Skift Take

Asian business travelers are willing to use untraditional means of travel that business travelers generally aren't lumped in with, such as flying low-cost carriers or staying in an Airbnb. With these statistics in mind, it's no wonder places like China and Japan are Airbnb's fastest-growing markets and low-cost carriers are dominating that region.

As the world’s fastest-growing business travel market, Asian business travelers are probably bolder and more open-minded than the U.S. and European business travelers who dominated this stage for decades.

Some 69% of business travelers in Asia have the freedom to choose which airline they fly and which hotel they stay in with no restrictions from their travel policies. About 41% are willing to fly low-cost carriers and about the same percentage would consider staying in a home or apartment rental during business trips. That’s according to a survey of 2,500 business travelers from China, India, Japan, Indonesia and Singapore conducted by the Singapore Tourism Board this year. The survey sample included an even spread of all generations, seniority rankings from junior management to executives and business sizes from small enterprises to multinational corporations.

Business travel spending in Asia-Pacific makes up 38% of the global business travel market, and between this year and 2018 business travel in this region will grow four times faster than the U.S. and more than twice as fast as Europe.

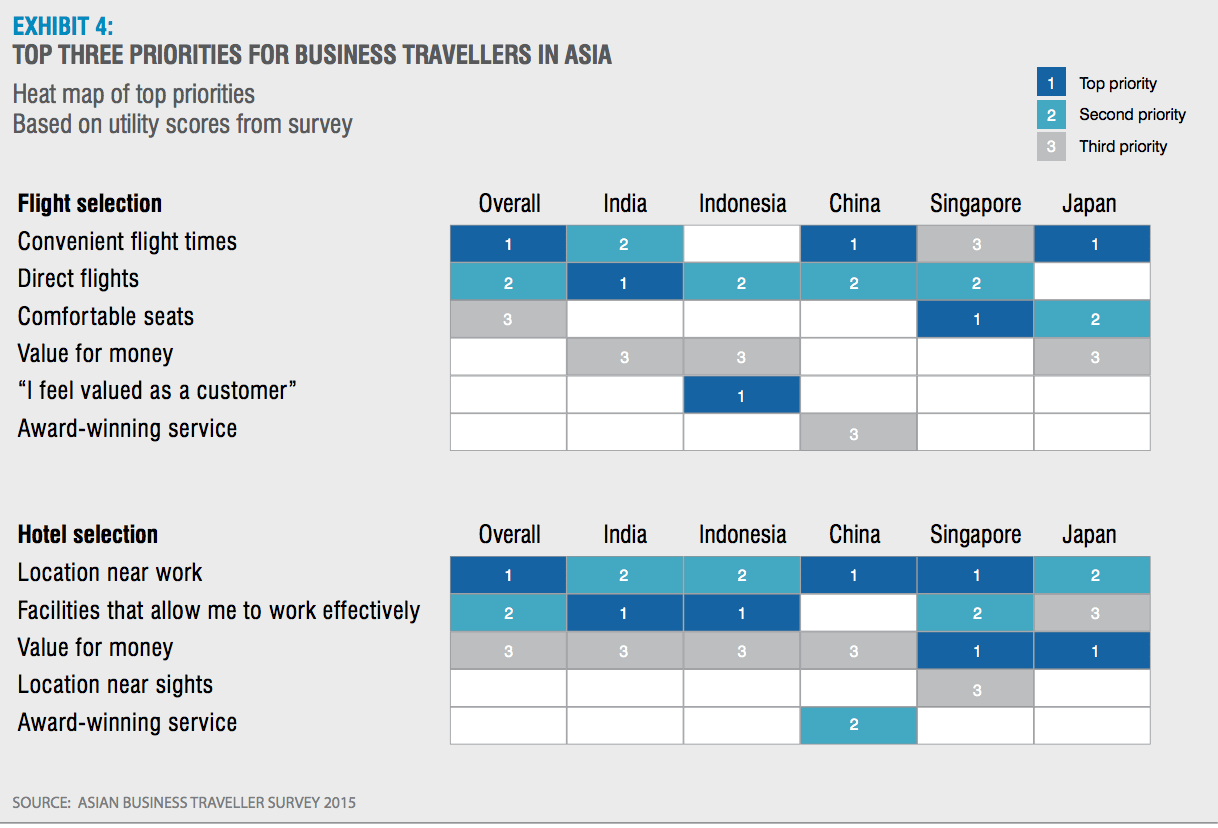

Though like many of their business travel counterparts in other regions, Asia-Pacific business travelers value convenience above all else, evidenced in the charts below. Convenient flight times, accommodations close to their meetings and easily turning a business trip into a mini-vacation with a long weekend are parameters they seek when booking travel.

