Skift Take

Expedia's expansion outside the OTA world is afoot. With their aquisition of Homeaway and the expansion of Egencia, Expedia keeps a steady foot in online travel.

Last week we launched the latest report in our Skift Trends Reports service, A Strategic Deep Dive Into Latin America’s 20 Largest Hotel Chains.

Below is an excerpt from our Skift Trends Report. Get the full report here to stay ahead of this trend.

In this report we take comprehensive look at Expedia’s positioning in travel. We particularly take a look at the Expedia’s acquisitions and expansion over the past year. From meta-search and car rentals to alternative accommodation, Expedia is expanding its presence beyond the OTA world.

Preview and Buy the Full Report

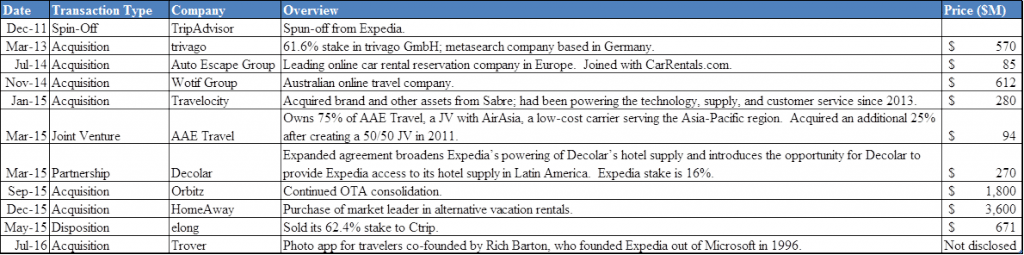

Since the 2013 stake taken in German metasearch company Trivago, Expedia has been very active acquiring companies, spending ~$7.3B on full purchases and joint ventures. It further consolidated the OTA industry in the U.S. by acquiring Travelocity and Orbitz and made a push into alternative lodging with HomeAway. The three most important acquisitions (for very different reasons) are likely to be Trivago, Orbitz, and HomeAway. Trivago is aggressively marketing as revenue continues to accelerate. The company recently announced it intends to explore an IPO. Orbitz adds to Expedia’s core OTA platform and synergies could help propel earnings growth in the coming years. With its business model change, HomeAway could very well be the most transformational acquisition of the three. We will discuss all three platforms below.

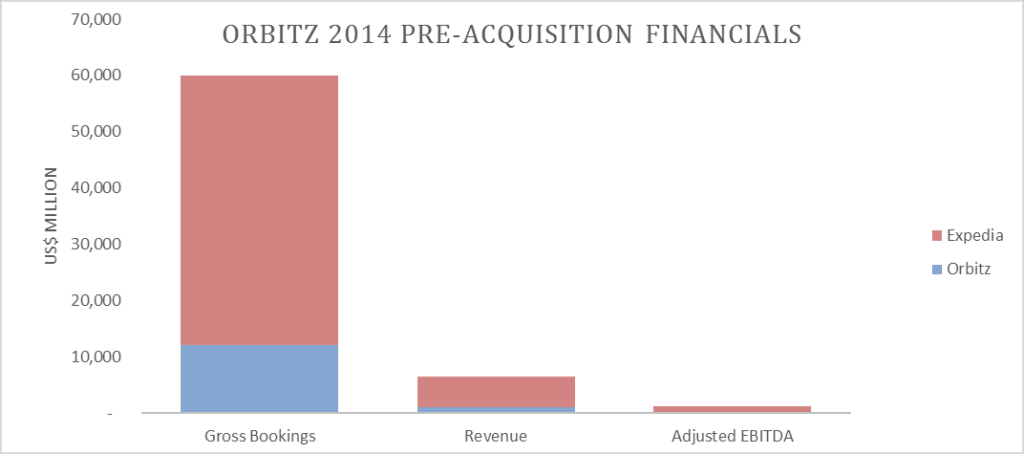

Expedia acquired Orbitz for a ~$1.8B enterprise value on September 17, 2015 after announcing the transaction in February. The purchase included $1.4B in cash and $432M of pre-existing Orbitz debt.

Orbitz increases scale for Expedia’s OTA business.

Orbitz generated $12B in gross bookings, $930M in revenue, and $155M in EBITDA in 2014. For context, Expedia had $48B, $5.6B, and $1.1B respectively amounting to Orbitz being 25% of bookings, 17% of revenue, and 15% of EBITDA for Expedia. Revenue and bookings for Orbitz skewed more towards lower margin air travel (62% of bookings and 25% of revenue in the last quarter as an independent company) and domestically (85% of bookings). This differs from Expedia’s hotel driven business where airlines are more additive and help with cross-selling hotels. Despite that, industry consolidation makes sense and the scale creates profitable synergies.

Preview and Buy the Full Report

Subscribe now to Skift Trends Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: expedia, online travel, ota