How U.S. Airlines Manage Customer Service Expectations on Twitter

Skift Take

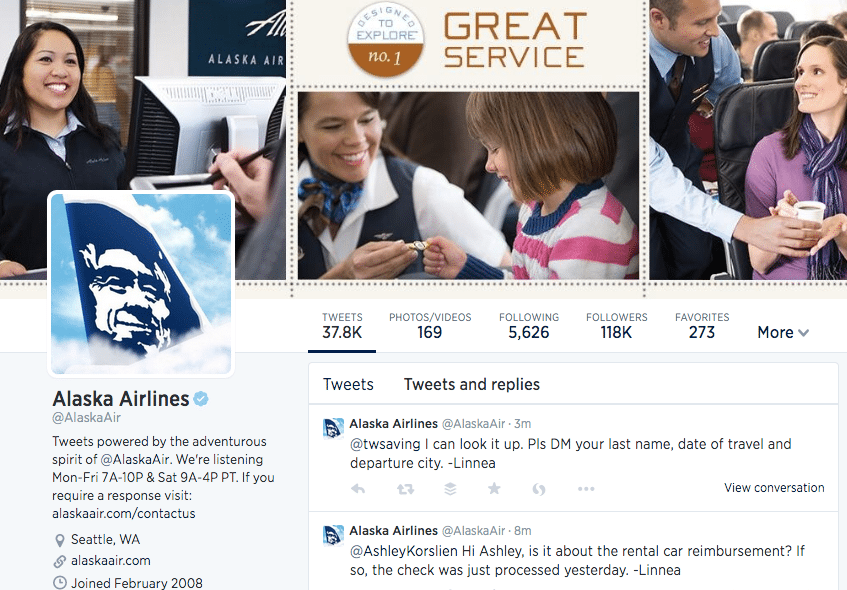

Separate Twitter accounts for customer service, discounts, and international fans are not the norm for U.S. based airlines.

For an airline employee managing a social media account, the sheer volume of tweets, @ mentions, direct messages and hashtags can be as high as 30,000 a week. And if the weather's bad it's even higher.

Although some of the airlines appear to be involved in a 24/7 race to provide customer service to their passengers, not all airlines promote their Twitter accounts as a channel to respond to complaints and concerns.

Most share a shortened link to fill out an online form in its descriptions. For example, even though American Airlines is active fielding customer service requests on Twitter, its bio reads, "Thanks for checking in! We’re here to offer advice and inspiration for your trip on American. Please click here if you require a formal response to a complaint: bit.ly/AACR1."

Two of the ten U.