8 Charts That Show the Outlook for Global Airfares and Hotel Rates in 2016

Skift Take

The increased worth of the U.S. dollar during the past year has already shown clear signs that it will impact travel and will continue to help raise travel costs in many parts of the world through 2016.

With room demand rising in places like the U.S. and Latin America and ancillary fees becoming more difficult to avoid on many airlines, global travelers can expect travel costs to grow steadily as they plan their trips for next year.

According to a survey report done by the Global Business Travel Association and corporate travel giant Carlson Wagonlit Travel airfares and average daily rates will see larger growth in Latin American, North America, and Asia-Pacific than in Europe due to the latter's currency deflation and several countries in the other three regions seeing economic gains.

Below are eight charts from the report outlining projections travelers can expect to see play out as they search for both business and leisure travel for next year.

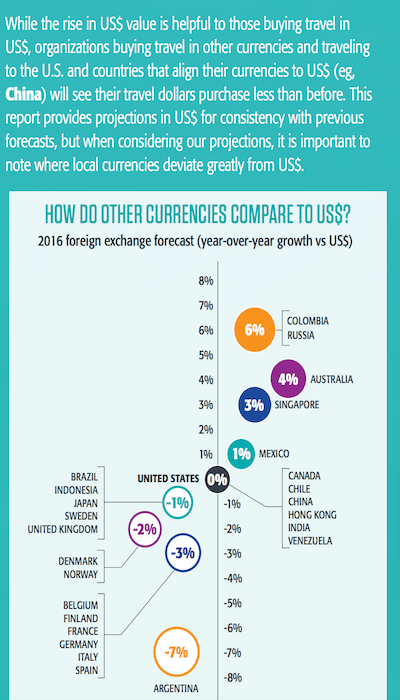

Chart 1: Travel to the U.S. will be more expensive for Western Europeans as the euro continues to deflate against the U.S. dollar while China's yuan won't show any growth next to the dollar due to that country's economic slow-down. Other countries with increasingly large populations of people traveling, like Brazil and Japan, will see their currencies lose value against the dollar as well.

Source: GBTA and CWT

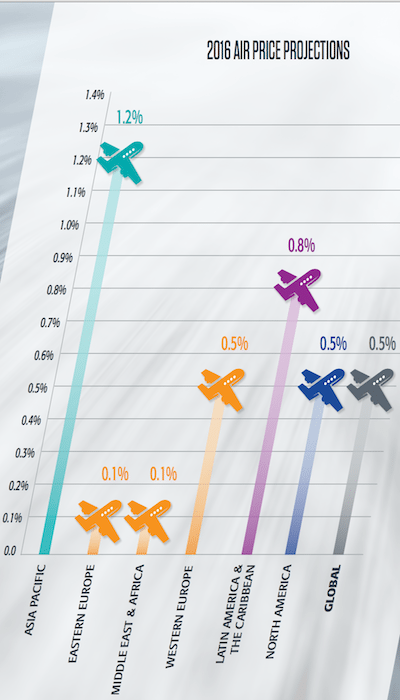

Chart 2: Airlines' profitability continues to rise as global oil prices and jet fuel fall 50 and 60%, respectively, and carriers' haven't indicated they'll pass up the chance for higher profits to give travelers' a price break. But there could be some pressure to lower prices to remain competitive, though not very likely, as load factors make a small dip from record highs and overall ticket prices won't see astronomical increases.