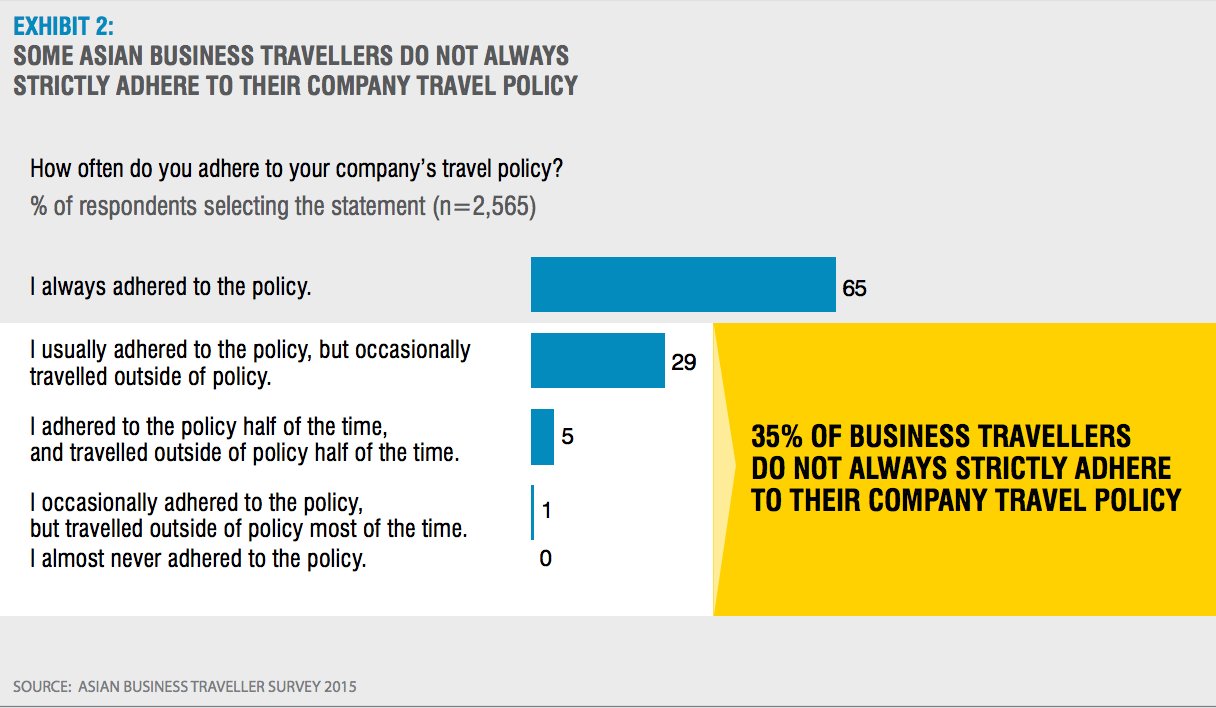

Chart 1: Asia is a lot like the U.S. when it comes to corporate travel policies–many business travelers don’t abide by their travel policies or pick and choose when to book within policy. In the case of Asian business travelers, more than a third don’t always follow their companies’ travel policies.

