UK expects one million more tourists in 2013, even as post-Olympics 2012 disappoints

Skift Take

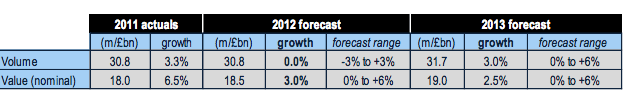

Even as data points to decline in visitors to UK post-Olympics much to the disappointment of all the officials, the country is more hopeful on 2013, hoping that its good image boost in the last year will help. According to VisitBritain's forecasts for 2013, the volume of international tourism to Britain will grow by 3% over 2012, which is about 1 million more tourists. The amount spent by visitors from overseas is set to reach £19 billion, representing growth of 2.5%.

And yet, the total numbers for 2013, if they hold, will still not be as much as the high of 2007 (32.8 million) nor, in real terms, will spending be at record levels, with 2006 being the high-water mark on this measure.

And it helpfully lists the risks factors to blame 2013 numbers if they happen to go south:

- There is a further deterioration in the Eurozone economic crisis during 2013 with the risk of widespread opposition to spending cuts and tax increases in Eurozone countries facing the greatest hardship.

- The US fails to navigate a pathway to avoiding the so-called ‘fiscal cliff’ and returns to recession

- Tensions in the Middle East, particularly between Israel and Iran spill over into a confrontation thatbrings volatility to the price of oil