How Booking.com Profits Handsomely From Bidding on Hotel Names

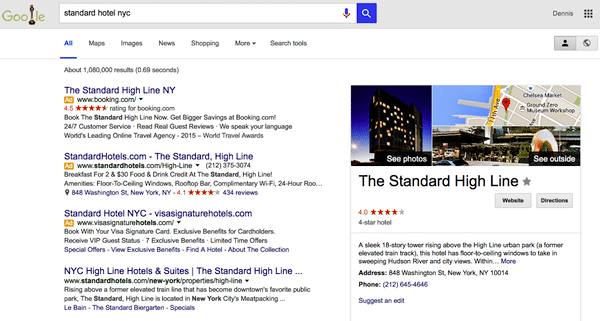

Photo Credit: Booking.com, in the example above, outbid the Standard High Line New York on its own name and appears higher in Google search results than the hotel itself. Google

Skift Take

Many cash-strapped independent hoteliers have been relatively laid back and allowed Booking.com to bid on their trademarked names and are even handing over their digital marketing and website creation to Booking.com's BookingSuite division. Given their resource constraints, that's not likely to change in any meaningful way anytime soon.

Few things can be more frustrating for a hotel brand, including independent properties, than when they see a major online travel agency such as Booking.com or Expedia outbid them in Google AdWords on the hotels' own trademarked brand names.

But it is a huge business for the online travel agencies -- and could entail a substantial hit for the hotel brands in lost business or higher distribution costs, according to a blog post by Spain-based Mirai, which focuses on enabling hotels to boost their direct bookings.

In fact, Mirai estimates that 15 percent of Booking.com's sales come from bookings gained by using hotel brands' trademarked names in Google AdWords.

Some 15 percent of Booking.com parent the Priceline Group's 2015 total revenue would amount to around $1.3 billion. Lodging-only Booking.com generates the vast majority of the Group's revenue so it would be safe to say that bidding on brands' keywords in Google generates hundreds of millions of dollars in annual revenue for Booking.com and is a key component in its marketing and revenue strategies as it bids annually on trillions of keywords.

Expedia and other online travel companies likewise bid on hotels' trademarked names but weren't the focus of this particular study.

As you can see in the following screenshot, a Booking.com sponsored result in Google for The Standard High Line NY appears in the top position -- above the hotel's own ad.

"If that approximate 15% of sales (or your hotel’s estimated %) that come via your hotel’s adverts did not come through Booking.com but rather from your own website, how much would you save on intermediation costs?," Mirai asks. "That amount would directly go to the GOP (Gross Operating Profit) on your results account."

Mirai concedes that the revenue that Booking.com derives by bidding on hotel names varies widely by property and might actually range from 5 percent to 35 percent.

Mirai came up with its estimate by analyzing bookings of 22 of its hotel customers from January to March 2016. It calculated the number of bookings processed by each hotel's website, how many were generated by Google AdWords, and the number of bookings that Booking.com did for that property.

Crunching information from Google AdWords, Mirai estimated that for these 22 hotels, the Booking.com's AdWords sponsored results using the hotel brands' names showed up 80 percent of the time at an average position of 1.4 while the hotels' own brand advertisements appeared only 52.5 percent of the time at an average position of 2.4.

What To Do?

Mira isn't dead-set against hotels getting sales through intermediaries such as Booking.com as long as these sales are beyond the capabilities of properties getting them directly or the distribution costs are lower than other channels.

But if these factors aren't in play, Mirai suggests that the hotel "remove your name's AdWords by OTAs."

But how?

Mira spokesperson Isabel Rey says it is preferable if hotels negotiate directly with the online travel agency "in a friendly way" its prohibition of bidding on the hotel's brand names. Lots of chains do this, she adds.

"The other alternative is to ask Google to stop posting ads with the hotel's name," Rey says. "It is possible in continental Europe for hotels with registered trademarks."

The Google AdWords trademark policy makes such a prohibition more difficult for hotels in the U.S., Canada, the UK, Ireland, and Australia.

Mirai says hotels generally shouldn't fear that Booking.com would retaliate by diminishing the placement of the property on the Booking.com site, which would lead to declining bookings there.

Booking.com's algorithm, the Mirai blog post states, is based on content, conversion, constant availability, competitive rate, correct payment, cancellation and commission -- and doesn't supposedly penalize for a hotel that opts to attract more direct bookings.

In fact, when some Mirai's clients saw Booking.com cease to run AdWords with the hotels' names, no Booking.com penalty took place.

"If your hotel is still working well in searches within Booking.com (by conversion, cancellation, price and the remaining Cs), why would Booking.com penalise it in results? It would be penalising itself since it would put a hotel (or many others) above yours that generate much less income per click, something they don’t want or are interested in."

Leslie Cafferty, a spokesperson for the Priceline Group, points to the positive impact of Booking.com's marketing for hotels.

"Booking.com is actually creating the initial interest for many of these hotels in the first place," Cafferty says. "We do that globally and in 40+ languages -- not something many of our partners can do alone -- across all devices and all search engines; maximizing all search interactions through the customer's decision journey. We think this is a huge value add and opportunity for hotels to gain visitors and maximise business from a global audience. "