The new American: detailed investor presentations from both companies

The SEC filings American Airlines and US Airways filed this morning are filled with enough pretty graphs and bullet points to fill an afternoon spent waiting on a delayed departure.

Some highlights American:

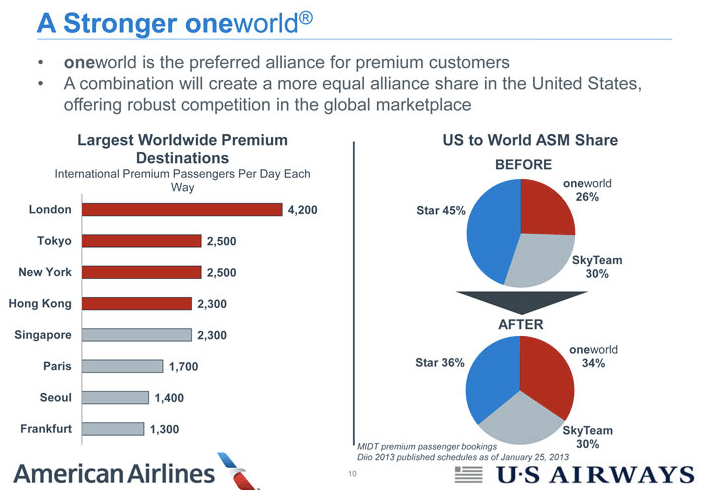

Yes, as expected, US Airways will exit the Star Alliance, and the new airline will be in oneworld, where American is an anchor member. Oneworld's available seat miles jump from 26% before the merger to 34% post-merger, while Star Alliance's share takes a hit.

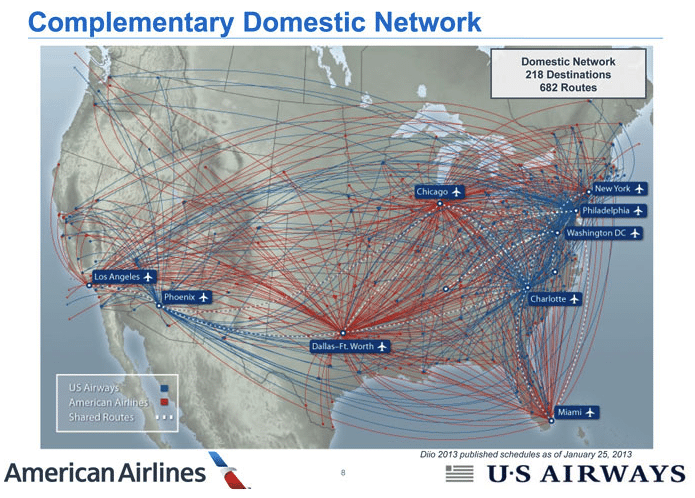

The new airline would serve 218 destinations and 682 routes for now, but there would be some trimming an rationalizing down the road. Within all of those squiggly lines, the two airlines are said to overlap on only about a dozen routes.

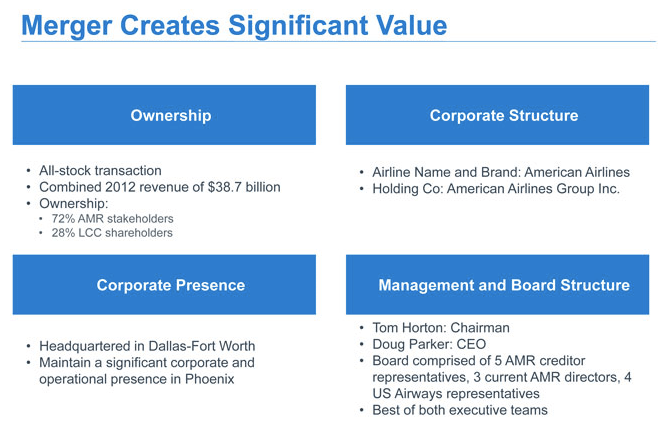

This chart outlines who gets what, and the pecking order. American CEO Tom Horton says AMR's creditors get an unprecendented opportunity to make their money back. Not sure they look at it this way, though.

