Lastminute Bought WAYN's Assets for Just $1.2 Million

Skift Take

Despite trying to spin it as a positive move, WAYN was heading towards oblivion until lastminute.com group stepped in. Are those 20 million registered users worth $1.2 million or will the deal prove a costly mistake?

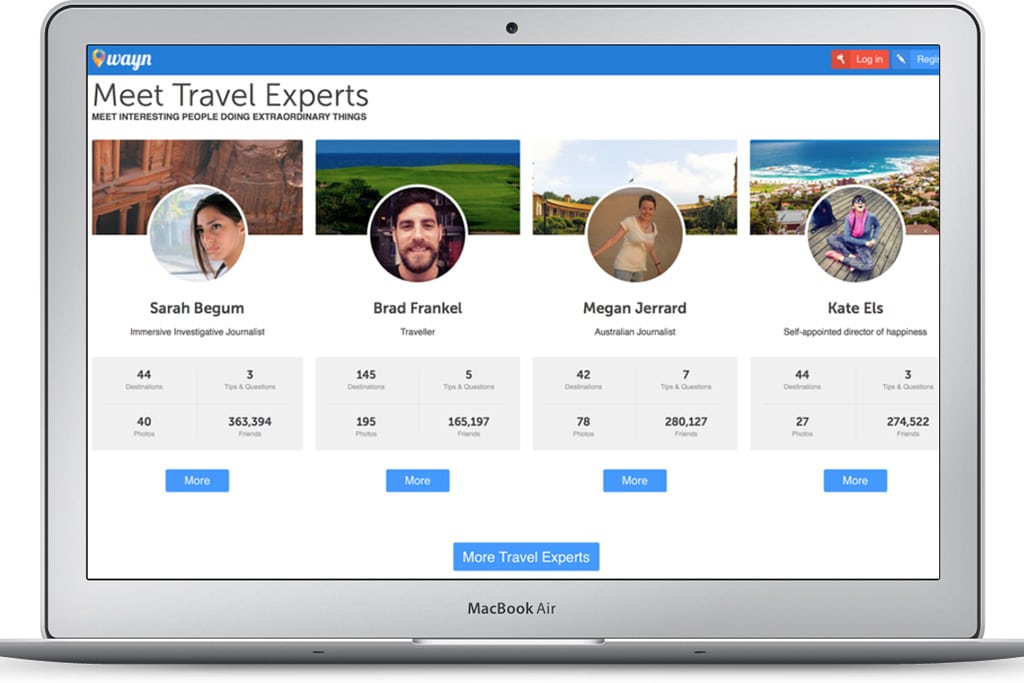

Social travel network WAYN was rescued from insolvency by lastminute.com group after the Swiss-based company agreed to acquire its assets for a mere $1.2 million (£1 million) in a controversial "pre-pack" deal.

Over the course of its 14-year history, WAYN had raised $11 million from investors so the $1.2 million payday did not please many investors. A pre-pack purchase is common in the UK and is controversial because the buyer doesn't have to take on the company's debts or onerous contracts.

WAYN and lastminute.com group didn't provide any of these deal terms when they confirmed the acquisition last month but subsequently Skift found some of the fine print in the administrators' report.

According to the report, Lastminute.com group submitted its initial offer to acquire WAYN on June 2 and it totalled $2.8 million (£2.3 million) but the company eventually reduced its bid to $1.2 million (£1 million) after it carried out due diligence. Match.com, owned by Barry Diller's IAC, s