Skift Take

Lots of food for thought in this report.

SITA has released its 2015 Passenger IT Trends Survey, conducted in the first months of 2015 across 17 countries, representing 76% of the world’s passenger traffic, which reveals that aviation could implement simple changes to dramatically improve the passenger experience.

Despite much-hyped announcements of innovations which are either complex in their deployment, or requiring large investments infrastructure, such beacons at airports, and the introduction of mobile payments systems, passengers prefer solutions which take far less effort to deliver.

Engrained passenger preferences will also contribute to airline ancillary revenue, specifically from baggage fees, with additional opportunities for revenue to be found in the implementation of simplified in-flight entertainment and onboard Wi-Fi.

Here are the major trends from SITA’s survey, which reveal where airlines and airports could find the low-hanging fruit.

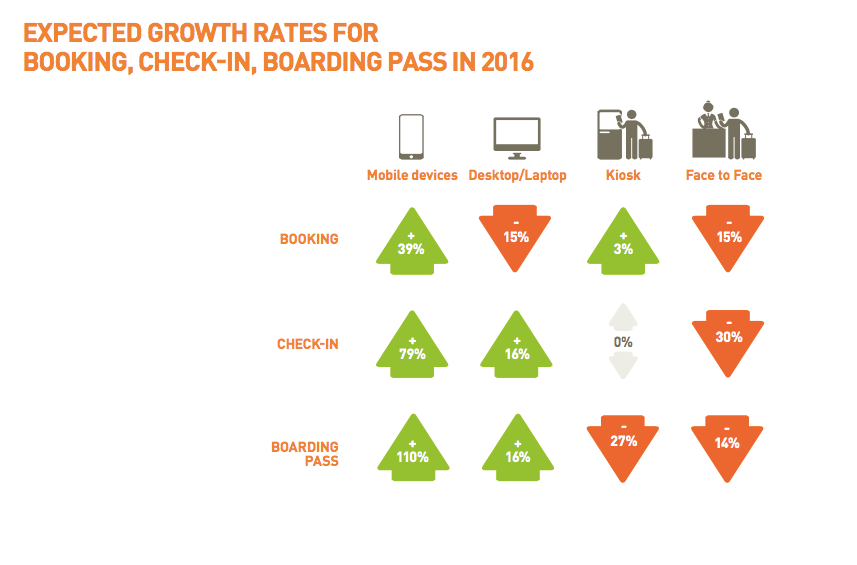

Airlines should expect fewer PC-based bookings, and start perfecting mobile apps. According to the SITA Survey, though 62% of passengers book flights on a PC, this percentage is expected to drop to 53% over the next 12 months. Tablet and smartphone bookings are expected to rise from 27% now to 37% by 2016.

Twenty-six percent of passengers booked their last flight via a mobile device, but this could grow to 36% over the next 12 months.

Growth in mobile should be complimented by website booking engine improvements. Booking travel through tablets is growing much faster than through smartphones, but, with tablets, respondents prefer to book via a browser, while smartphone users prefer to use a mobile app.

Self-Service and Mobile Check-in continue to gain traction. Our growing check-in preferences yield airlines and airports an opportunity to reduce overhead costs, if they implement simple changes.

Most passengers retrieved their boarding pass at the airport, either directly from an airport desk (33%) or from a kiosk (29%), but adoption of automated services in this area are paying off. Home printing of boarding passes will grow 20% to reach 26% of passengers.

We’re slower to adopt mobile check-in and mobile boarding passes, but SITA projects that we eager to adopt these simple improvements where available.

Mobile boarding pass use is expected to more than double, and become the preferred choice of 18% of passengers within a year, and the use of mobile apps for check-in will also double from 8% of passengers preferring this option to 16% by 2016.

Forty-three percent of passengers surveyed still used a check-in counter, but the majority of passengers (57%) are using a self-service option, be that online, kiosk or mobile.

Mobile is the fastest growing check-in channel and is expected to go from 11% of passengers today to 20% by 2016. And passengers are clearly equipping to support this growing trend.

This year smartphone penetration among flyers surveyed has nudged up to 83% of passengers from 81% last year, while 15% travel with three mobile devices (mobile phone, tablet, laptop).

