Google Ventures Leads $60 Million Round for Secret Escapes

Skift Take

Who says flash sales are dead? OK, we did but Google Ventures doesn't think so.

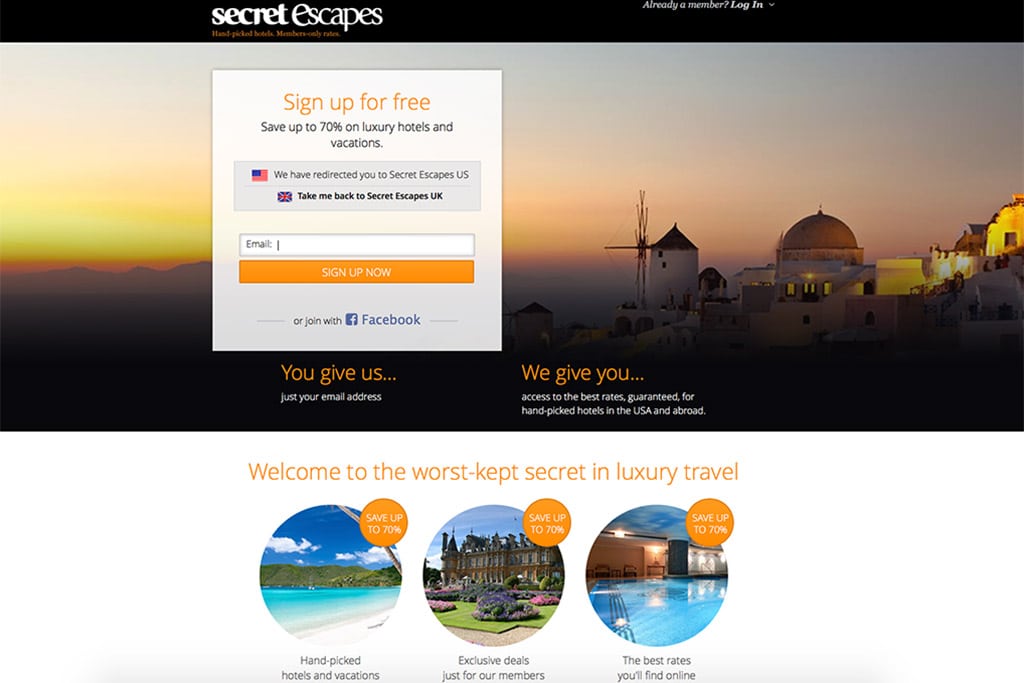

Google's investment arm, which has backed Uber, Slack, and Nest, and Octopus Investments led a $60 million Seris C funding round for UK-based Secret Escapes, which bills itself as offering exclusive deals to members through flash sales for luxury properties and vacations. The membership is free.

Secret Escapes operates in 13 countries, primarily in Europe, and 14 million of its 19 million members are based in the UK. Founded in 2011, and having sold 2 million room nights in the interim, Secret Escapes says it plans to use the funding to expand in the U.S. and Asia.

The funding round, which brings Secret Escapes' total funding to around $73 million, included participation from existing investors Index Ventures and Atlas Venture.

Does Secret Escapes really offer exclusive deals for luxury properties?

Secret Escapes was promoting a flash sale on its homepage last night for the 4-star The Palms Hotel & Spa in Miami Beach, Florida at $169 per night for a standard city room with a king bed. Expedia, Booking.com, Priceline.com, Kayak and Hotwire were all offering the same room for 29.6 percent higher at a rate of $219. All of the sites excluded the $22.95 per day resort fee.