Source: GBTA and CWT

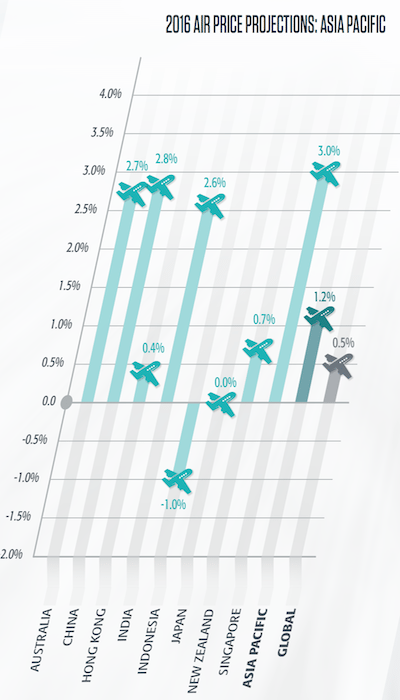

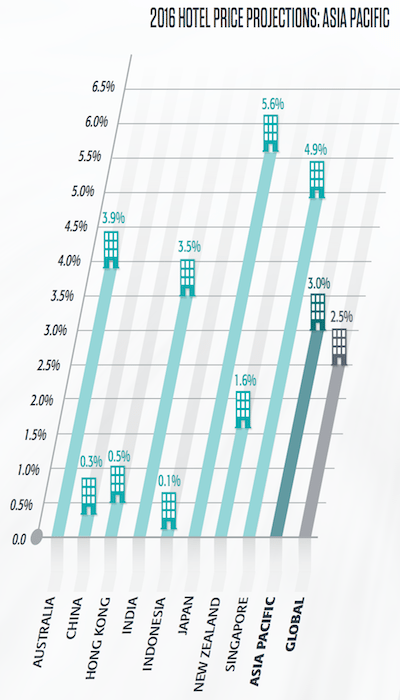

Chart 3: Airfares will increase the most in Asia-Pacific and Latin America, up 3% year-over-year in Singapore, Colombia and Mexico and just shy of 3% in Australia, China and India. Low-cost carriers also account for 26% of total capacity in Asia-Pacific.