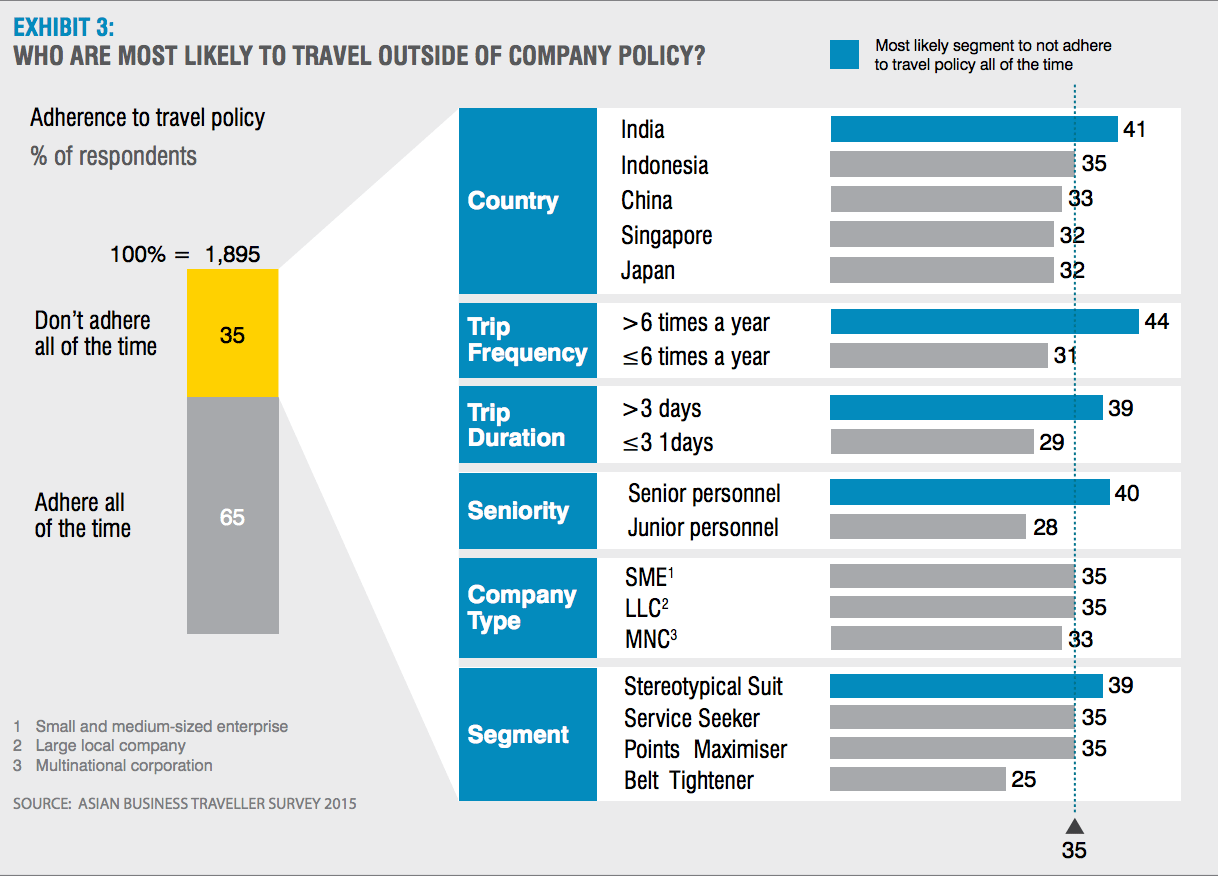

Chart 2: The survey found that Asian companies can’t rely on their senior personnel to lead by example when booking travel. Some 40% of senior personnel booked outside travel policies compared to 28% of junior personnel.

Chart 3: Concerning flight selection, the top priority for Asian business travelers overall and in China and Japan are convenient flight times. For hotel selection, the overall top priority is location near work as it is for respondents from China and Singapore, however Indian, Indonesian and Japanese respondents listed location near work as their second priorities.