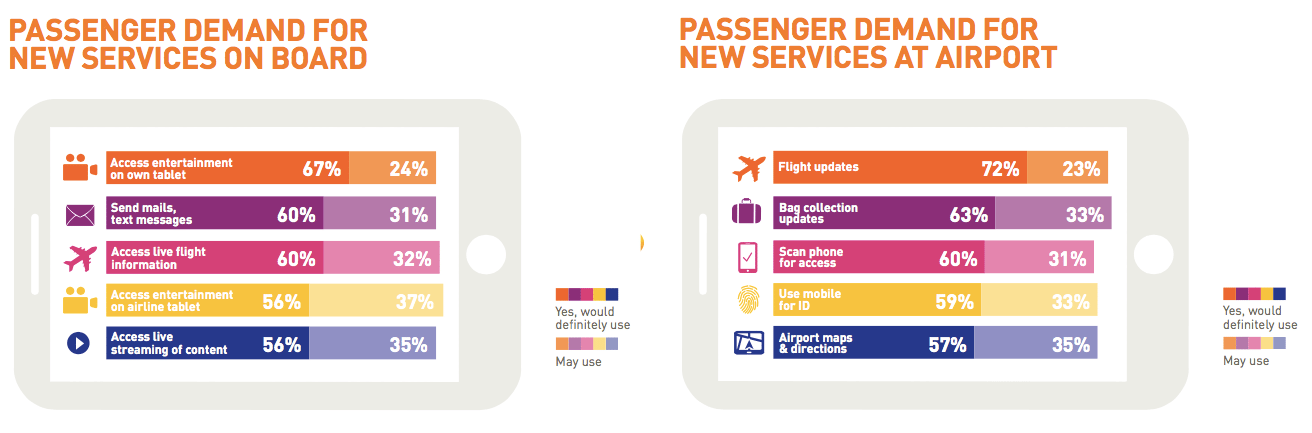

We want better information at the airport, direct to our devices. Airports can make passengers happy by updating their notification systems and airport apps. For example, SITA indicates that flight updates would “definitely” be used by 72% of passengers, while 63% would “definitely” want more details, such as carousel and wait time, for bag collection on arrival.

Nearly sixty percent of passengers want to use their smartphones to board aircraft and access airport lounges. Passengers today are only “slightly less (59%) keen to use smartphones for identification purposes,” IATA indicates.

Interestingly, despite numerous programs introducing mobile payment solutions, SITA finds that using the phone for purchases and making payments is “of less importance” to passengers, though the benefits to airlines in fighting fraud could justify acceleration of these programs.

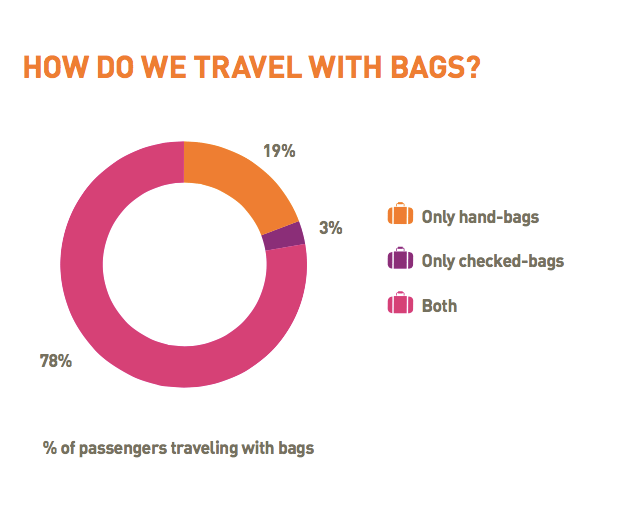

We’re not so keen to carry-on, and rather drop it. When it comes to baggage fee revenues, despite passenger complaints, it seems this vital airline income stream is secure. SITA finds passengers traveled with 1.2 bags, on average, with 81% of passengers checking-in one or more of their bags. By comparison, SITA’s survey reveals that the number of us prefer to carry our luggage onboard is “nearly one in five.”

Those who check luggage are happy using dedicated bag drops and self-service areas, where available. By next year, 31% of passengers drop off checked bags at automated baggage drops, compared to 20% this year. The challenge here, for aviation, is acquiring and installing sufficient baggage drops to accommodate a growing demand.

Baggage drop system installations represent a significant capital expenditure for airports, which may or may not be recovered from airlines, depending on agreements. But the strong passenger preference for self-service and for checking-in luggage combine to make this a smart infrastructural investment.

For now, 64% of passengers who checked-in luggage used the airline check-in counter, with the remainder using either a staffed (16%) or unstaffed bag-drop (4%).

SITA’s survey finds that 77% of passengers feel good about using bag drop stations when there’s someone around to help, versus only 59% of passengers who are happy using unstaffed bag drop systems.

On the plus side, passengers have reaped the benefits of infrastructural improvements made to baggage retrieval systems. Based on the passenger’s own perception of their last flight, SITA’s results show that 42% of passengers received their baggage within 10 minutes of arriving at the carousel, while 88% waited less than half an hour.

Tech soothes boredom on board, but heavy investments should focus on connectivity solutions. Two-thirds of passengers (67%) said they “definitely” want to use their own personal electronic devices for entertainment when flying, and 56% expect airline-provided content. This could make BYOD (Bring Your Own Device) in-flight entertainment systems increasingly useful to airlines who want to keep flyers happy, especially on routes where equipping existing aircraft is financially prohibitive.

The SITA survey hints that the best place for airlines to focus capital, to improve passenger satisfaction, would be on installing onboard Wi-Fi. Passengers expressed a preference for staying connected to the ground so that they can send and receive text/emails (60%), and stream live content (56%).

Of course, as some airlines have found our onboard entertainment preferences can help fund for demand for connectivity.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: passenger experience, sita

Photo credit: Old-school departures and arrivals information at New York's Newark Airport. 148442