Source: GBTA and CWT

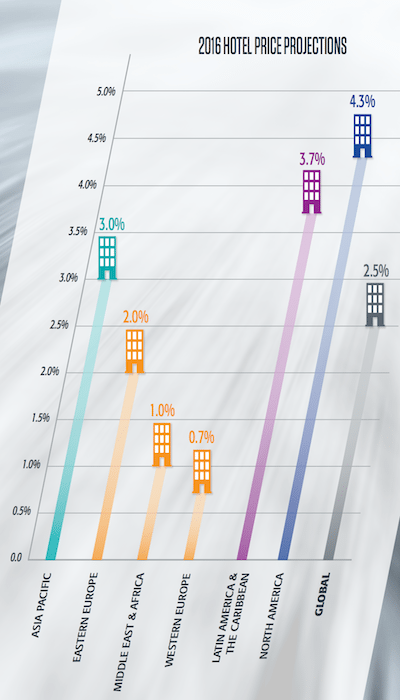

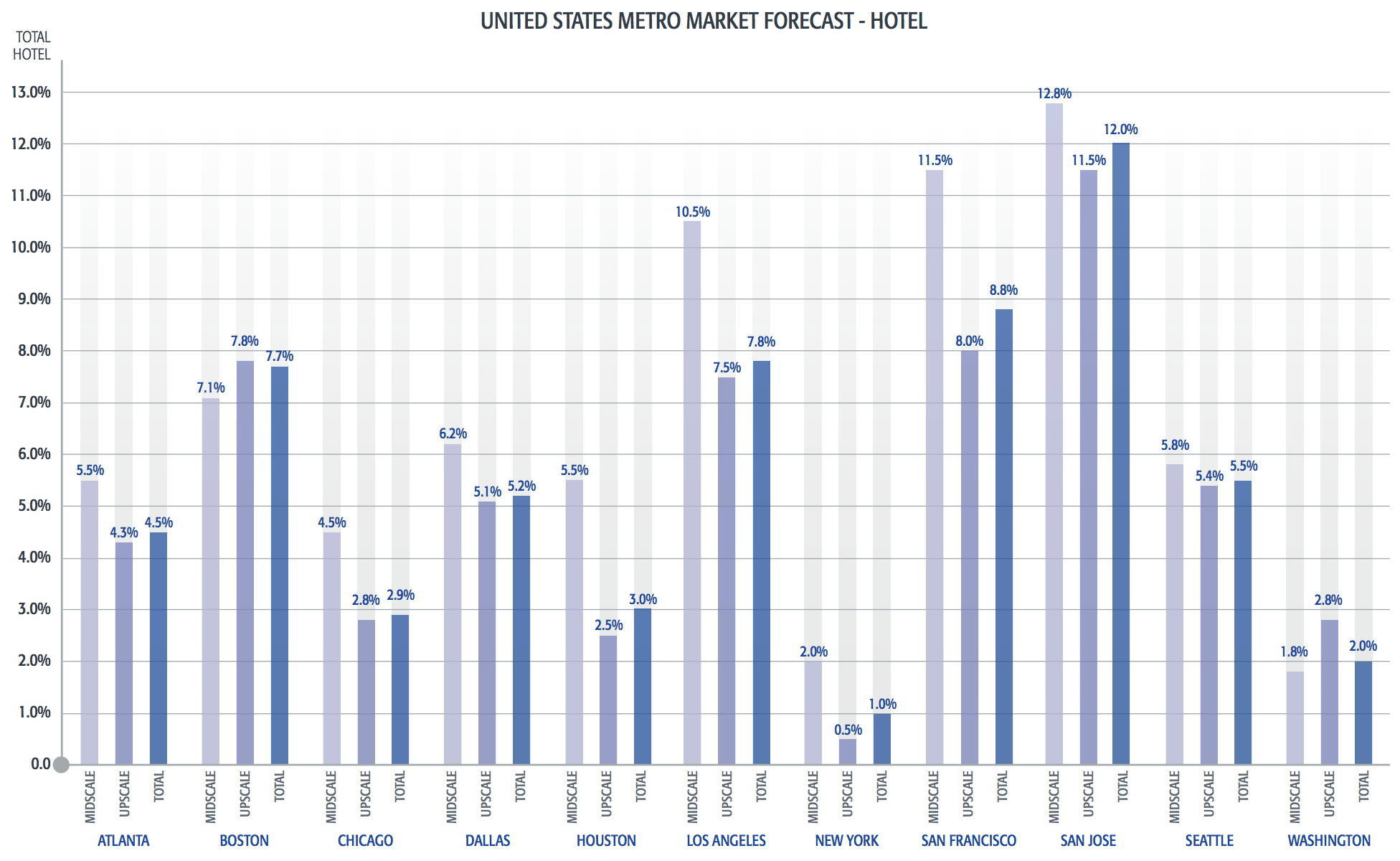

Chart 4: Hotel rates will see the largest increases in the U.S. following room demand reaching record highs this past year.

Source: GBTA and CWT

Chart 5: Japan's hotels will have the largest rate increases mainly due to limited supply in large markets like Tokyo and Osaka. In Latin America, Brazil's hotels will see some of the largest rate increases as they host visitors for the 2016 Summer Olympic Games in Rio de Janeiro.

Source: GBTA and CWT

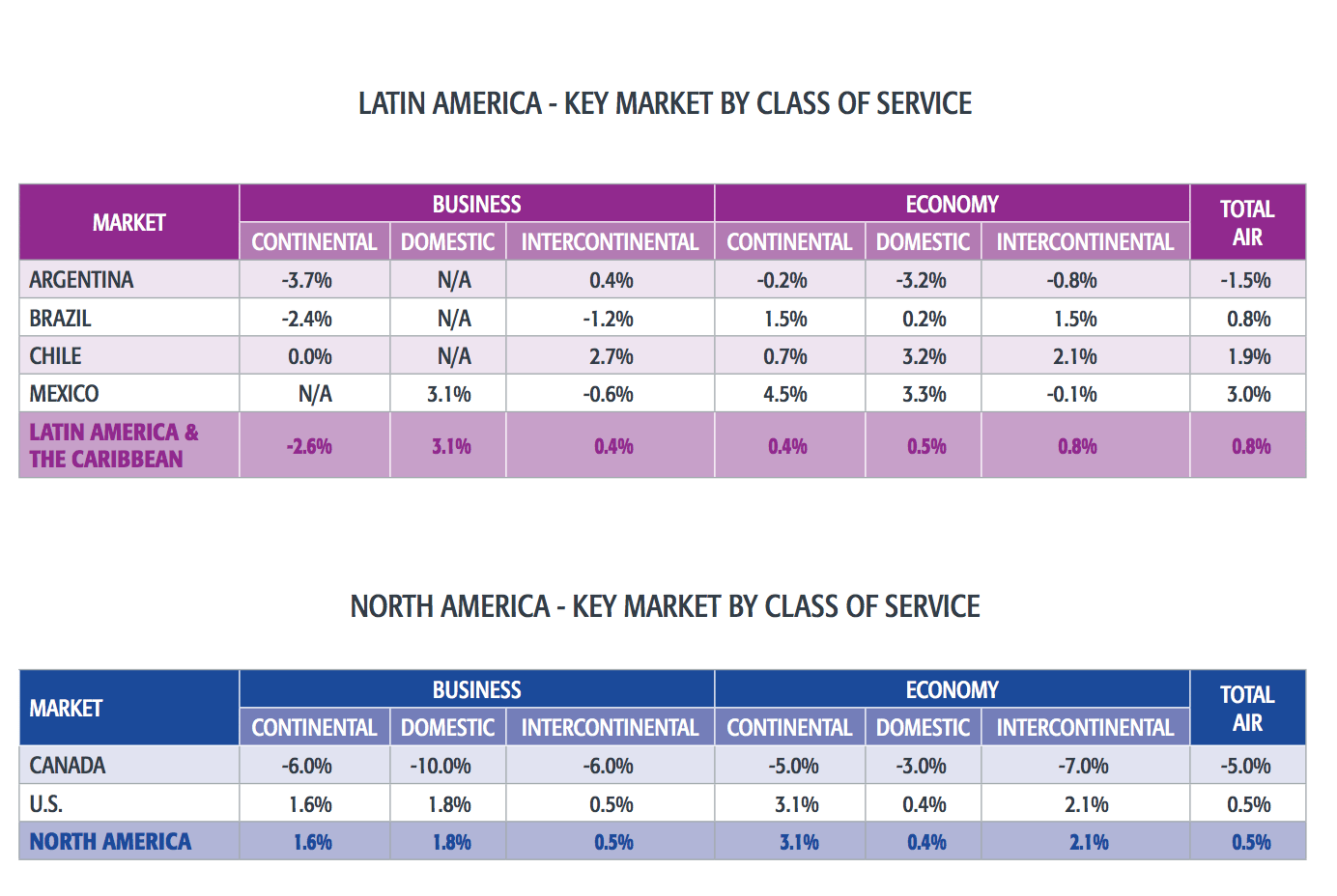

Chart 6: Diving deeper into airfare price projections: Brazil's business fares will see some of the largest decreases while all of its economy fares will increase, though not as much as Mexico's. Canadian travelers can also look forward to lower prices thanks to excess capacity.