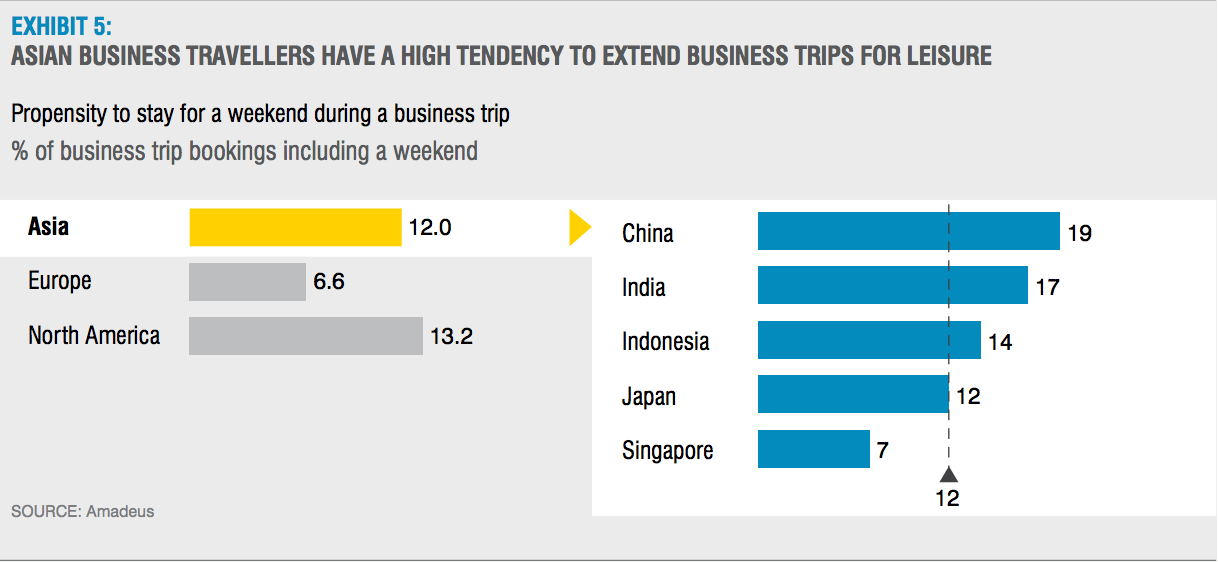

Chart 4: Some 12% of Asian business travelers will extend business trips to the weekend for leisure travel, with the highest percentage of Chinese respondents indicating they do this (19%).

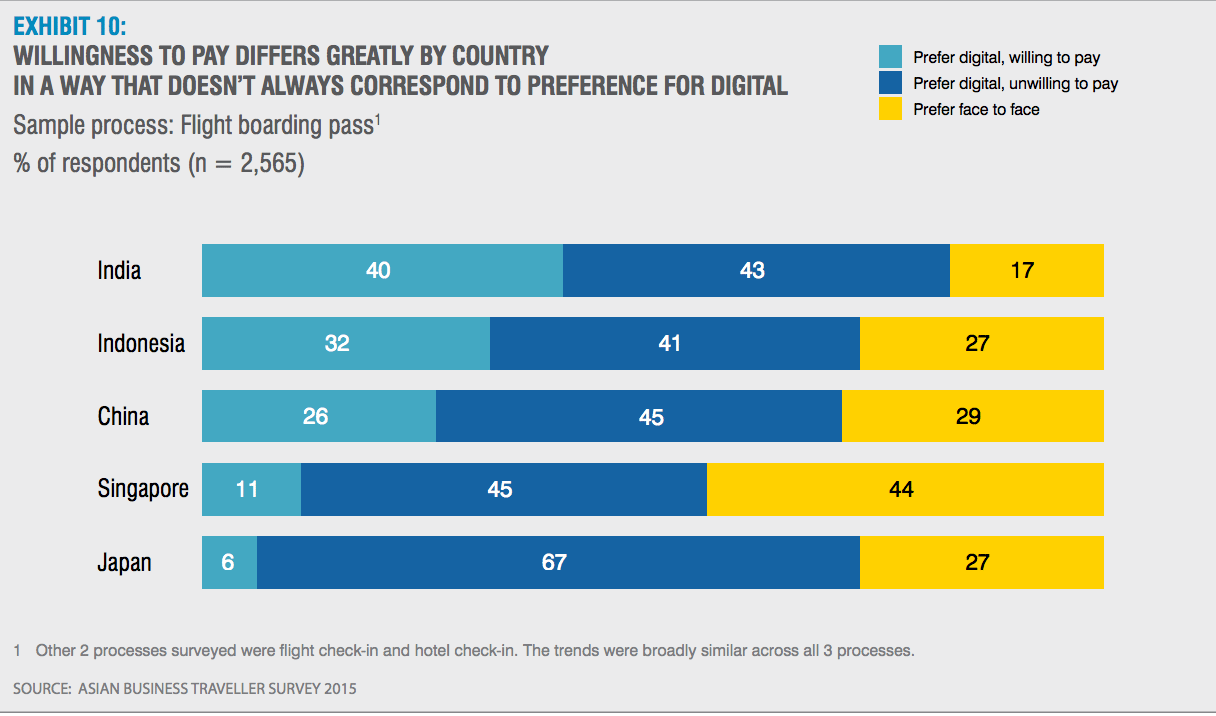

Chart 5: More Asian business travelers aren’t willing to pay for digital boarding passes than those who are. Overall, digital is more important than face-to-face with this group except in Singapore where nearly as many respondents prefer obtaining boarding passes face-to-face as those who prefer digital boarding passes but don’t want to pay for them.

Source: Singapore Tourism Board

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: asian travelers, business travel

Photo credit: Business travelers on board an Asiana Airlines flight. Asiana Airlines