What Americans Really Think About Airbnb and Home-Sharing

Skift Take

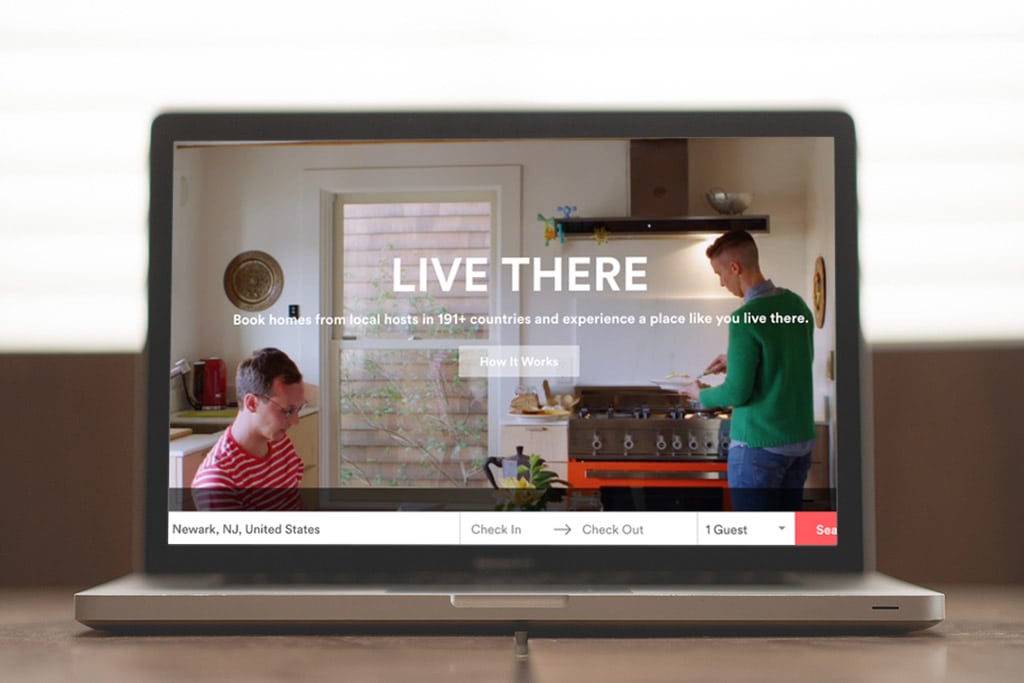

In less than a decade Airbnb, the San Francisco-based home-sharing platform worth an estimated $25.5 billion, has become one of the biggest disruptors in the travel space.

And the industry for whom Airbnb has been the most disruptive — hospitality — is keeping a very close watch on the company's every move.

Every day, there seems to be a new headline suggesting the hospitality industry's demise at the hands of short-term rental sites like Airbnb.

On May 16, a New York City budget analysis highlighting a 4% drop in hotel occupancy taxes from October to March delivered the following headline: "Websites like Airbnb blamed for drop in revenue from NYC hotel tax." It's not the only factor: the city of New York is in the midst of a glut of new hotels both in development and under construction; 126 new hotels are slated to open in the city in 2016 and beyond.

On May 19, Bank of America hospitality analysts announced they were downgrading their suggestions from "buy" to "neutral" for hospitality stocks like Hilton and Hyatt, primarily because of threats like Airbnb.

In February, media outlets reported the findings of a survey conducted by Goldman Sachs that seemed to suggest once someone stays in an Airbnb, they don't want to go back to staying in a hotel. But if you look closely at the survey results, you see more consumers prefer hotels to peer-to-peer accommodations or have no preference. Of those who've stayed in an Airbnb or similar accommodation before, a majority (40%) still prefer hotels, while 36% prefer peer-to-peer accommodations, and 24% have no preference.

But is Airbnb really taking away market share from hotels? That's a question looming on every hospitality executive's minds these days and, judging by the latest survey from the Pew Research Center.

New Report

Released on May 19, "Shared, Collaborative, and On Demand: The New Digital Economy," takes a comprehensive look at how sharing economy companies like Airbnb are impacting Americans, as well as what Americans' views and perceptions are regarding these disruptors.

The Pew Research Center surveyed 4,787 American adults from Nov. 24 to Dec. 21, 2015, to compile its research. It found 72% of American adults have used at least one of 11 different shared and/or on-demand services; one in five have used four or more of these services and 7% have used six or more.

When looking specifically at usage of home-sharing platforms like Airbnb, HomeAway, or VRBO, however, the study found that only 11% of American adults have used them to stay overnight in a private residence, meaning 89% of Americans have yet to stay in an Airbnb or similar peer-to-peer accommodation. Thirty-four percent are familiar with these services, but more than half (53%) haven't even heard of them before.

This is a great growth opportunity for the companies, but it also suggests home-sharing isn't necessarily as pervasive as some have assumed it to be, although it continues to grow worldwide. Last month, analysts from Cowen Group, Inc. predicted a billion room nights per year in Airbnb's future by 2025.

The Pew Research Center study also delivered insights into who is using these platforms, how they are using them, and how they feel about them.

Who Uses Home-Sharing Services?

