Skift Take

Despite the mobile revolution, it is tough to believe that Google would make a game-changing bet on hotels and other suppliers over OTAs and metas when the latter two categories generally have much larger marketing budgets.

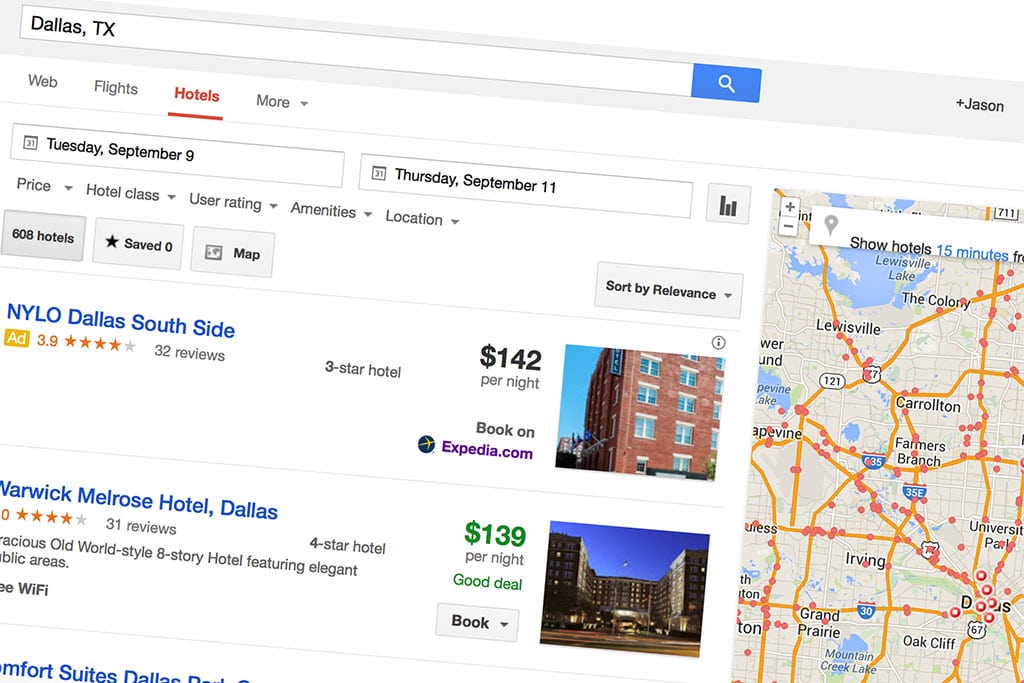

The sky is falling for online travel agencies and metasearch players because Google is rolling out a couple of new advertising products for hotels and wholesalers that will likely level “the search playing field in travel like we have never seen before.”

That’s the word from Evercore in a new report, Google’s Travel Plans in a Post-Atomic Era [embedded below].

One product, Limited Offers, which appears to be an experiment but Evercore says was launched this summer, enables hoteliers to work around rate parity provisions and to contract with wholesalers to offer limited-time discounts off published rates on Google to fill rooms, thus undermining the published and opaque rates found on Expedia, Hotwire, Booking.com, Priceline Express Deals, and TripAdvisor.

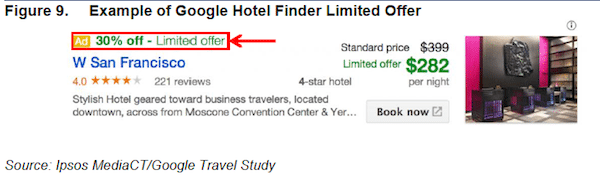

Here’s an example of a Limited Offer from the report that purports to show a 30% discount off the published rate that a wholesaler, Lmtclub.com, did for the W San Francisco in Google Hotel Finder.

Evercore believes a second initiative, a soon-to-come “captive demand platform” in partnership with major brands, would be “potentially the most disruptive travel initiative by Google to date.”

The captive demand platform would integrate brands’ loyalty and rewards program information “into a logged-in Hotel Finder travel search experience,” Evercore says. Google would leverage properties such as Gmail, Google Maps, Google Wallet and Google Now “to integrate offers directly received, such as memberships and loyalty programs, into its logged-in travel search experience,” the report states.

“Therefore, what we can expect from Google’s Hotel Finder product as the next iteration is a search experience that leverages the captive demand of the suppliers,” the report states.

Under the portrait that Evercore paints, these two initiatives would diminish the enormous advantages that online travel agencies and metasearch players such as Booking.com, Expedia and TripAdvisor currently have in Google search over hotel and other supplier brands.

In some ways, Google’s purported moves have a rough parallel to how its ITA Software-powered Google Flights favors airlines over online travel agencies.

Why Alienate Your Best Customers?

But why would Google want to shoot itself in the foot by eating into the advantages enjoyed by its most-free-spending customers?

Evercore argues that Google is looking to the future and that mobile has changed the game.

“The reason we believe Google to be stepping up its travel efforts now, after many years of trying with mixed success, is that the stakes are so much higher,” Evercore states. “In the past, an effort by Google in travel would undermine some of its best advertisers, making the commitment to the space possibly half-hearted, in our estimation. However, what’s changed is mobile.

“As mobile transactions threaten to make ‘marketplace’ experiences the first destination in travel search, such as those provided by the OTAs or TripAdvisor, we would argue that Google’s need to act has gone up by orders of magnitude.

“The point being that the services to the traveler around his or her profile are increasingly being shaped by the ability of a platform to bring more supplier information to one’s fingertips. Reviews, discounts / points travel, checkin conveniences, and itinerary all require deeper supplier integration, which we see Google increasingly doing.”

A Mobile Advantage for OTAs?

But, does mobile really give the OTAs, TripAdvisor and their “marketplaces” such a decisive advantage over Google in e-commerce? Perhaps if you believe that mobile apps would win out over the mobile Web, and that travelers would be content to do all of their travel searching and booking through a travel app or two.

The verdict is definitely still out on these questions.

And, despite the mobile revolution, it is still very tough to believe that Google would make a game-changing bet on hotels and other suppliers over OTAs and metas when the latter two categories generally have much larger marketing budgets.

Evercore also argues that Google has plans to “retain the traveler from Search to Research to Book” in a way that online travel agencies and metasearch companies are ill-served to match since more than 50% of travel searches start with the Google search engine.

Google Study for Hotel Finder Partners

A Google Travel study shared with its Hotel Finder partners seemed to point to Google getting much more involved in travel bookings, and the need to make the booking path more efficient, Evercore states.

“Google cited that travelers spend an average 55 minutes to book a hotel and flight, visit 17 websites, and click 4 different search ads per travel search, with 90% of those travelers conducting the booking process over multiple screens,” Evercore states.

Evercore made two ratings’ changes related to its report.

Evercore upgraded TripAdvisor to equal-weight, arguing that although TripAdvisor could be hurt by Google’s initiatives, TripAdvisor’s Instant Book platform, which has attracted Best Western, Choice Hotels and Travelport, among others, is similar to what Google envisions on the booking front and “leaves us more favorable.”

Evercore downgraded the Priceline Group to equal-weight, arguing that although Priceline acquired Buuteeq, Hotel Ninjas and OpenTable for a B2B enterprise play, “the initiative is nascent and doesn’t address head-on some of the newer ‘captive demand’ channels we believe Google is integrating.”

It should be pointed out, though, that Google’s Limited Offers and captive demand initiatives are nascent, as well.

Have a confidential tip for Skift? Get in touch

Tags: advertising, google, otas