Skift Take

Every CEO would like to view his or her company as a crocodile in the Yangtze or Amazon rivers, but some of these companies have more bite than others.

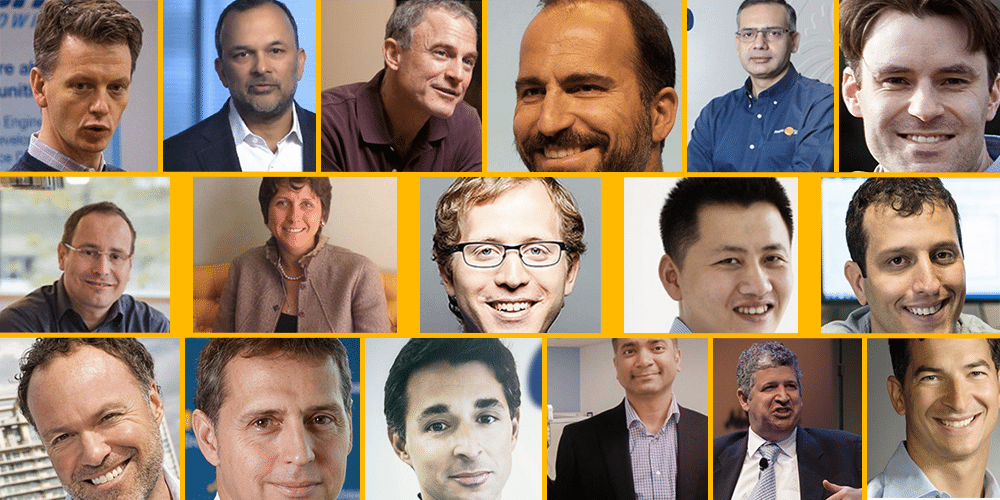

We released our first e-book earlier this month about the Future of Travel Booking — an unprecedented collection of 17 interviews with the CEOs of virtually all of the world’s top online booking sites, including an extensive, book-only interview with the Priceline Group’s Darren Huston.

The leaders provided insight into all aspects of their businesses, from marketing to technology to mobile habits to tricky customers like millennials. Below are quotes from the e-book that address each companies’ competitors across the sector and market.

Get the “Future of Travel Booking” E-Book Now

Darren Huston, Priceline Group CEO

I know for sure China is a very dynamic environment and all the big players there, Alibaba, Tencent, Baidu, they all have different stakes in the game. What we are proud of is we’ve partnered with Ctrip, which are the other people who really do the hard work. The Ctrip folks know exactly what it takes. That’s why they’re winning because they know that it is at the end of the day about customer service, a great product, about how you balance demand and supply.

By the way, I think Alibaba will play in travel. They’re a huge source of demand. We’ll see where it all ends up. They’ve been with Taobao Travel for awhile.

Dara Khosrowshahi, Expedia Inc.

China is a unique market and there are very few Western companies that have been able to be successful in China. There’s a really good reason for that because China is different. And we are very lucky to have a terrific team with the eLong team, and a terrific CEO with Guangfu Cui. You know Guangfu tells me that westerners don’t do well in China because they are not street fighters and the Chinese are street fighters.

João Ricardo Mendes, Hotel Urbano

On Booking.com, we are big fans of the company. We are very close to Priceline and all of the Booking.com team. I’ve learned a lot from those guys. People ask me when is Booking.com coming to Brazil, and I say, ‘Guys, Booking.com has been in Brazil for over 10 years.’ They are very strong for Brazilians traveling internationally and vice versa for international travelers coming to Brazil. But for Brazilians traveling in Brazil we are by far far the biggest one.

Despegar is a huge player. Most of their top-line revenue comes from flights, maybe 85%. Their net revenue may be 35% from hotels because the margins are so much bigger than flights.

Have you seen the documentary, Crocodile in the Yangtze: the Alibaba Story? It’s about Jack Ma about 15 years ago when eBay was going to China. And [Alibaba CEO] Jack Ma said something very interesting — and I use their words for us a lot — he said, “eBay may be a shark in the ocean, but I am a crocodile in the Yangtze River. If we fight in the ocean, we lose. But if we fight in the river, we win.” So basically, I believe we power knowledge, we power the relationships with the hotels, we power low-cost, we power an understanding of our base. We can be the Alibaba connecting these dots. OK guys, global players like Priceline and Booking.com and Expedia: They may be a shark in the ocean. But we are a crocodile in the Amazon River.