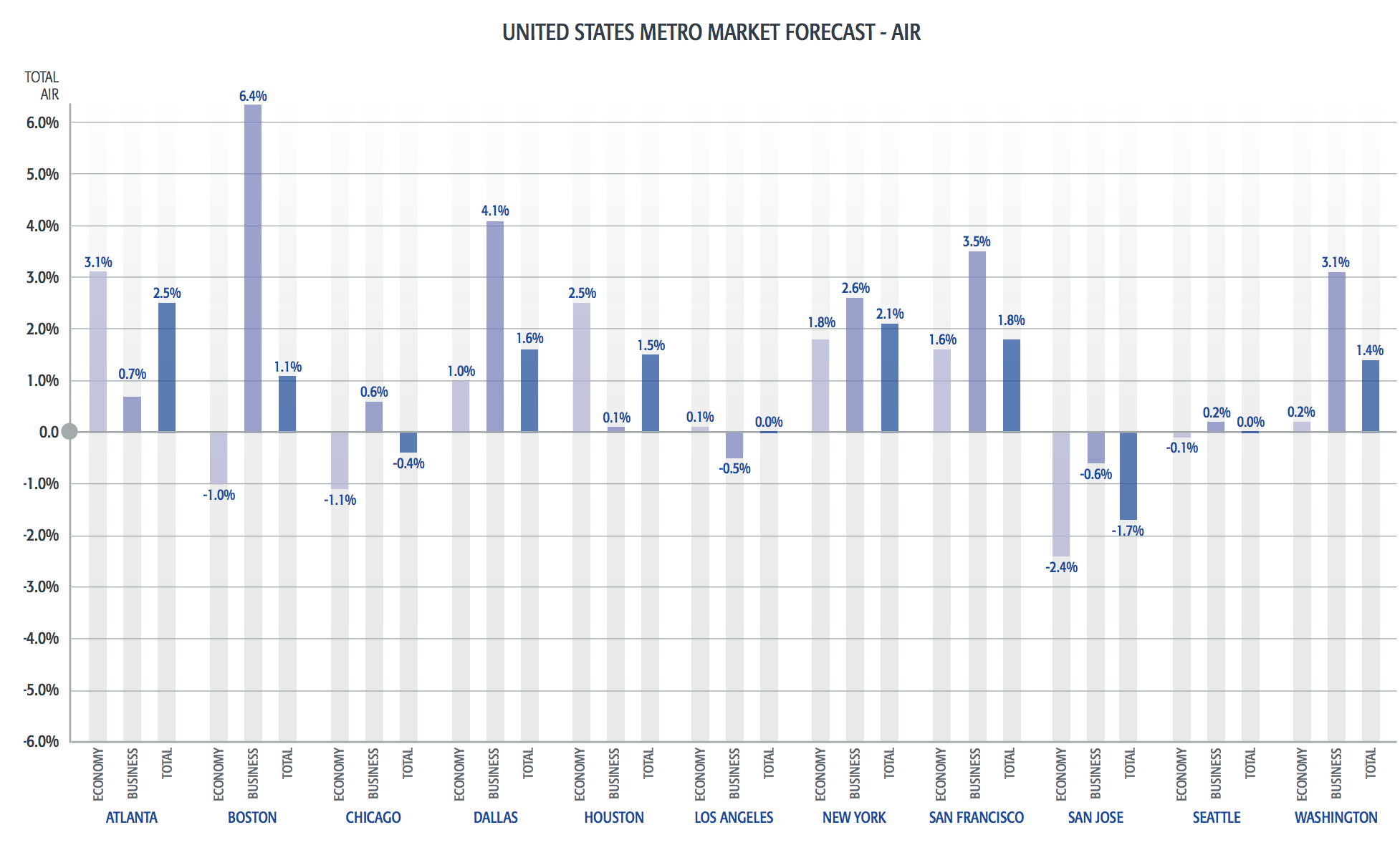

Chart 7: Business fares will see larger increases than economy fares in seven of the 11 biggest U.S. business hubs.

Source: GBTA and CWT

Chart 8: Midscale hotels will see larger increases in average daily rates than upscale hotels in nine of the 11 biggest U.S. business hubs.

Source: GBTA and CWT