Skift Take

While regulation is catching up with the alternative accommodations scene, the sector itself is still booming thanks to its social and tech-savvy consumers.

Earlier this month we launched the latest report in our Skift Trends Reports service, The State of Alternative Accommodations 2016.

Below is an excerpt from our Skift Trends Report. Get the full report here to stay ahead of this trend.

The report provides a thorough analysis of the alternative accommodations landscape in the U.S. — who are the big players and what is their presence in the top five markets? Throughout the report we draw a picture of the legal frameworks aimed to regulate the industry, and the supporters behind the regulation – from hotels to affordable housing advocates. Our report is accompanied by a deep data dive on the top 5 U.S. markets, looking at inventory and composition thereof alongside an insightful profiling of the Alternative Accommodations user.

Preview and Buy the Full Report

The broader alternative accommodations ecosystem extends far beyond the mainstream consumer facing platforms. Just like for traditional hotel establishments there are a multitude of support services and apps now available for the alternative accommodation sector.

The business facing platforms for the alternative accommodation sector have also extended into new directions. Services such as concierges, also known as rental managers, take care of all the steps involved in the process of renting: listing, pricing, cleaning and laundry, key delivery, and the whole booking and scheduling process.

Chart courtesy Jason Shuman.

In a recent Skift survey targeting U.S. adults who were traveling at the time of the survey, we queried respondents about their attitudes toward alternative accommodations as well as loyalties towards alternative accommodations brands such as Airbnb and HomeAway.

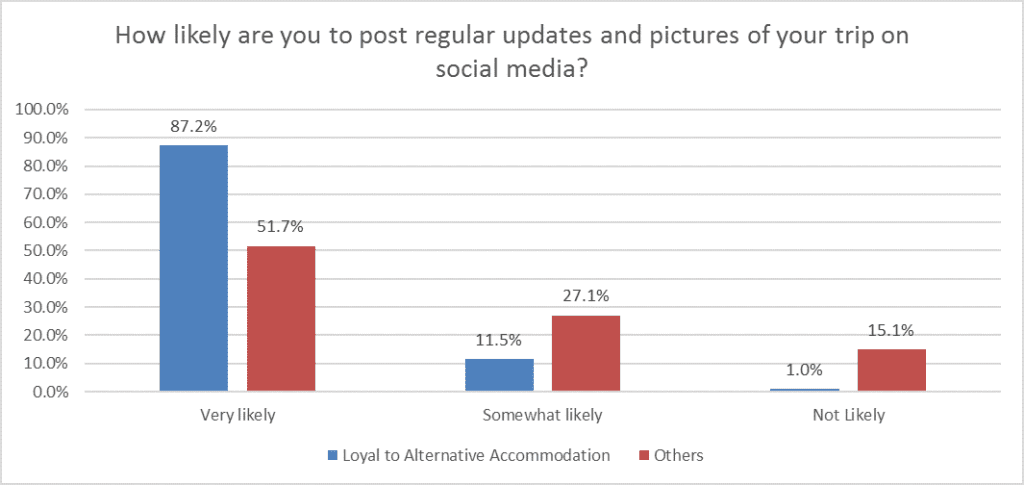

When looking at mobile and social behavior of our alternative accommodation loyal respondents, we found that they were regular users of both. Every respondent stated that they use social media regularly, and 70% engaged with social media at least three times per day.

Of users loyal to at least one alternative accommodation platform, 87% had a dating app installed on their smartphone, compared to just 25% of those who weren’t. And they were far more likely to use such an app, to connect with locals whilst on their trip.

Preview and Buy the Full Report

Subscribe now to Skift Trends Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, alternative accommodations, research reports, sharing economy