Priceline CEO on Why Restaurants Are the Next Frontier for the Travel Giant

Skift Take

With the Priceline Group announcing its intention to acquire OpenTable for $2.6 billion, Priceline Group CEO Darren Huston spoke about some of the synergies, but said Priceline has a “strong and aggressive” plan to spearhead OpenTable’s growth internationally in its own right.

Asked whether the OpenTable acquisition is part of a broader Priceline Group strategy (such as Booking.com focusing on restaurants, for example) Huston said although the Priceline Group looks at all aspects of travel, it sees restaurants as an attractive opportunity on its own.

“We see this [OpenTable and the global restaurant business] as another big other footprint,” Huston said.

In the short term, at least, Huston said the Priceline Group didn’t necessarily agree to acquire OpenTable to improve the rest of the group’s travel offerings.

“We have offices, as I mentioned in every major city in the world,” Huston said during a conference calling with analysts following the acquisition announcement, hinting how the Priceline Group can assist OpenTable’s growth ambitions.

On the question of scaling the business, Huston said OpenTable has been developing a cloud-based solution for bring restaurant reservations online, and he is satisfied that it is an ample foundation to build the business.

He said Kayak, acquired for $2.1 billion in 2013, is on track with sustainable international expansion and this “provides some kind of road map for OpenTable.”

There will, of course, be some synergies between the Priceline Group companies and its hoped-for newest member, assuming the deal closes as expected in the third quarter.

Huston noted that many restaurants are located in hotels so a Booking.com account manager would be able to introduce an OpenTable account manager to restaurant or hotel personnel.

There also could be some shared learnings between OpenTable and Buuteeq, the hotel digital marketing company that Priceline announced it had acquired just three days ago.

Both companies have developed or are developing cloud-based solutions, a factor that Huston believes would allow both companies to scale.

On the scaling front, Huston said OpenTable has some parallels to Booking.com, the world’s largest accommodations site, because both are focused on adding supply and generating demand.

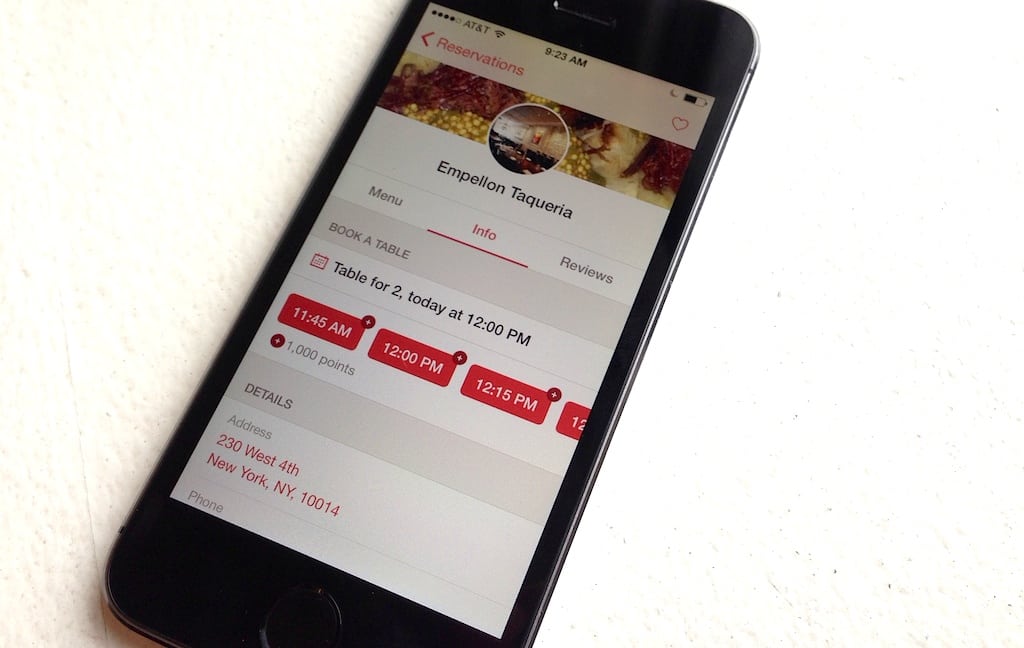

In addition to working on OpenTable’s international expansion — an initiative that puts it head to head against TripAdvisor and Yelp, as well — Huston said OpenTable will also focus on improving the customer experience for diners, and will look for mobile innovation.

On the financial front, the Priceline Group has a big bankroll, and CFO Daniel Finnegan said the company feels comfortable paying for the $2.6 billion acquisition all in cash.