Norwegian Cruise Line closer to IPO; appoints more bankers

Skift Take

Norwegian Cruise Line Holdings, the smallest of the big three North American cruise lines, is finally close to its market debut, as it filed an updated S-1 filing with SEC last week outlining more details. It has been working with UBS, Goldman Sachs and Barclays since it first filed for Nasdaq listing in 2011, but the latest fling says it has added more, including Deutsche Bank, Citigroup, JP Morgan and HSBC.

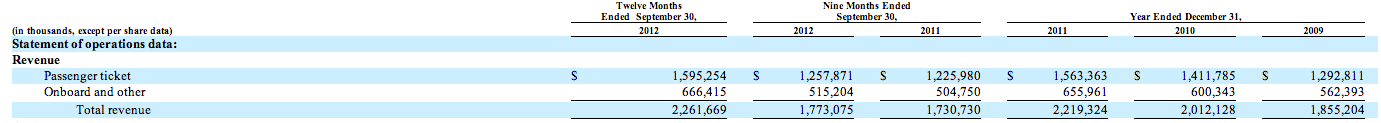

It is still raising $250 million with this IPO but no share price has been set yet. For its year ending Sep 2012, it has total revenues of $2.26 billion, with net income of $165.6 million (click for full chart):

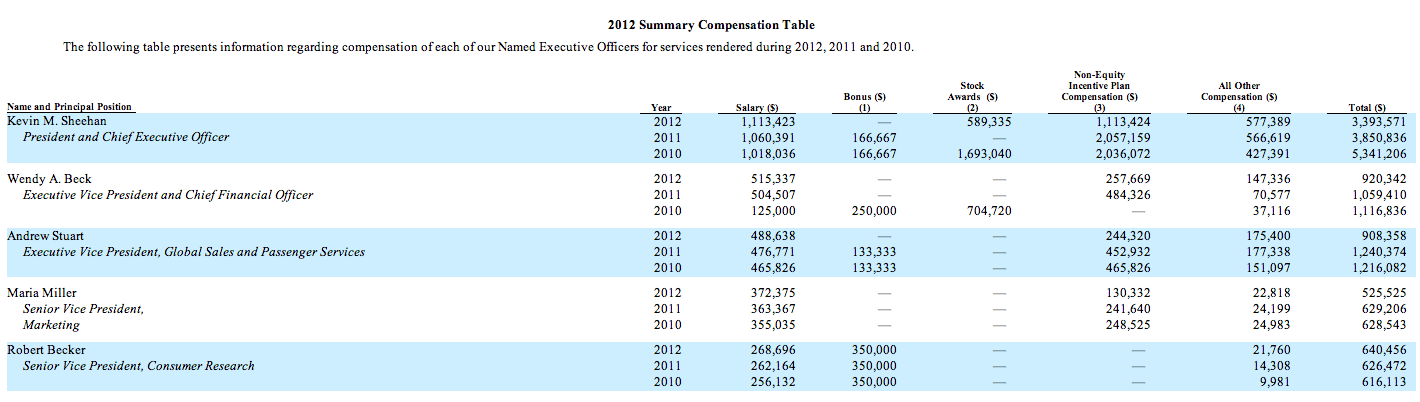

Meanwhile, the total compensation of its top management, widely credited with engineering its turnaround since Genting HK, Apollo & TPG purchased it in 2008, has seen a decline over the last three years, a rarity in corporate land these days. From the amended S-1, the comp table (click for full chart):