Skift Take

Expect Kayak to increase its leave of absence from the classic metasearch approach and to expand into new travel verticals with its Kayak booking path. Others, including Room 77, already are following Kayak's lead.

Source: Skift

Author: Dennis Schaal

Kayak, in finally getting its entire IPO story, replete with video, out into the public, says there has felt “no material impact” from Google’s introduction of flight and hotel search.

Those were the words of co-founder and CEO Steve Hafner, decked out in a sports jacket to impress investors, as he used the video to address the big rhinocerous in the room — Google’s acquisition of ITA Software and Google’s increased activity in travel in the form of Google Hotel Finder and Google Flight Search.

Hafner emphasized that Kayak obtains less than 10% of its traffic from Google, and has lived to fight another day despite Google’s much-hyped and feared entry into the travel sector.

The video, which also included statements from co-founder and chief technology officer Paul English and CFO Melissa Reiter (on the job for less than four months), provided tidbits about Kayak’s operations and strategic direction.

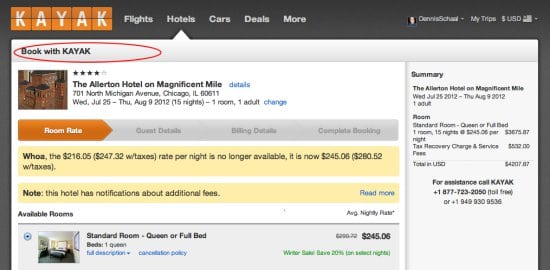

English revealed that 39% of clicks on Kayak now go through the Book Kayak hotel and flight path (Air Canada only for now), and that Kayak receives higher commission when bookings are transacted in this manner.

This makes Kayak increasingly look like a hybrid of sorts: It refers users to online travel agency, hotel and airline sites for the majority of its clicks, but it is handling an increasing number of bookings on its own, after a fashion, through a private label partnership with the Travelocity Partner Network.

For consumers, whether on Kayak websites or its mobile platforms, this makes for an easier user and more consistent user experience over being shepherded to a bunch of disparate third-party sites.

Travelocity apparently is paying Kayak a higher commission for hotel bookings than Kayak would otherwise receive if it transferred users to third-party sites such as Expedia, Booking.com, Orbitz, Getaroom, Westin Hotels and countless other partners.

And, English revealed that Kayak intends to expand the use of its own booking path, instead of the classic travel metasearch proposition, to new verticals in the future.

Kayak introduced the use of its own booking path last year and at least one other hotel metasearch site, Room 77, has followed Kayak’s lead.

You can therefore expect Kayak to increase the number of airlines direct-connecting with their APIs to Kayak, and car rentals would be another logical area as a focus of its Kayak booking path expansion efforts.

With the current share price range of $22 to $25 that Kayak is offering for its IPO, its net proceeds would be about $72.7 million.

International expansion is a key priority and Hafner noted that Kayak currently gets only about 18% of its traffic from outside the U.S. and generally makes two to three acquisitions per year.

If the IPO is successful, you can expect Kayak to use part of those proceeds to pick off a couple of competitors in an international market or two.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch