Skift Take

The global tourism map has been redrawn and we're already seeing travel brands feverishly try to break into developing markets at a heightened pace. The question is whether those markets' own hotel and airline competitors will have the gumption to take on that foreign entrenchment.

Gone are the days when advanced European economies dominated the international tourist arrivals landscape and enter an era of emerging economies getting much larger chips in the game of global tourism.

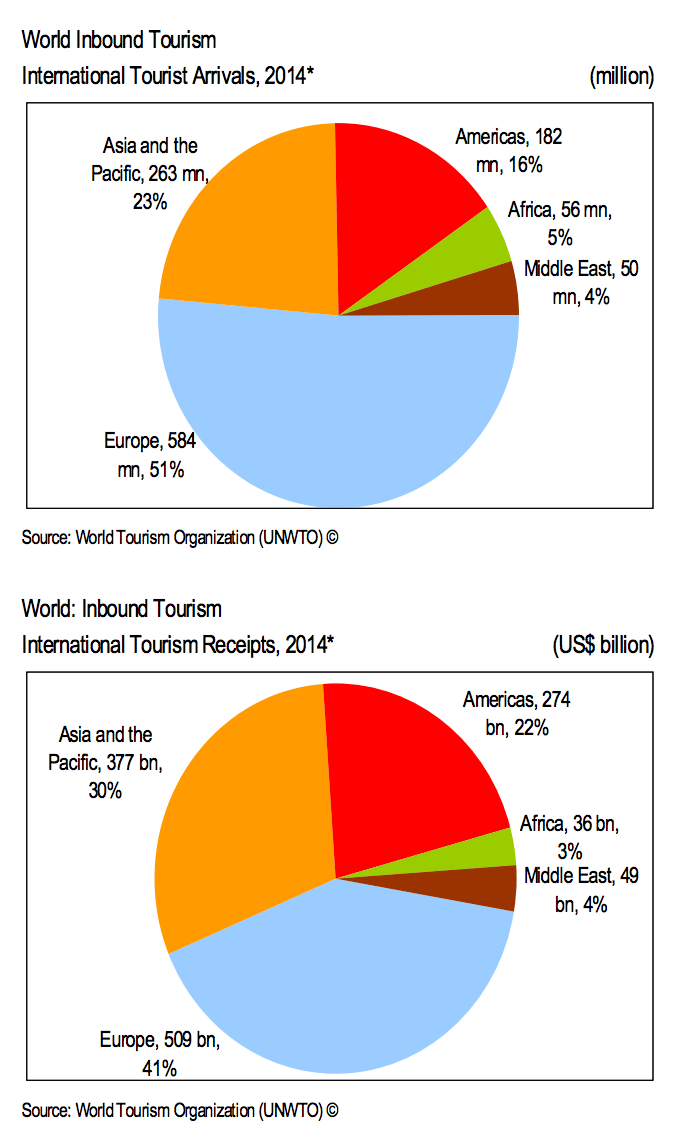

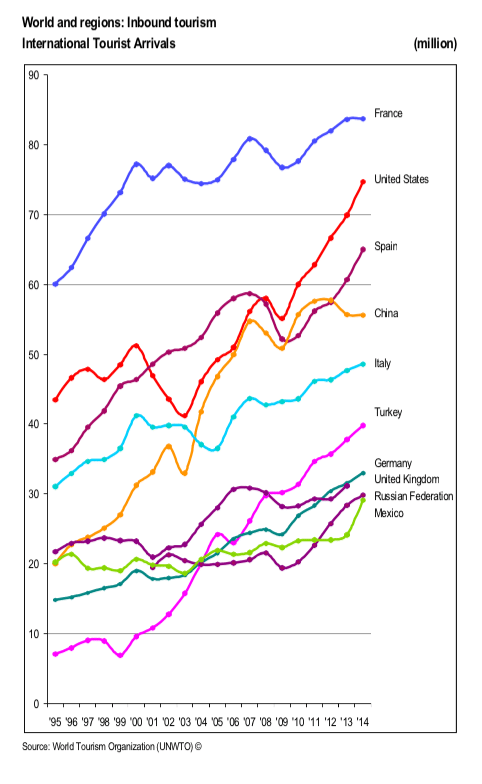

The United Nations World Tourism Organization’s (UNWTO) projection that emerging economies will welcome more international tourists than advanced economies by 2020 is clearly on track to fruition. Already, developing countries account for more than 40% of all international tourist arrivals and spending in these countries claims about half of all international tourist spending. International tourism growth was relatively stagnate year-over-year in places like France while Mexico’s growth experienced acceleration.

