Skift Take

Despite JetBlue's protestations, small isn't necessarily beautiful in the airline business. Still, the contrarian airline has proven so far that it can compete effectively in the middle.

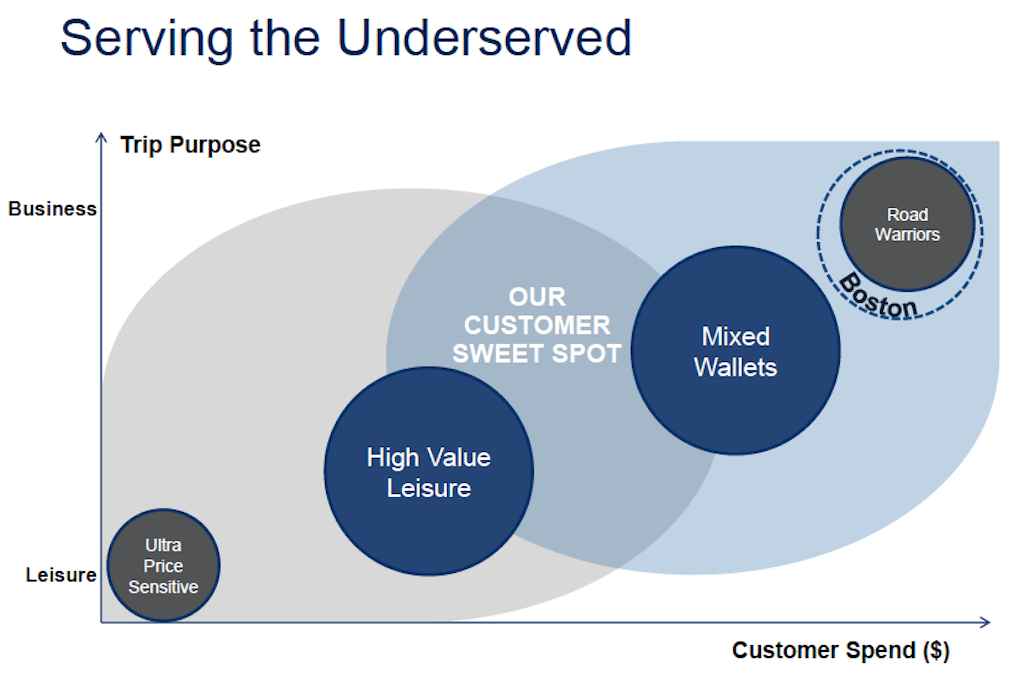

For years JetBlue has been talking about making strides with business travelers, but chief commercial officer Robin Hayes admitted today that the airline doesn’t target “road warriors,” and has no intention of starting to do so.

JetBlue CEO David Barger indicated the airline also has no desire to become a United, Delta, or American, and observed that network carriers “are a product almost exclusively of bankruptcies.”

Similarly, JetBlue doesn’t seek to become or compete with “discounters” [read Spirit or Allegiant], either, Barger said.

Kicking off a JetBlue analyst day, conducted at Nasdaq today, Barger outlined JetBlue’s centrist strategy, what he referred to as JetBlue’s “sweet spot.”

Barger and Hayes argued that JetBlue has a cost structure advantage over the legacy carriers, and a price disadvantage when it comes to the discount airlines, and therefore JetBlue sits happily in the middle.

Less charitable observers might say JetBlue is being squeezed on both ends, but that’s not how the airline sees it — or at least wants to articulate its position.

As an airline with about 5% domestic market share, JetBlue can compete against the big airlines, Barger said. “We know we can compete against these carriers from the standpoint of those [passengers and destinations] that are underserved,” he said.

JetBlue doesn’t go after “road warriors,” defined as business travelers who fly 20 to 30 segments per year, because the network carriers already serve them well, Hayes said.

Instead, JetBlue targets “mixed wallets,” namely travelers who fly for business and leisure, and the airline also tries to capture the “high-value leisure traveler” while conceding “ultra-price sensitive” leisure travelers to the discount airlines with their “$9 fares,” Hayes explained.

“We are clear about who we are targeting and who we are not,” Hayes said.

There is room “for a third model,” Barger said.

Hayes noted that JetBlue attracts road warriors in Boston, for example, but isn’t actively pursuing these most-frequent flyers.

However, along with adding Wi-Fi, JetBlue plans on adding a “premium offering” on its under-performing daytime transcontinental flights this year, Hayes said, and this likely will attracted both “mixed wallet” and “road warrior” travelers.

“We are going to have a product that will wow customers,” and at a price point that will impress them, as well, Hayes said, without offering further details.

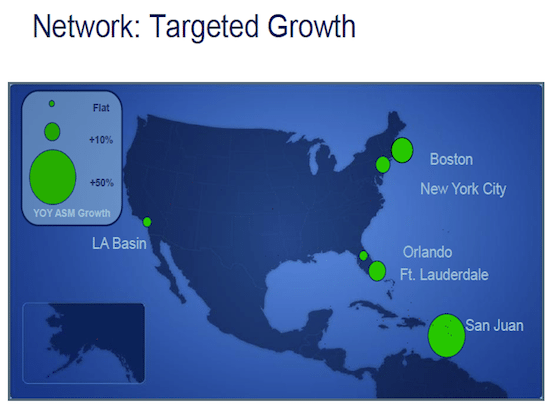

In other news, Hayes said Fort Lauderdale, Florida, can expect some big things from JetBlue. JetBlue currently operates about 50 flights a day to Fort Lauderdale, envisions investing in the airport, and bringing the flight totals to around 100 daily.

“We see Fort Lauderdale as the next big opportunity,” Hayes said.

The chart (at right) represents JetBlue’s growth in available seat miles at key destinations, and you can expect that green circle representing Fort Lauderdale to get a lot bigger in coming years.

Hayes explained that it would be four times more costly for JetBlue to operate in nearby Miami than to bulk up in Fort Lauderdale.

JetBlue also expects to revamp its partner model, which currently includes interlining and one-way codeshares.

Hayes said JetBlue will soon announce a two-way codeshare with one of the airline’s existing partners.

JetBlue is focused on increasing its ancillary revenue by expanding its Even More seat and security products, and it also hopes, once IT enhancements are in place, to begin pricing the products by flight, and not just by route.

That means a passenger on a 7 a.m. flight from Boston to Chicago might pay even more for Even More than a passenger taking a later flight, for example.

But, don’t expect JetBlue to start charging for first-checked bags even though the airline is focused on increasing ancillary revenue.

Hayes said the potential revenue contribution from a first-checked bag fee would be “much lower” than many might expect because there is a cost to administering it, and customer perceptions of the airline would plummet.

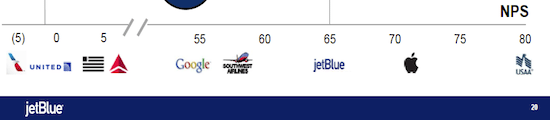

In fact, JetBlue believes it has a huge advantage over American, United, US Airways, Delta, and even Southwest in NPS (Net Promoter Scores), which is the readiness of a passenger to recommend the airline to a friend or colleague.

That’s a fancy way of measuring word-of-mouth.

Charging for a first-checked bag would be considered a “takeaway,” Hayes said, and JetBlue’s NPS would fall.

JetBlue believes its NPS is in Apple territory, and way ahead of other airlines. Here’s JetBlue’s view of its NPS standing.

Its customer perceptions are ahead of Google and Southwest, but they lag Apple’s.

Not shabby for an airline that doesn’t even have Wi-Fi yet.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: corporate travel, jetblue airways