Skift Take

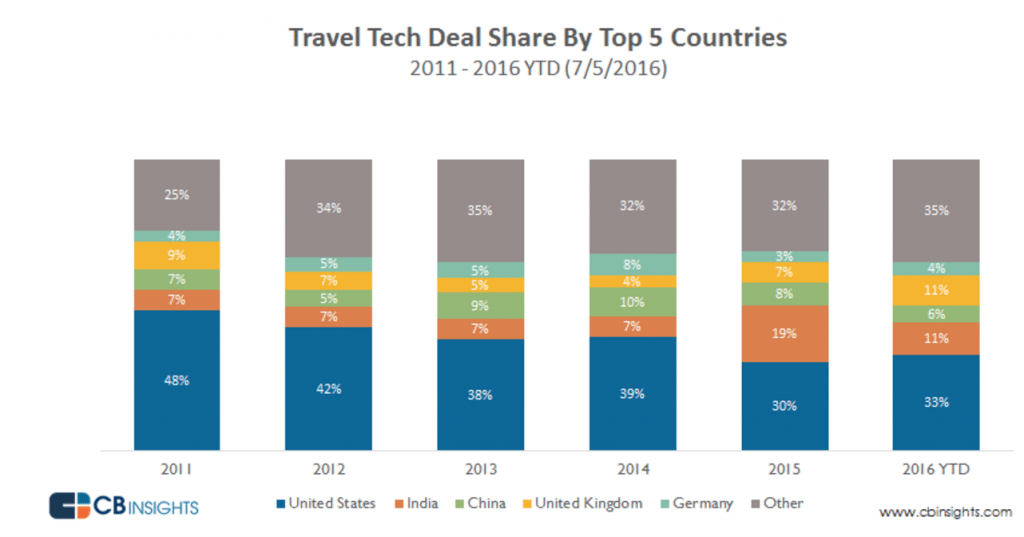

The funding balance of power is changing as 67 percent of venture capital deals for travel tech startups took place outside the U.S. in the first half of 2016, although that was 3 percentage points lower than the year-earlier period. Funding for mobile-travel startups jumped 500 percent.

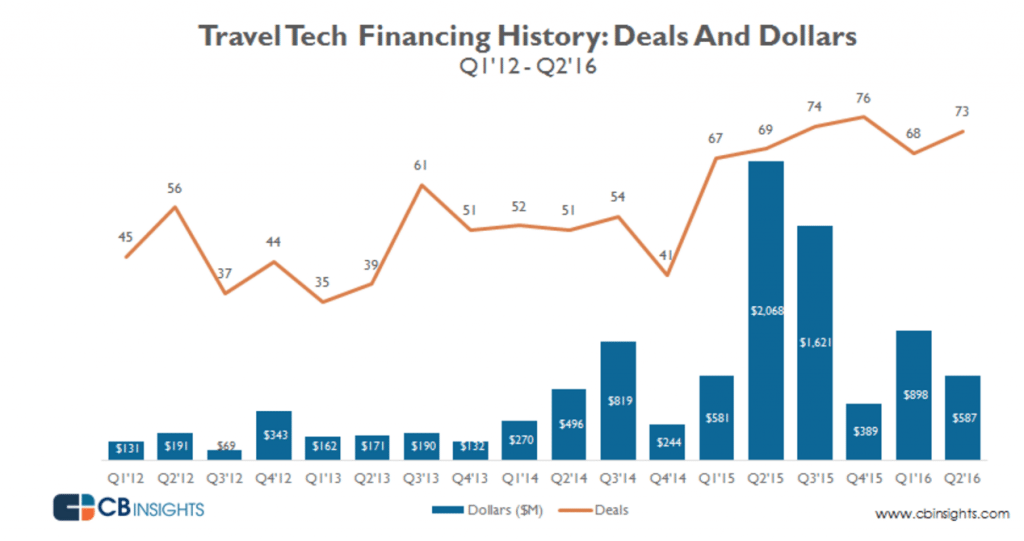

Travel-tech startup funding sank nearly 44 percent to nearly $1.5 billion during the first half of 2016 and startups seeking the bonanza-like funding rounds in 2016 that Airbnb and Uber have enjoyed in the past may want to consider readjusting their expectations.