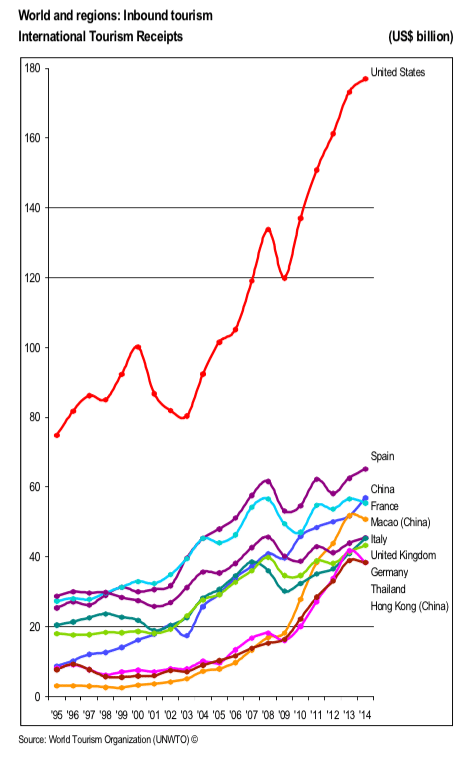

The U.S. is still a hotbed for both outbound and inbound tourism spending, having the world’s second highest amount for the former and highest for the latter. China’s situation is also notable–with more outbound Chinese tourists traveling abroad and spending large sums outside the Chinese economy while inbound tourists still spend far less there than their U.S. counterparts.

Below are four charts laying out the state of global tourism spending and arrivals:

Chart 1: Europe accounted for half of all international tourist arrivals in 2014, but the gap is smaller between Asia-Pacific (the region with the second highest number of arrivals) and Europe when it comes to tourist spending. About 30% of international tourist spending was in Asia-Pacific last year compared to 41% coming from Europe.

Source: UNWTO

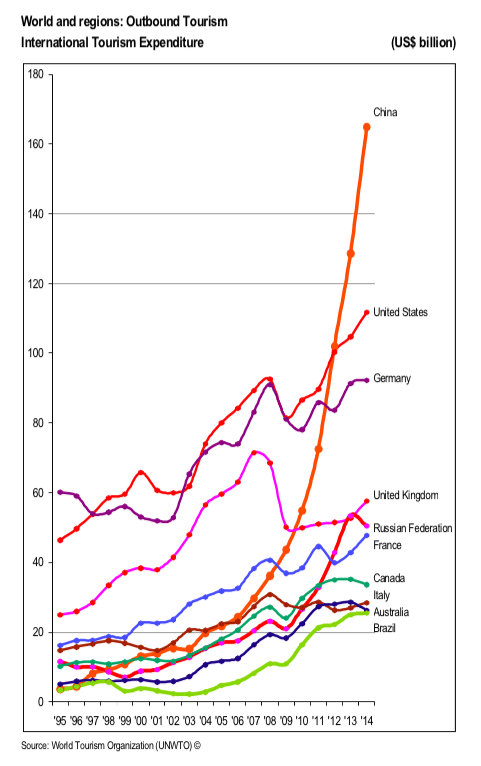

Chart 2: Chinese outbound tourists spent about $60 billion more last year than U.S. outbound tourists did and China’s outbound spending has made a steeper ascent during the past five years than the U.S. or any other country.

Source: UNWTO

Chart 3: But when it comes to inbound tourist spending, the U.S. flattens the competition. Inbound U.S. arrivals spent $180 billion in the country last year, far above Spain, the country with the second highest inbound spending, at about $70 billion.

Source: UNWTO

Chart 4: France has always claimed the most international arrivals but it didn’t see much growth year-over-year for 2014 in the number of arrivals and neither did China. Countries like the U.S., Spain, Turkey and Mexico saw larger increases in the total number of international visitors.

Source: UNWTO

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: A tourist buying souvenirs in the city center of Medellin, Colombia. Dan Peltier / Skift