The inexorable decline of loyalty in travel

Skift Take

This post was originally posted on LinkedIn Today, where I am writing now as a travel "influencer.

Among the big macro trends we've been following on Skift -- and indeed among the underlying premises on which we've built Skift -- have been the blurring of boundaries between business travel and leisure travel, between managed and unmanaged travel, and the rise of "rogue" travelers that find their way outside the corporate travel booking walls.

All of these are travel industry defined terms, traditionally the silos that kept various subsectors of the giant travel industry separate, from the operational as well as from a use case perspective. The rise of digital, and its cousin globalization, has smashed the traditional boundaries of these silos together, as consumers using online and mobile tools jump across all kind of industry-defined value chains.

Among the first things to go out of the window as users got hooked onto digital was loyalty of brands, as price, choice and convenience became the deciding factors across most consumer industries, and indeed travel.

You can draw a straight line from what online booking sites started to where hotel and airline loyalty programs have ended up now: we have all become promiscuous comparison shoppers, and even if we're enrolled in loyalty programs, we're comparison shopping across those too, to "hack" the best deal. Online services, forums and blogs have only exacerbated that behavior as a whole ecosystem is building up around how to hacking travel brand loyalty and related travel credit card loyalty programs. And the brands have reacted by making these loyalty programs more complex by the minute, so much so that financial services seem more user-friendly by comparison. Imagine that.

Which is a long winded scene-setting to the actual research survey that Deloitte conducted and just came out with the results of, which reported a steep decline in consumer loyalty to travel brands. Only eight percent of survey respondents indicated they always stay at the same brand of hotel brand, while just 14 percent of survey respondents always fly on the same airline.

The Deloitte survey codifies a lot of what we now know anecdotally:

- The best-case scenario is that hotel loyalty programs as they are constituted today have either little or no impact on travelers’ purchase decisions, and, worst case, these programs drive undesirable brand-switching behavior.

- Only 55 percent consider loyalty programs of high importance when choosing airlines and 45 percent consider loyalty programs of high importance when choosing hotels.

- Nearly 50 percent, on average, of hotel loyalty members’ annual hotel spend is not with their preferred brand

- Most consumers believed even grocery stores had much more innovative and ultimately rewarding loyalty programs.

- Consumers are no longer craving the luxury of premium class, particularly when it comes to domestic travel.

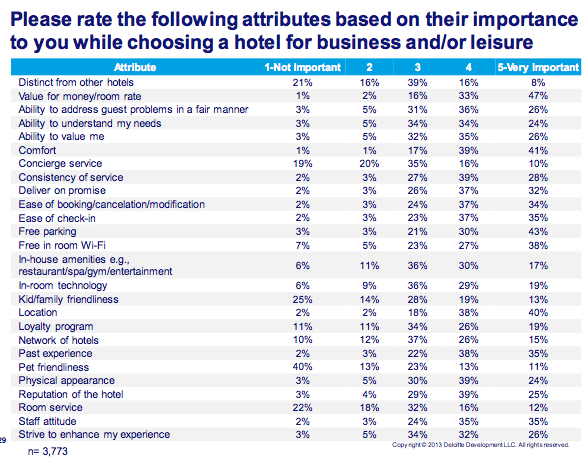

This question below and the survey answers to it is the stuff of nightmare for loyalty executives in hospitality:

That said, what can be done now? How do you reinvent loyalty programs around today's digitally savvy priority traveler that doesn't want cookie-cutters choices, but wants simplified yet personalized services?

Deloitte offers some insights: "While earning and redeeming points are the most important attributes for choosing hotel and airline loyalty programs, travel brands should focus on enhancing the customer experience, making rewards personally meaningful, encouraging loyalty with unexpected rewards if they want to boost consumer engagement, and ultimately building long-term customer relationships.”

Some loyalty program rebuilding strategies suggested:

- Encourage specific behaviors with unexpected rewards: keep it fresh, in other words.

- Make rewards personally meaningful: Using data and actual marketing insight, as opposed to generic solutions.

- Provide in-the-moment accessible rewards: don't keep users waiting for the big prize, create smaller yet more accessible reward milestones along the way, especially as consumers are in the travel experience.

- Be forgiving; don’t penalize behavior that loyalty programs encourage, that is if you have loopholes don't be too mad if your users know how to use them.

- Reinvest in capabilities and infrastructure: Use data to your advantage.

The full survey results, embedded below:

[gview file="https://skift.com/wp-content/uploads/2013/01/us_thl_customerloyaltyinhotelindustry_011813.pdf"]