Skift Take

T-Mobile's unlimited data plan for international travelers is fantastic news for travelers and travel businesses. Now, if only T-Mobile's rivals would follow along.

It was the shot — or data plan — heard ’round the world in October 2013 when T-Mobile debuted a plan with unlimited international data and texting in 122 countries, and flat-rate calls with no roaming charges at 20 cents per call.

For travelers worried about data charges for accessing emails, viewing maps, using navigation and all sorts of apps to find their way around unfamiliar cities when traveling, this was the news they had been waiting for.

Now, T-Mobile has revealed usage statistics since the advent of the program within its Simple Choice plan: In the first quarter of 2014, T-Mobile customers traveling outside their home countries were using 28 times more data, transmitting seven times more texts, and and making three times more calls than they did prior to the launch of the plan.

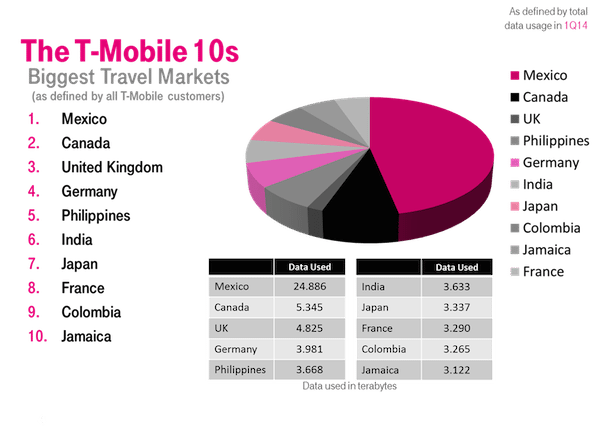

The following chart shows the top 10 countries, including Mexico, Canada and United Kingdom, for T-Mobile customers’ data usage.

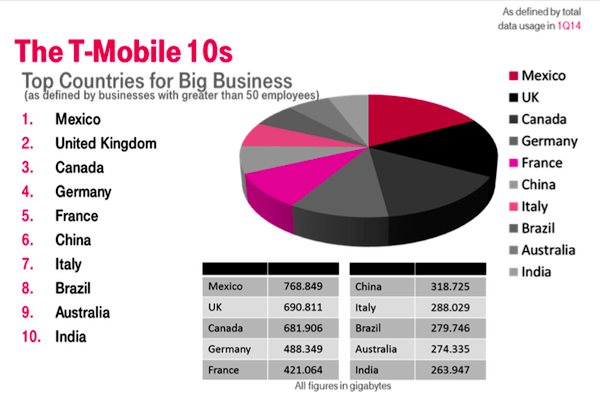

The following chart shows data usage rankings among T-Mobile’s large business accounts (more than 50 employees), with Mexico, United Kingdom and Canada leading the way. These rankings, of course, reflect in some ways T-Mobile’s consumer and business customer base.

T-Mobile also released the results of an online survey, conducted for T-Mobile April 25 to April 29, 2014, by Kelton Global, that highlighted consumer frustration with roaming and excessive data charges when traveling.

Among the findings, 20% of respondents indicated they leave their mobile devices at home or don’t power them up when traveling abroad; 40% disable data roaming to avoid the high charges, and 20% would shut off data roaming if they knew how to do it.

Overall, according to the T-Mobile/Kelton survey, 88% of respondents stated they felt frustrated by the expense and difficulties of staying connecting while traveling internationally.

T-Mobile CEO John Legere isn’t one to mince words about this and other topics.

“It’s completely outrageous that old guard carriers are still raking in billions each year from these ridiculous roaming fees,” Legere says. “That they continue to gouge their customers to the tune of 90% margins every time they set foot outside the country is shameful. Americans deserve better.”

Brandy Bishop, a T-Mobile spokesperson says when the carrier launched the plan, travelers didn’t take advantage of it right away, and she attributed that to an “ingrained fear” that was still prevalent.

“I think it is a mindset that is starting to shift,” Bishop says, adding that data usage among customers traveling abroad is doubling month to month.

In the first quarter of 2014, T-Mobile added more than 2 million customers — more than all of its major rivals combined — although its profits slipped.

Bishop says that its unlimited data initiative, coupled with its move to do away with wireless contracts, aren’t gimmicks.

“All of the moves we have made are commitments and not promotions,” Bishop says.

These plans are great news for travelers.

Asked why competitors haven’t introduced similar roaming charge and data plans for international travel, Bishop claims they are larger than T-Mobile and can’t afford to slice into their profit margins.

Stay tuned.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Photo credit: T-Mobile CEO John Legere speaks during a news conference at the 2014 International Consumer Electronics Show (CES) in Las Vegas, Nevada, January 8, 2014. R Steve Marcus / Reuters