Skift Take

Small business owners are eager to take a vacation, but seldom get the chance to do so. Resourceful ones are mixing business with leisure and making smart use of business rewards credit cards to make their “me time” special.

This sponsored content was created in collaboration with a Skift partner.

Sponsored by:

Marriott Rewards Premier Business Credit Card

Sponsored Advertising Content from Marriott Rewards Premier Business Credit Card.

As one of the hardest working cohorts in today’s labor market, it is no surprise small business owners (SBOs) are often anxious about taking extended breaks from their jobs. However, a majority of SBOs are mixing pleasure with business in order to get some much-needed “me time” when traveling.

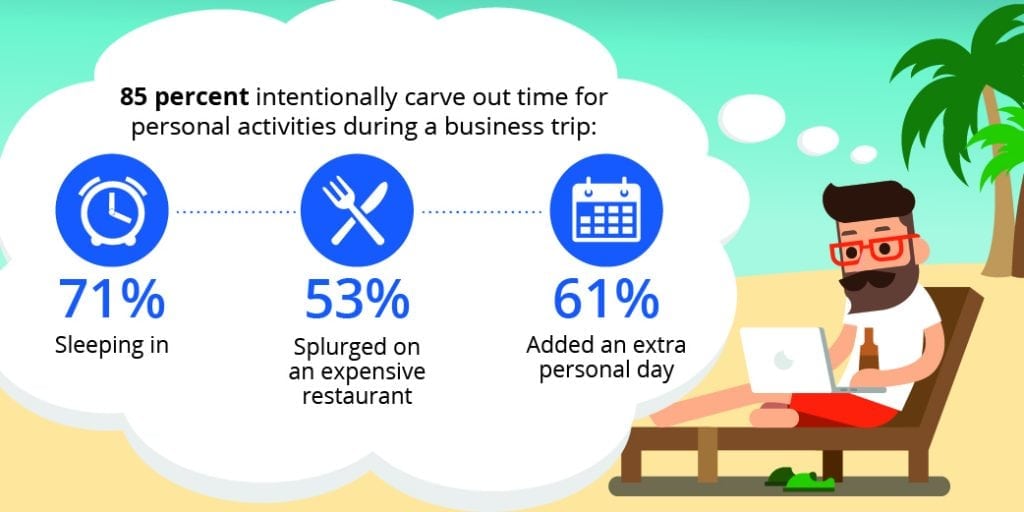

A new survey¹ released by Marriott Rewards Premier Business Credit Card from Chase found that 85 percent of SBOs intentionally carve out time for personal activities during business travel. With only 25 percent reporting they completely unplug from work when on vacation, building a mini-vacation into a trip for work helps SBOs briefly decompress – something more than two-thirds believe is a necessity that ultimately benefits their business.

Just how do they manage this “earned time off”? By adapting. For instance, 61 percent of SBOs reported they often add an extra personal/leisure day to trips, while nearly half purposefully group meetings together to allow for an afternoon or morning to unwind. And, nearly half of SBOs staying at a hotel with enjoyable amenities – like a pool or beach – take advantage of them.

Most are finding this type of break during business travel to be well worth the effort.

The Benefits of Being Resourceful

More than three-quarters of survey respondents who see the benefits of vacations find that even brief time off provides them with a mental break, with 72 percent noting it refreshes their creativity and 67 percent finding their focus is enhanced once they do return to the job.

However, many face a common dilemma, how to afford the time or cost needed to truly get away? That’s where being resourceful can save the day. “Many are realizing the benefits of using rewards points earned or other card features to augment a business/leisure journey,” said Vibhat Nair, general manager, Chase Card Services.

Choosing the right card for the job can make a significant impact. One way small business owners can make the most of their business and personal travel is by using the Marriott Rewards® Premier Business Credit Card from Chase for all purchases. Thanks to a few new benefits, cardholders will now have an enhanced path to Gold Elite Status when they spend $50,000 a year, which helps them enjoy free breakfast and upgraded Wi-Fi at many locations, as well as room upgrades (subject to availability), priority late checkout and even Hertz Gold membership.

“Whether it’s during business trips or actual vacations, SBOs deserve to completely unplug from their everyday responsibilities,” added Nair. “If they are able to unplug, they – and their business – will likely reap real rewards.”

1 Online survey conducted April 19, 2016 through April 29, 2016 among a nationally representative sample of 1,001 small business owners with 99 employees or less, ages 25 and older, who travel at least three times per year for work. The survey margin of error is +/-3 percent at the national level and +/-10 percent at the local market level with a 95 percent confidence level.

Have a confidential tip for Skift? Get in touch

Tags: business travel, leisure travel, marriott, travel habits