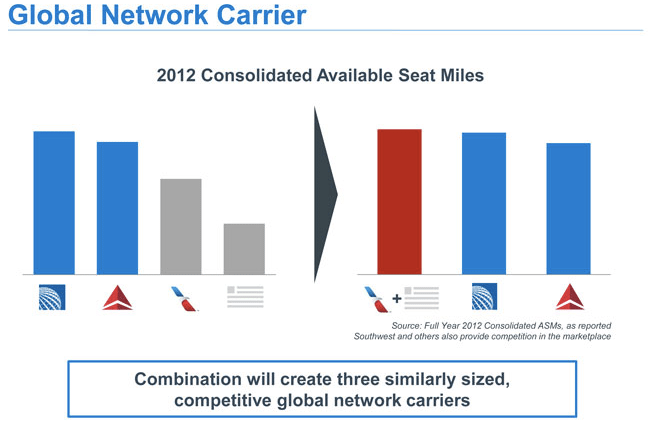

The new American will stand taller than United (#2) and Delta (#3) in available seat miles. That was a key idea behind the merger. Bigger means better with more ability to compete, goes the thinking.

Holy moly! The new American will have more than 100 million loyalty program members, with US Airways flyers transitioning from Dividend Miles to AAdvantage.

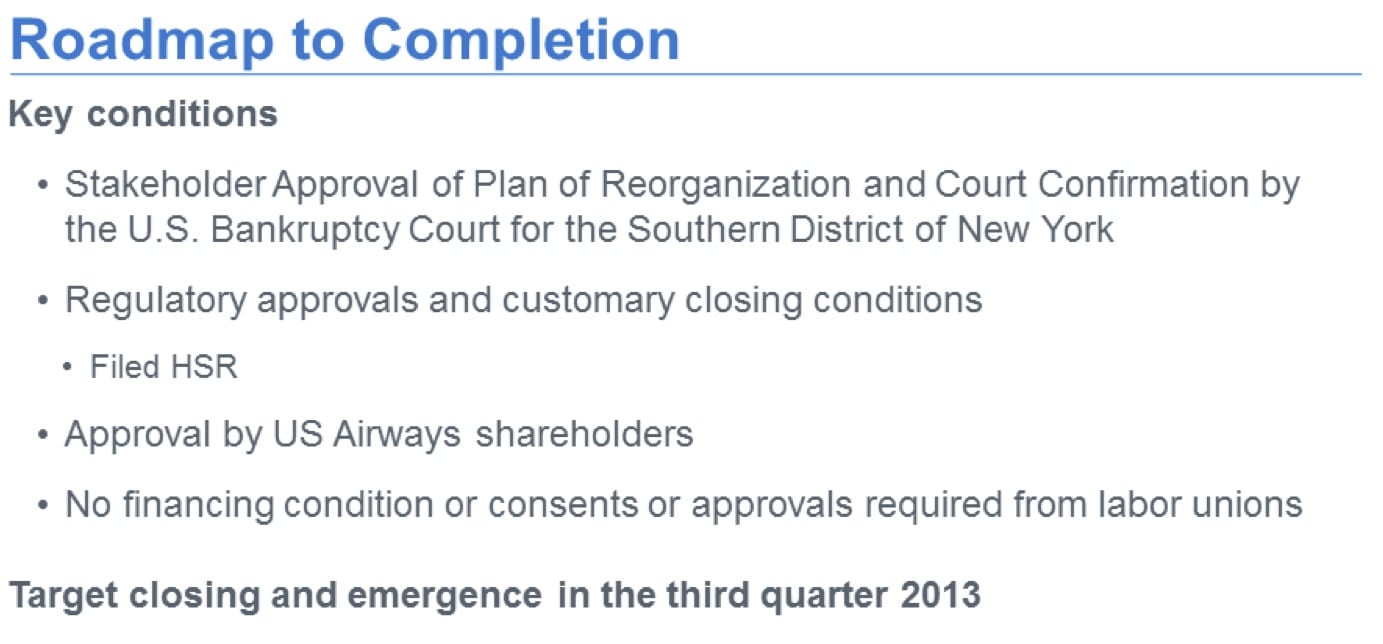

The timetable calls for this transacation to close and AMR Corp. to emerge from bankruptcy by the end of September 2013. That's when the real fun begins as the two airlines get down to trying to become one.

US Airways investor presentation on merger:

Us Airways InvesUS Airways investor presentation on the merger with American Airlinestor by skiftnews

American Airlines investor presentation on merger:

American Airlines investor presentation on the merger with US Airways by skiftnews