The $1.5 billion in total funding for travel startups during the first and second quarters was spread across 141 deals, nearly all of them below $40 million, according to CB Insights, a New York City-based venture capital and investment data firm.

The number of deals for the first half of the year remained stable compared to the first half of 2015, when there were 136 deals.

For its funding analysis, CB Insights defined travel tech as tech-enabled companies offering services and products focused on tourism, including booking services, search and planning platforms, on-demand travel and recommendation sites. Car-hailing services were excluded from all funding totals.

The chart below shows the history of travel startup funding since the beginning of 2012, although it requires some explanation. Airbnb raised about $1.6 billion in equity during the first half of 2015 which is included in the chart, but it raised a $1 billion line of credit this year that CB Insights didn’t count as part of the total funding as it only considers equity investments. So while the chart shows a sharp drop-off in overall funding year-over-year, if Airbnb’s credit line were included during the first half of 2016 then the latter total would have been just $164 million lower than the first half of 2015. On the other hand, some of the other funded companies might have likewise taken lines of credit that were likewise excluded from consideration.

*Note: Airbnb funding is including in Q1 and Q2 2015 funding totals, but a $1 billion credit line is excluded from the Q1 and Q2 2016 totals.

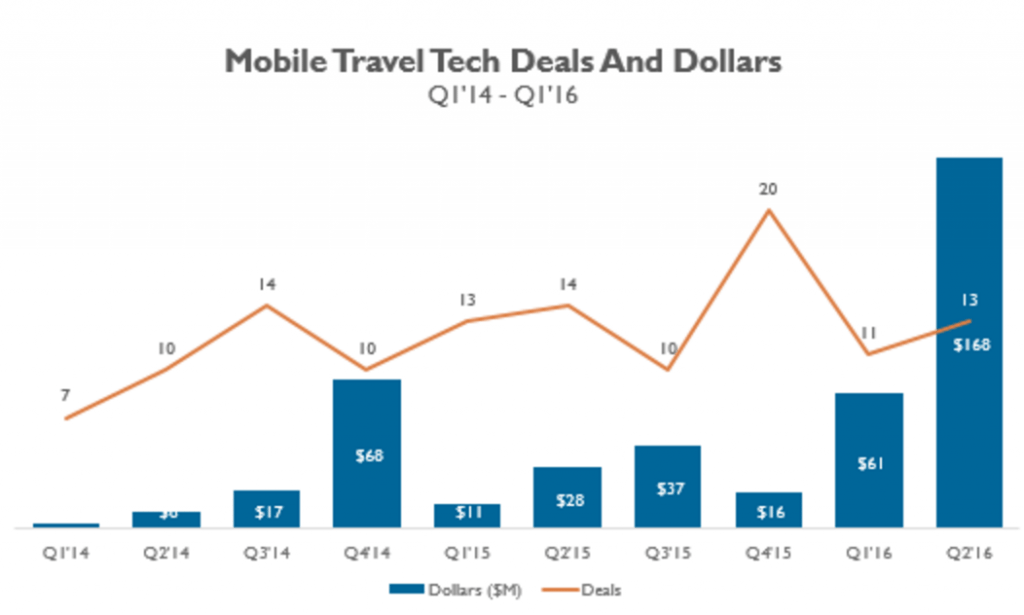

Mobile travel startup funding, which is part of the overall $1.5 billion total and includes companies building their businesses specifically on mobile apps and devices, is up nearly 500 percent, or $190 million so far this year. CB Insights said this is due in part to a mega $144 million Series C round for Chinese flight and hotel booking app Huoil that closed in the second quarter.

Some 67 percent of deals happened outside the U.S. so far this year. U.S.-based travel startups made up one-third of all funding rounds during the first two quarters but that’s down from 2011 when nearly half of all deals were for U.S. companies. As this chart highlights, the gradual growth of funding for Indian startups has taken share from the U.S. The U.K.’s share of deals has also waxed and waned during the past five years but accounts for 11 percent of deals so far in 2016.

It will be interesting to see what impact the recent Brexit vote, in which the UK voted to leave the European Union, might have on UK travel startups and their ability to raise funding.

Source: CB Insights

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: funding, venture capital

Photo credit: Pictured are AllTheRooms.com employees working at an office in Latin America. AllTheRooms