Greg Marsh, OneFineStay

If I look at the emergence of the nontraditional lodging category more broadly, we are at the beginning of the beginning. This is going to represent a major change in behavior. We have also seen a lot of the distribution-focused mass market businesses, including Priceline, HomeAway, Expedia and Airbnb, all of these guys have very significant war chests and are going to be going aggressively after mindshare and distribution visibility over the next couple of years. When we talk to travel agents, they are telling us people are asking for vacation rentals. They are asking for non-hotel accommodation experiences. Businesses like ours represent the very tip of that mega-trend and it’s going to be fascinating to watch this over the next couple of years.

Deep Kalra, MakeMyTrip

Expedia on their own have been in the country [India] about five years with their own presence. They haven’t made a big mark. If you look at ComScore you’ll see that they are probably number five, but I’m sure over time they will get their act together. We do welcome good competition.

Booking.com is focused mainly on the inbound market. I think we are hearing more rumblings that they are getting interested in the domestic market, and I’m pretty sure we are going to see them take a more aggressive position in the market here. I think it is just a matter of time.

Brian Sharples, HomeAway

I think these are interesting times for sure because you have a combination of a lot of M&A activity in the Internet sector in general and travel in specific. Coupled with that you have some very big market cap players like Expedia and TripAdvisor and Priceline and now, oh by the way, probably Alibaba that all have their mind set on global travel dominance.

Which is different from HomeAway. We have our eyes set on global vacation rental dominance. But these guys [Expedia,TripAdvisor, Priceline, Alibaba] view themselves as kind of full-service. If you are a company that is the market leader in a category that’s significant if you look at accommodations, hotels is number one, vacation rentals is number two, maybe cruise is number three. This [vacation rentals] is the number two category in accommodations [and] then you have to suspect that some of those players are going to be eyeballing a consolidation there.

Now we can’t run the business that way and so what we are doing today is saying, look, another way for everyone to benefit from HomeAway is for us to partner with them. We got aggressive about building our distribution platform because it may just turn out that the industry evolves in a way that we are distributing inventory through a variety of platforms; we are also selling to the hardcore vacation rental consumer, and the world goes on.

But it is unlikely to think that one of those players wouldn’t want to get more aggressive and develop a competitive advantage in the space.

Marina Kolesnik, Travel.ru

The answer is short: We have a large market, and it’s growing very fast. Sure there will be competitors. There will be local competitors in any market. There will be international competitors. They all will have their own strengths. But the current trends are such that it will probably favor domestic players rather than international.

Steve Kaufer, TripAdvisor

Skift: On vacation rentals, I think you guys came out with a number that you now offer 630,000 vacation rentals through TripAdvisor and Flipkey. Meanwhile, HomeAway CEO Brian Sharples said during HomeAway’s second quarter earnings call that HomeAway hasn’t felt the impact of TripAdvisor in vacation rentals.

Sharples said: “This is a marketplace business where you need both supply and demand. So it’s one thing to have properties, it’s another thing to get bookings against those properties.” Are you buying his argument that TripAdvisor has some beautiful numbers regarding vacation rentals but really isn’t driving demand or being felt in the marketplace?

Kaufer: Actually I do agree with Mr. Sharples: It is a marketplace, you need supply and demand. I was only at liberty to talk about the increased supply that we have, which is a big number and just means to consumers, hey, we have good choice. We are proud of that number, but it really doesn’t tell the whole story.

We don’t disclose the demand numbers and the bookings that we do, but he [Sharples] knows we are in the marketplace. I’m sure we have siphoned some demand from other sources. I have no way of knowing whether it is from HomeAway, from offline rental agencies or from any other player in the marketplace. But we do a very nice business in vacation rentals that’s growing quite nicely so we ourselves are pleased with our own progress.

Sam Jain, CheapOair

Metasearch for us is not really a competitor. They are more friends for us. We work collaboratively with most of the major metasearch engines. They bring us good, qualified traffic. The market is big enough for metas and online travel agencies to coexist. It is a very different model. Metas don’t do bookings. They don’t have that deep customer relationship.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: ceo interviews, fotb