Skift Take

Where's the beef? Orbitz's turnaround has been tortoise-like, putting the business' viability in doubt.

It’s getting hard to remember a time when Orbitz Worldwide wasn’t struggling, a situation highlighted with the release of its third quarter financial results today.

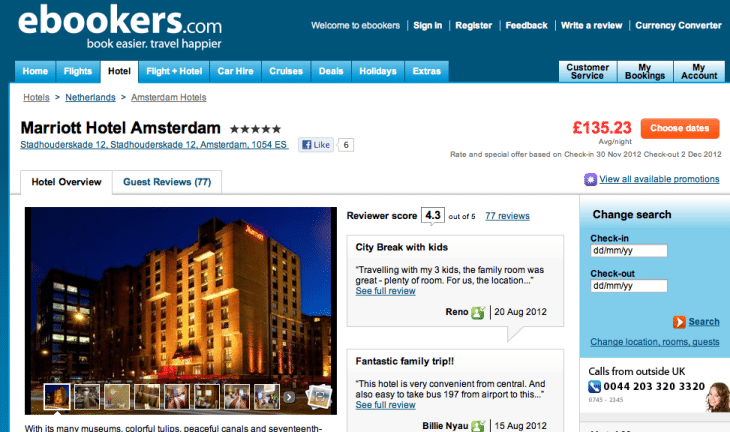

The company, which owns various brands including Orbitz, CheapTickets, ebookers, and HotelClub, and also runs a private label business, saw gross bookings and revenue drop 7% and 2%, respectively, in the third quarter, although net income rose 32% to $14.8 million.

The business was impacted by lower air volumes and declining revenue from car rentals and travel insurance, although standalone hotel-room night revenue increased a relatively lethargic 4% to $61.2 million.

“We had mixed results for the third quarter 2012,” said Barney Harford, CEO, Orbitz Worldwide. “Our U.S. consumer business had a challenging quarter, but we have made solid progress resolving some of the underlying performance issues. The economic slowdown in Europe over the summer caused growth in Q3 stayed room nights at ebookers to decelerate, but on a booked basis we are already seeing recovery and reacceleration in key markets.”

“Our efforts to stem the decline in our HotelClub business are beginning to bear fruit,” Harford added. “We were pleased to launch the American Express Consumer Travel Network partnership in the quarter and to see continued strength in our mobile channels.”

Operational issues in air business

In the U.S., Harford said the Orbitz and Cheaptickets business was negatively impacted by now-resolved operational issues in its air business. This also hurt the hotel business because it put a damper on cross-sell opportunities, he said.

Harford declined to detail what the operational issues were, saying they revolved around availability issues tied to airline host systems.

Orbitz Worldwide has been struggling to turn around ebookers since former parent Cendant acquired it, and its unwieldy mess of technology platforms in 2004. ebookers had recently turned the corner but the slowness in its Europe business has set it back.

On the other hand, Priceline saw its European room nights grow 36% under the same conditions in the third quarter.

Hotels still just 38% of the business

Meanwhile, Orbitz reveals that its hotel business grew as a tad as a percentage of total revenue to 38% in the third quarter, which means that Orbitz is still overly reliant on airline tickets, car rentals, and add-ons such as travel insurance. Harford said the goal is to increase the percentage to 50% of revenue.

Orbitz kicked off its private label partnership with American Express, powering its American Express Consumer Travel Network, in the third quarter.

For a year, since the agreement became known, Orbitz has been touting such partnerships as a savior among other struggles that would begin to kick in during the second half of this year.

Interim CFO David Belmont said the ramping up of benefits from that American Express agreement is “different than expected,” adding that the cutover, with Orbitz replacing Travelocity as American Express’ private label partner, is 100% complete.

It’s very early days, but there isn’t much to show for it so far.

Orbitz revealed that it has entered into an additional distribution agreement with American Express, with Orbitz providing hotel inventory to “select” American Express-branded websites globally.

Orbitz’s stock price was down nearly 8% to $2.40 per share in early trading this morning.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch