Skift Take

Airbnb, with its roughly $24.5 billion valuation, would likely be too big for most of the online travel agencies to acquire but if they are forced to enter the sharing economy in a bigger way several years from now they always have the resources to buy their way in.

Officials at the Priceline Group and Expedia Inc. haven’t felt compelled to jump into peer-to-peer apartment rentals despite the phenomenal growth of Airbnb over the last few years.

They are loathe to do so because of all of the legal and regulatory issues that would need to be sorted out, and the fact that the sharing economy doesn’t pose a material threat in the next few years, according to a recent report from Morningstar that touches on Priceline, Expedia, and the sharing economy.

The Morningstar report, written by senior equity analyst Dan Wasiolek, states that the competitive threat from Airbnb is “manageable for both Expedia and Priceline.”

In fact, the report estimates that Airbnb is currently adversely impacting Priceline’s and Expedia’s booking growth about one-third of a percentage point and that could reach a little more than 1 percentage point by 2019.

Hardly a doom and gloom scenario.

Commenting on the economics of vacation home and apartment rentals during the Priceline Group’s first quarter of 2015 earnings call on May 7, CEO Darren Huston said the commission levels and take rates are similar to the hotel business but “we don’t feel pressure to go lower.”

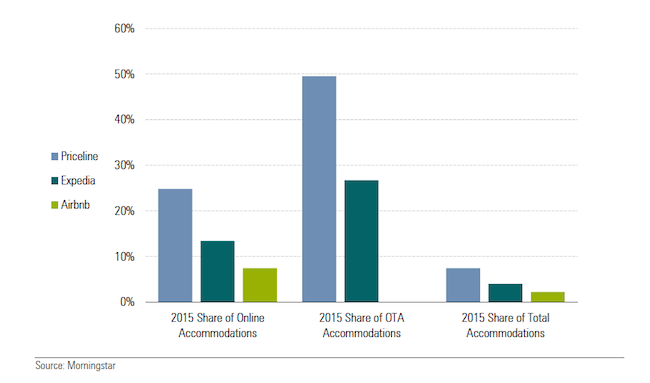

“Priceline and Expedia dominate the OTA (online travel agency) accommodation space, while Airbnb has become a meaningful presence in the market in a short amount of time,” the Morningstar report states. “We still see plenty of opportunity for all three of these players to grow, as each of their shares of the total accommodation market is still in the single digits.”

Priceline, Expedia and Airbnb Market Share

With an average room rate of around $60, according to Morningstar, Airbnb is stealing share mostly from the economy hotel sector and weaker vacation rental players and not Priceline and Expedia. In contrast, the average hotel room rate in the U.S. was about $115.

In contrast to a recent Deutsche Bank report which argued that the sharing economy would take a bigger piece out of Booking.com than Expedia, Morningstar views “Priceline as best-positioned for long-term growth” in the vacation rental market.

Booking.com, Airbnb, and HomeAway each feature roughly 1 million rental units and TripAdvisor has around 700,000, Morningstar states.

All of Booking.com’s rentals, ranging from vacation homes to apartment hotels, are instantly bookable while only 43 percent of HomeAway’s properties can be booked online and even then the owner has 24-hour wiggle room to accept or reject the reservation.

“Priceline’s brand and proven user experience make it a preference of landlords of multi-unit rental properties,” Morningstar states. “Finally, it has an overexposure to Europe, a market where the average worker gets and takes five weeks of vacation each year versus the average U.S. worker getting two weeks of vacation but taking only one.”

Further tilting things Booking.com’s way, the European vacation rental market is about 30 percent larger than the U.S. market and is poised to grow 16 percent on a constant currency basis from 2015 to 2019 compared with 13 percent for the U.S., Morningstar forecasts.

Expedia Lags on Vacation Rentals

Morningstar forecasts that an Expedia vacation rental distribution trial with HomeAway, which is slated to soon be launched in Europe, “can amount to around one-sixth the current booking presence of Priceline and grow at a rate slightly below Priceline to account for share concession to Airbnb, as we believe HomeAway has a higher mix of individual renters (versus large property management suppliers) and a smaller percentage of online bookable properties versus Priceline.”

Expedia hasn’t done much with its vacation rental trial to date as it buried HomeAway’s properties within a broader hotel search. Expedia has been preoccupied with a spate of acquisitions over the last year.

Priceline/Booking.com’s online market share in vacation rentals would increase to the mid-20s in 2019 versus the current high teens, Morningstar states, and Priceline’s compound annual growth rates in vacation rentals would be 22 percent in the 2015-2019 period versus the mid-teens for the rest of the industry.

While Airbnb may be negatively impacting the hotel industry, the large online travel agencies, particularly Priceline.com/Booking.com, can afford to see how it all plays out — especially because Booking.com has a substantial lead over its rivals in vacation rentals.

“Finally, it is worth mentioning that Airbnb and its hosts currently do not pay hotel tax or need to comply with the safety and zoning regulations that hoteliers must adhere to,” Morningstar states. “The Airbnb model also neglects many local jurisdiction rules that cap the amount of days each year that a primary residence can be rented out, which is said to be causing housing shortages for workers living in cities such as San Francisco. If Airbnb or other models similar to it end up having to comply with the same rules as others in the industry, then the threat we have outlined will be diminished.”

Airbnb didn’t respond to a request for comment about the Morningstar report.

Airbnb, with its roughly $24 or $25 billion valuation, would likely be too big for most of the online travel agencies to acquire but if they are forced to enter the sharing economy in a bigger way several years from now they always have the resources to buy their way in.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, expedia, priceline, sharing economy, someway

Photo credit: Priceline has taken on multiple challenges before. Priceline/Airbnb