that all guests are seeking hotel restaurants with prominent chefs and Michelin stars.

But as travelers tastes have evolved and diversified and their demands have sharpened and increased, the challenges facing hotel food and beverage have also increased.

Travelers increasingly prioritize local, unique culinary experiences that may not come from a prominent chef, or even be rated at all. Moreover, services such as Postmates, DoorDash, and Seamless deliver food to hotel guests in their rooms, and restaurant booking/review engines like TripAdvisor, Yelp, and OpenTable, provide guests with alternate off-site options.

The result is that hotel food and beverage has more to compete with than ever. That’s not to mention the varied reasons for travel, and how that can define the food experiences guests seek.

Defining the Threats

“Eat Like a Local”

Celebrity chef Anthony Bourdain told Skift in a 2016 report, “If you do a poll of what motivates people to travel to a particular place, food is now the number one reason, I’m sure that that’s a significant change. I think they’re looking to have a more, for lack of a better word, real experience.”

Travelers today use food as an entry point and a conversation starter to experience the social fabric and cultural customs of a destination. This change in mindset raises travelers’ expectations of culinary experiences, and also raises the bar for hotel food and beverage. Large destinations and hotel groups in particular can capitalize on this paradigm shift by gathering local data on what kinds of experiences travelers are looking for, and using that data to personalize their offerings and promotional campaigns.

“Hotel F&B strategy should begin by listening to what your customers think about your existing F&B product. Location-based social media provides rich insight into the perceptions of your menu, the ambiance, and even provides opportunities for you to go above and beyond to delight your guests” says Jonathan Barouch, CEO of Local Measure. Local Measure is a business tool that delivers real-time local insight about guests, for example, identifying social posts from a specific hotel location (or restaurant within a hotel) and delivering that data to local front line teams who have the ability to influence a customer journey. To learn more, download The Ultimate F&B Guide for Hotels e-book from Local Measure.

That kind of insight can provide a starting point for creating the type of “real experience” Bourdain identifies travelers seek.

Digital Disruption in Dining

Many hotels fear or dismiss disruption from the sharing economy’s food delivery options like Postmates, UberEATS, and Seamless, and review and booking sites like TripAdvisor, Yelp, and OpenTable.

But the competition and disruption can provide free insights that can help hotels unlock new revenues and deeper relationships with their customers.

Ana Brant, Global Director of Guest Experience and Innovation for Dorchester Hotels, has a role primarily devoted to guest listening. Brant embraces the data provided by such “disruptors” to her advantage, by distilling the collective digital wisdom of the crowds into insights.

“TripAdvisor and other review sites have been perceived as enemies of the hospitality industry because they made any organizational dysfunction transparent, instantly. Industry-wide there was, and still is, a large tendency to simply ignore or dismiss the importance of customer reviews.” says Brant.

The insight she gleaned, and is applying to the Dorchester Collection strategy, was that, “...if we want to compete in this competitive marketplace we need to realize we are not in the hotel business running a restaurant, we must be in the restaurant business. This is the key starting point.”

Not all Travelers are Created Equal

One of the biggest factors determining a guest’s culinary preference is the purpose of their visit. Brant explains, “A couple travelling on a special occasion will most likely stay in and indulge in the room service experience or choose to visit one of the fine dining restaurants. The business traveler is looking for a more casual and approachable option with good atmosphere and vibe. Bucket list guests love our weekend brunches or afternoon teas, while families are looking for dining options with food variety suitable for children. Unfortunately, it is impossible to have one restaurant catering to all the needs; the key in luxury hotels is to have wide variety and be extremely flexible.”

By tapping into real-time, location based data, companies can better understand the nature of a guest’s visit. “New technology can allow a hotelier to pick up on the subtle preferences of their guests and to truly cater to their needs — and operationalize those preferences to impact the customer during their journey. That’s where companies like Local Measure come in — to gather real-time feedback and push it into the hands of the F&B staff who can positively impact the guest’s visit,” explains Barouch.

Financial Opportunity

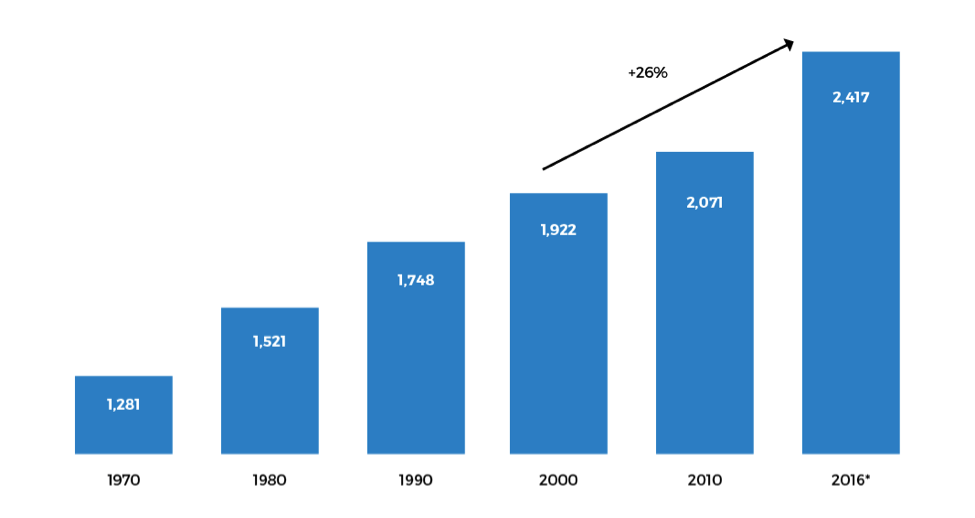

People are spending more as a whole on restaurant experiences. Data from the National Restaurant Association shows that in the U.S., overall restaurant spending per capita has jumped by as much as 25% since 2000 (see the figure below).

U.S. Annual Restaurant Spend Per Capita

Sources: National Restaurant Association data adjusted for inflation; population data from U.S. Census Bureau; * projected by restaurant.org

This means there’s tremendous opportunity to capitalize on hotel food and beverage as an operational revenue generator by getting ahead of these threats. Ana Brant suggests that somewhere between 20–30% of total revenue for a luxury group like Dorchester Collection comes from food and beverage offerings, inclusive of in room dining and banqueting.

Steven Chan, Head, Operations Support and Franchise Operations, Asia Middle East & Africa (AMEA) at IHG has taken a strategic approach to differentiating and growing restaurants and bars. Chan said, “Products and services are designed in tandem, encapsulating a whole dining experience; not just food or service alone.” Chan explains further, “In the process of conceptualizing a restaurant, insight is key. Research gathers insights ranging from consumers and the marketplace, to dining trends etc. to align our presumptions. Once the idea gets clarity, we work with design houses in all touch points. The process is guided by creating that distinctive customers’ dining experience that touches all senses; visual, taste, smell, audio and even the linens and crockery wares. Execution is underpinned by a robust training and measurement mechanism to ensure it stays on course. ”

To accommodate this within the operational strategy, IHG has created a new position focusing on just restaurants and bars across three sub-regions. “This will strengthen our capabilities in the field and continue our growth in this segment” explains Chan. Food and beverage at IHG (Asia, Middle East and Africa region) accounts for more than $1B in revenue annually, with an average of 5% to 7% growth.

Getting Ahead

- Chan recommends being known in the marketplace so that locals and guests alike are enticed by the property’s food and beverage options.

- Listen to what the guest wants, and don’t assume that every guest’s need will be able to be met through a single offering.

- Gain local insights into where people are eating off-property by leveraging digital, location-based data.

- Provide authentic dining experiences on the property.

- Use guest data to understand consumers on a deeper level - and even interact with them - targeting them with the food and beverage experiences or surprise and delight moments that answer to what they are looking for.

- Flip the model upside down; as Brant recommends, think of being in the restaurant business rather than solely the hotel business.

To find out how to drive your hotel revenue with real-time local data to understand what guests want from your F&B offer, download The Ultimate F&B Guide for Hotels e-book from Local Measure.