According to the Pew survey, the median-age of home-sharing users in the U.S. is 42 but usage and awareness of these services is higher among people with college degrees and those who are relatively affluent (making $75,000 or more per year) — both of which are groups who are more likely to travel in the first place than those who are less wealthy.

Twenty-four percent of Americans who live in a household with an annual income of $75,000 or more have used a home-sharing service, compared to 9% of those who make $30,000 to $74,999, and 4% who make less than $30,000 a year.

This is interesting because some analysts have said that high-end, luxury hotels need not worry about the threat of Airbnb but that budget-oriented ones should. But this data seems to suggest that fairly affluent Americans are using Airbnb more than those who are not as affluent and would, presumably, be more value-driven

The survey also shows White Americans (13%) are more likely to use a home-sharing service than Blacks (5%) or Latinos (9%). The study doesn't suggest any correlations as to why Whites are more likely to use Airbnb than Blacks or Latinos, but this information is particularly timely, and speaks to another issue involving Airbnb: that of racial discrimination.

This week, Gregory Selden, a black man, filed a civil-rights, class-action lawsuit, accusing Airbnb of allowing its hosts to racially discriminate against guests, and for ignoring his complaints about that discrimination.

Airbnb wouldn't comment directly about the lawsuit, but a spokesperson issued the following statement: "We strongly believe that racial discrimination is unacceptable and it flies in the face of our mission to bring people together. We prohibit content that promotes discrimination, bigotry, racism, hatred, harassment or harm against any individual or group and we are taking aggressive action to fight discrimination and eliminate unconscious bias in our community. More details on our work to fight bias and discrimination are here."

Airbnb also recently appointed David King as its director of diversity.

In terms of gender, the Pew survey shows slightly more women (13%) are using home-sharing services compared to men (10%), however the types of accommodations they are booking on the platforms varies.

How Are People Using Home-Sharing Services?

Most people who use home-sharing services aren't staying in a shared space where the host is present. The Pew study found 37% of home-sharing users (or 4% of all American adults) are staying in a shared space (a single room or other type of shared space) in someone's home, meaning that 63% of people who've used home-sharing services are staying in homes where they don't have to share a space with a host.

Of those users who have shared a space with a host, 43% are men and 32% are women but both men and women share similar levels of concern about staying with a stranger (45% of men and 51% of women).

What Do People Think of Home-Sharing Services?

For one, most people don't realize that there's a fight between the hotel industry and sites like Airbnb. The Pew study found that not only have a majority of Americans not used home-sharing services, but a majority are also unaware of many of the regulatory debates surrounding short-term rentals in major cities.

Only about one in five Americans (22%) has heard of the debate over the legality of home-sharing services. Of those Americans who have used home-sharing services, 43% have heard "nothing at all" with regard to the debate.

When asked how they feel about where home-sharing should be legal and/or tax-free for hosts, 52% of Americans think home-sharing should be legal and hosts shouldn't have to pay taxes. Likewise, 56% of home-sharing users who know about the legal debate over these services think they should be both legal and that owners shouldn't have to pay any local hotel or lodging taxes; 31% think hosts should be able to legally rent their homes but should have to pay taxes.

Airbnb currently collects and remits taxes in more than 170 municipalities worldwide, and the company is using those tax agreements as a primary method for gaining legalization in those cities.

Regardless of their politics, both conservative (68%) and liberal (54%) Americans who use home-sharing services feel that owners should not have to pay taxes for using these services. Fifty-percent of Americans who don't use home-sharing services but are aware of the regulatory debate surrounding them also feel that owners should not have to pay taxes.

Most Americans who have used home-sharing services also believe: (1) that it's a good option for families or groups (87%); (2) it's a good way for homeowners to earn extra income (85%); and (3) that they are less expensive than a hotel (73%).

Interestingly, people who have used a service like Airbnb or HomeAway tend to think of those companies more as software platforms (58%) that simply connect people, than traditional hospitality companies (26%) that have more control over the customer experience and vouch for the quality of the properties they list.

Even if they think of Airbnb or HomeAway as more of a tech platform than a hospitality company, however, the majority of those who use those services (67%) feel it's the responsibility of both the hosts and the platforms to make sure properties are described accurately. Fifty-seven percent think both hosts and the platforms should be responsible for resolving payment issues between guests and hosts, and 53% think both hosts and platforms should be responsible for addressing any problems that may come up during a stay.

What This Means for Hotels

Looking at the Pew study's findings overall, it's clear there's still quite a lot of room left for platforms like Airbnb and HomeAway to grow in terms of awareness and usage. As it stands now, hotels probably shouldn't be too concerned with these services cutting directly into their businesses. They should, however, be more concerned with how people are perceiving these platforms.

The hotel industry has lobbied for a more level playing field in terms of regulating business like Airbnb and HomeAway, asking that city governments treat these companies and their hosts more like businesses, especially since many reports suggest a growing number of hosts on those sites are either hosting illegally and/or operating commercially. But if this report is any indication, it's clear that the majority of Americans not only feel that home-sharing and short-term rentals should be legal, but that those who participate in it shouldn't have to pay any taxes.

That, right there, is a much bigger messaging problem for the hotel industry to address if it wants to continue to lobby for more regulations and restrictions on short-term rental sites.